Get free updates from the National Bank of Poland

Sign up to receive a daily email digest of the latest National Bank of Poland news each morning with the myFT Daily Digest.

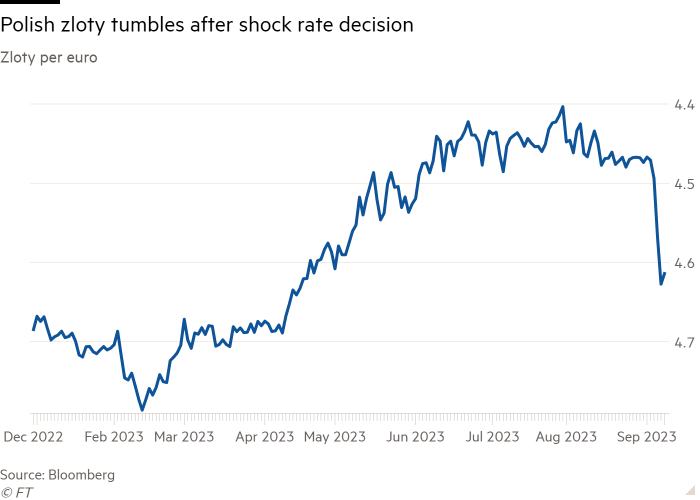

The Polish zloty has plummeted nearly 3% against the euro following the National Bank of Poland’s surprising decision to cut interest rates. This highlights the challenge central bankers face in boosting growth while managing high inflation.

Analysts expected a smaller rate cut, but Poland’s rate setters lowered borrowing costs by 0.75 percentage points to 6%. This move comes despite inflation running at 10.1%.

A weaker currency could worsen inflation by increasing import prices and stimulating export demand.

The central bank governor, Adam Glapiński, based the decision on a significantly changed economic outlook, with concerns about a recession in Germany which could impact Polish exports. He expects inflation to decrease to slightly above 8.5% in September and continue to decline as the economy weakens.

“Poland is closely connected to Germany, which is experiencing stagflation,” said Gustavo Medeiros, head of research at Ashmore Group.

The German economy has been rapidly deteriorating, with industrial production falling 0.8% in July, more than expected. Core inflation in Germany remains stubbornly above 5% since October last year.

“Poland is being proactive and trying to pre-empt a broader growth slowdown,” said Aaron Grehan, head of hard currency emerging market debt at Aviva Investors.

The European Central Bank is also facing a crucial decision on whether to raise interest rates as it navigates the challenge of reining in rising prices without worsening an economic downturn.

Poland’s rate cut and the subsequent fall in the zloty may serve as a cautionary warning for other central banks considering rate cuts.

“It’s an extreme move,” said Salman Ahmed, global head of macro at Fidelity International. “It signals that they are willing to tolerate inflation.”

Some economists argue that Poland’s central bank may have been influenced by the goals of the ruling Law and Justice party, which faces a parliamentary election next month.

The rate decision in Poland has also affected nearby currencies such as the Czech Republic and Hungary, although the impact has been more limited as these countries are less likely to surprise with monetary policy changes.

The Czech National Bank has kept interest rates at 7% since June last year and is expected to maintain rates at its upcoming meeting. Headline inflation eased to 8.8% in July.

The National Bank of Hungary has gradually reduced its rates from 18% to 14% since May as inflation has declined from over 25% earlier this year to 16.4% in August.

Prior to the rate decision in Poland, the strength of the zloty was seen as key in curbing imported inflation. Grehan believes it is unlikely that the central bank will tolerate a rapid depreciation from this point, but Poland has sufficient foreign exchange reserves to intervene and support the currency if necessary.

Denial of responsibility! Vigour Times is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.