This week’s question: The cardinal rule of discipline is to not violate the cost basis and show patience to buy more high-quality stocks on the pullback. How do you evaluate a flying stock that may not return to the cost basis levels for adding more? Recent examples include Nvidia (NVDA), Eli Lilly (LLY), and Tesla (TSLA). – Thanks, Ravi

Great question! Let’s begin by understanding why we have the rule of not violating the cost basis. The idea is to gradually build a position in a stock by buying during market dips. Purchasing a stock at a lower price, with the same earnings estimates, represents a good deal. You pay less for the same future earnings, resulting in a lower price-to-earnings multiple. However, there is an exception to the cost basis rule. This occurs when a stock skyrockets before we can establish our full position. Since we do not anticipate the stock falling below our cost basis, but rather rallying, we need an alternative method to determine when to buy more shares. Our two best options are valuation and technical analysis. As fundamental investors, we primarily focus on valuation. Understanding that the price is what you pay and the value is what you get can help identify a suitable buying point. If you cannot buy below your price basis, aim to buy at or below your valuation basis. This way, you can be confident that you are getting an equal or better value than your previous purchase. Let’s take Nvidia as an example. If you bought shares in the chipmaker in February, you paid approximately 50 times the forward earnings estimates. On Friday, the shares were trading at around 30 times future earnings. Although the February valuation was significantly off, as the earnings turned out to be much stronger than expected, shares are still comparatively more favorable today. This scenario is known as a fundamental reset. We now have a better understanding of the immense opportunity in generative AI for Nvidia. Consequently, we reevaluate the stock using this new information. The fundamental drivers of Nvidia’s earnings are even stronger than previously anticipated, justifying a higher price. Other valuation methods can be utilized as well. For instance, if there is a new growth catalyst, such as the need to reconfigure the world’s data centers for AI workloads, a higher price-to-earnings ratio may be justified. In this case, the company’s PEG ratio, calculated by dividing the p/e ratio by its earnings growth rate over a specific period of time, would decrease, indicating a good buying level. If you choose to violate the basis, it is advisable to do it systematically and gradually. Following a rapid upward move, allow the stock to consolidate as traders sell out and longer-term investors reassess their next move. Then, establish buying points when the valuation decreases, just as you would when the stock price drops. Basic technical analysis can also be incorporated, but it is recommended to keep it simple.

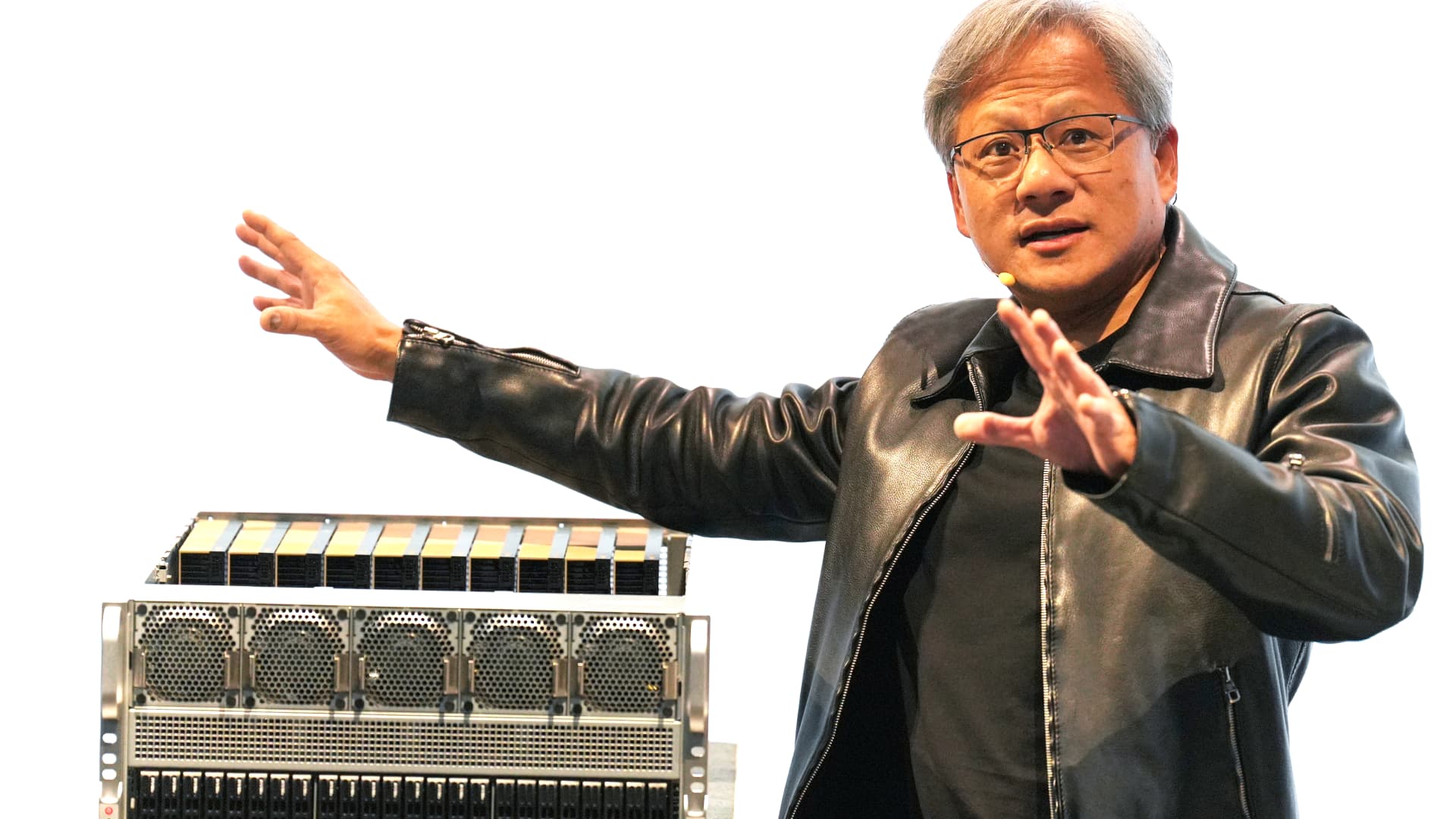

Nvidia CEO Jensen Huang speaks at the Supermicro keynote presentation during the Computex conference in Taipei on June 1, 2023.

Walid Berrazeg | Sopa Images | Lightrocket | Getty Images

As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has discussed a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade.

THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY, TOGETHER WITH OUR DISCLAIMER. NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Denial of responsibility! Vigour Times is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.