Receive free Currencies updates

We’ll send you a myFT Daily Digest email rounding up the latest Currencies news every morning.

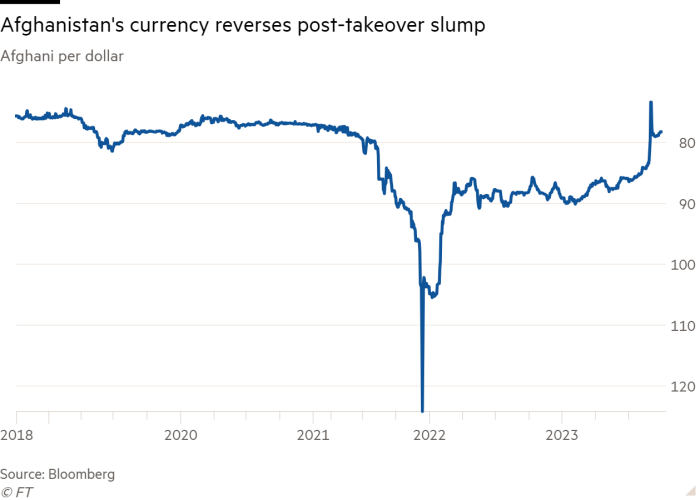

Afghanistan’s currency emerged as the frontrunner in global currency performance during the third quarter of this year. The afghani rebounded remarkably after reaching historic lows following the Taliban’s rise to power two years ago, due to foreign aid inflows and strict capital controls.

With a nearly 10% increase, the afghani now stands as the third-best performing currency of the year, trailing behind the Colombian peso and Sri Lankan rupee. This strengthening is advantageous for the Taliban’s finances as they navigate the challenges of widespread unemployment.

The Taliban’s takeover in 2021 triggered a severe economic collapse, resulting in a 20% contraction of Afghanistan’s gross domestic product. International powers withdrew their support and imposed sanctions, further exacerbating the situation.

Despite the recent gains, Afghanistan now ranks among the “poorest two or three countries in the world,” according to the UN Development Programme.

The Taliban’s consolidation of control has contributed to stabilization in the country’s economy. Inflows of dollars from the UN and other international aid organizations have played a significant role in stabilizing the afghani. Additionally, the Taliban implemented currency controls that limit ordinary Afghans’ access to foreign exchange transactions.

“They’ve implemented strict capital controls, preventing the exchange of afghanis for dollars,” explained Gareth Leather, a senior economist at Capital Economics specializing in emerging markets. “Combined with aid funds, this measure provides essential support to the currency.”

The authorities have also taken steps to combat currency speculation and corruption at customs offices, as noted by Graeme Smith, a senior consultant at Crisis Group. These efforts have helped stabilize the supply of dollars, making essential imported goods like wheat more affordable for ordinary Afghans who are facing food insecurity.

However, the future remains grim for Afghanistan. The central bank’s overseas reserves have been frozen by the US, cutting off a crucial source of foreign currency. Additionally, the UN has only secured about 25% of the estimated $3 billion in humanitarian aid required for the country this year. This shortfall in aid is expected to worsen due to the Taliban’s tightening of women’s rights, resulting in strained relationships with donors.

“Cash shipments to support UN operations are decreasing and will continue to decline,” Smith warned. “This could leave the Afghan economy dangerously short on liquidity.”

Despite the recent rally, the afghani’s volatility remains significant due to the ongoing geopolitical situation, according to Gareth Leather at Capital Economics.

Denial of responsibility! Vigour Times is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.