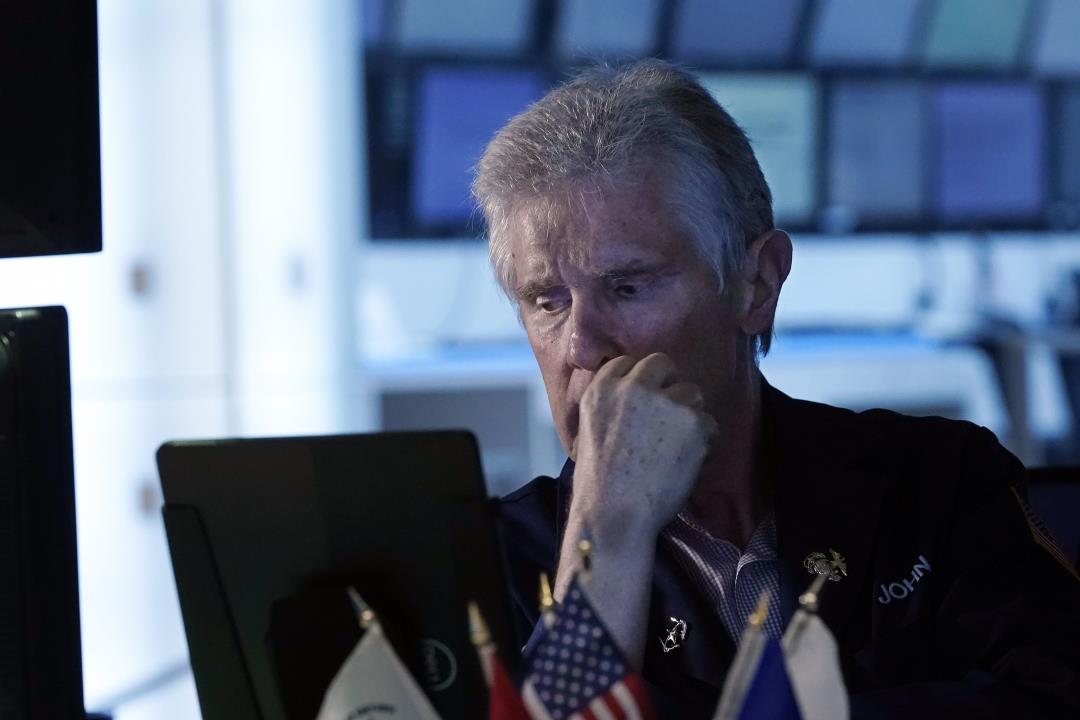

Wall Street experienced a significant downturn on Tuesday, with the focus shifting to the negative aspects of a surprisingly robust job market.

- The S&P 500 witnessed a decline of 58.94 points, equivalent to 1.4%, settling at 4,229.45.

- The Dow Jones Industrial Average suffered a loss of 430.97 points, or 1.3%, bringing it down to 33,002.38 and completely erasing all the gains made so far this year.

- The Nasdaq composite encountered a drop of 248.31 points, or 1.9%, closing at 13,059.47 as prominent Big Tech stocks emerged as the heaviest losers in the market.

Following the release of a report indicating a higher-than-expected number of job openings in the US, stocks took a nosedive. This triggered expectations for interest rates to remain at an elevated level, resulting in the 10-year Treasury yield hitting its highest level since 2007.

The report on the US job market could potentially fortify the Federal Reserve’s resolve to maintain high interest rates. With employers posting 9.6 million job openings at the end of August, significantly surpassing economists’ projection of 8.9 million, the intense demand for workers may lead to wage increases in order to attract talent. While this may be welcomed by workers trying to cope with inflation, the Fed’s concern lies in the potential fuel it could provide to inflationary pressures. Notably, Big Tech stocks took a severe hit in the market, as they are viewed as particularly vulnerable to high interest rates. Amazon experienced a decline of 3.7%, Microsoft dropped by 2.6%, and Nvidia lost 3.1%.

Point Biopharma, a company specializing in developing cancer-fighting treatments, witnessed a remarkable surge of 84.9% after Eli Lilly announced its acquisition of the company for approximately $1.4 billion in cash. Eli Lilly, on the other hand, experienced a decline of 2.4%. The underperformance of China’s economic recovery, compared to expectations, played a significant role in McCormick, a leading cooking spice manufacturer, reporting slightly lower revenue for the latest quarter than what analysts had predicted. Although its profits aligned with expectations, the company’s stock witnessed an 8.5% decline. (Read more stock market stories.)

Denial of responsibility! Vigour Times is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.