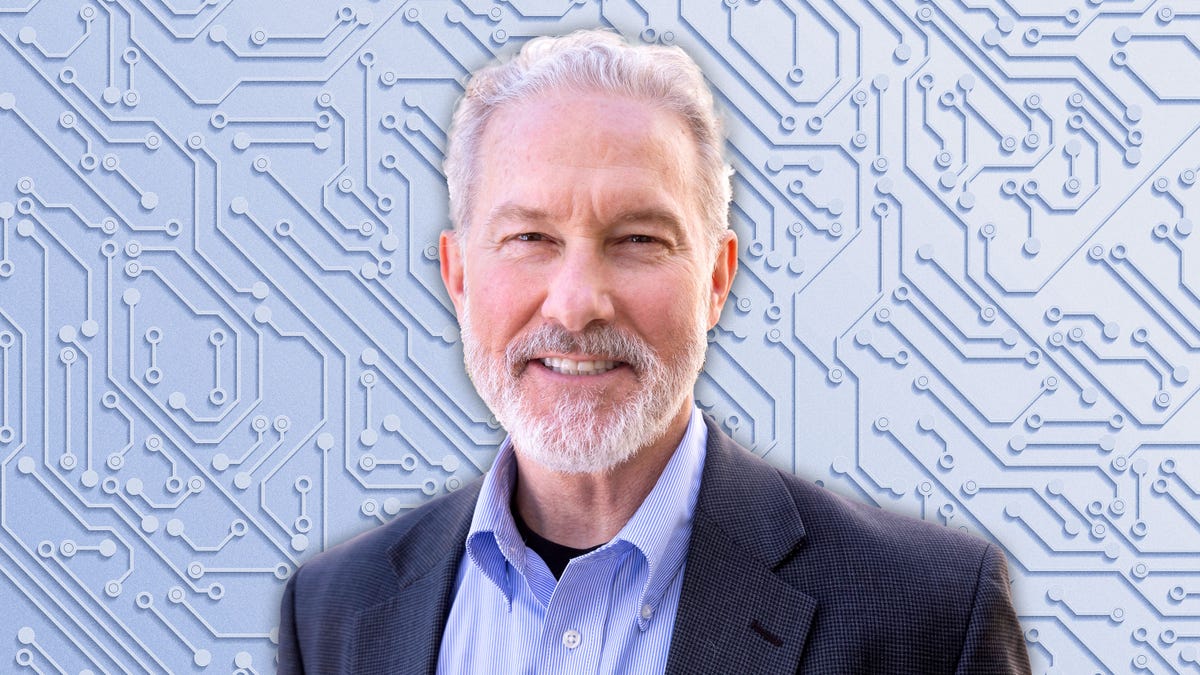

Innovation begins with ideas, but ultimately relies on financial support. Richard Lyons, the University of California, Berkeley’s first-ever chief innovation officer, has implemented a program that generates funding for innovative startups and channels the profits back to the university.

Lyons, a former dean of UC Berkeley’s business school and an expert in microfinance and economics, not only focuses on the innovations that the university’s funding can support, but also on the innovative approaches to funding these innovations. In an interview with Quartz, he discusses UC Berkeley’s venture capital funds and the concept of shared carry funds, in which the university receives a portion of the profits earned by the general partners of the funds.

The following transcript has been edited for length and clarity.

Quartz: What are you excited about right now in the world of innovation finance?

Lyons: One aspect I’m excited about is shared carry funds. Currently, we have eight external venture capital funds where the general partner shares 50% of the carried interest with Berkeley.

As we develop a financial model for a top research university, we ensure that resources flow back from the value we create. If we have the rights to purchase future equity in a startup that we’ve licensed our intellectual property to, we share those participation rights with these funds. There is a strong connection.

Did you come up with this idea yourself or did you see other universities implementing it?

Many universities may claim to have similar funds, but our approach of having eight categories and experiencing rapid growth has attracted other universities seeking a template.

The eighth fund, which hasn’t been publicly announced yet, is a gift from a donor. The university will be the sole limited partner in this fund, and we will recruit general partners who will hopefully share carry.

How did you develop this template?

The first fund, Berkeley Catalyst Fund number one, originated from our College of Chemistry. PhD alumni in the venture capital industry recognized the potential in Berkeley-founded companies. The template and legal framework were replicated for the subsequent funds.

How do these VC funds benefit students?

Ultimately, the general partners decide how to allocate the funds. They may offer internships to students and some funded companies are student-led. However, competition for these funds is intense. Our financing ecosystem for students also includes non-diluted grant funding of varying amounts. The VC funds are just one component.

What other innovative finance models are you excited about?

I’m particularly interested in builder VCs who not only invest in startups but also play an active role in building the company and shaping its business model.

As an expert in microfinance, how do you view cryptocurrencies? Are they overrated or underrated?

I believe the focus should be on blockchain technology. In my opinion, it is underrated. There was a lot of hype, followed by setbacks, but we are still in the early stages. For instance, digital identity on the blockchain has significant potential.

Denial of responsibility! Vigour Times is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.