Turkey eased its long-running battle to defend the lira on Wednesday, sending the currency into its biggest fall in more than a year as President Recep Tayyip Erdoğan’s new economic team implements more “rational” policies.

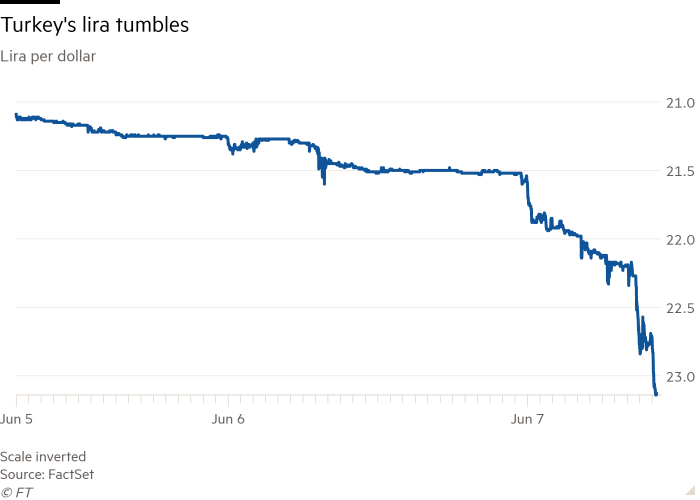

The currency dropped 6.9 per cent on Wednesday to a new record low of 23.17 against the dollar, leaving it down almost 10 per cent since the appointment of Mehmet Şimşek as finance minister at the weekend.

The lira has not ended a day with such a big fall since December 2021, Refinitiv data shows.

Şimşek, a former deputy prime minister who is well regarded by foreign investors, has promised to restore “rational” economic policies in Turkey after years of interest rate cuts and unconventional measures to prop up the currency.

“This exchange rate . . . was heavily suppressed by alternative financial [measures] before the election,” said Enver Erkan, chief economist at Istanbul-based brokerage Dinamik Yatırım Menkul Değerler. “The new period will bring a more liberal approach in this regard and will create a situation that will enable the lira to get closer to its real value.”

The fall this week highlights how investors are increasingly expecting a shift towards more orthodox measures in the aftermath of Erdoğan’s election victory last month. Erdoğan is expected by some analysts to also name a new central bank chief with a more orthodox economic approach.

The pace of the lira’s depreciation has been rapid: Goldman Sachs said at the weekend that it expected the lira to fall to 23 against the dollar in the next three months, a forecast that came to fruition in a matter of days.

One big bank in currency trading told clients on Wednesday that Turkish state banks appeared to not be intervening in the market, according to a person familiar with the matter. An executive at a rival western bank said it had seen the same trend. State bank lira purchases have been seen as a key tool in propping up the currency in recent years.

An executive at a Turkish bank, who asked not to be named, described Wednesday’s move as an “intentional devaluation” as opposed to a full loosening of controls.

Currency analysts broadly say the lira is overvalued in relation to Turkey’s economic position, even after falling more than 60 per cent against the dollar over the past two years.

Erdoğan had insisted on huge interest rate cuts, with the main policy rate falling from 19 per cent in March 2021 to 8.5 per cent today despite intense inflation. This has knocked “real”, or inflation-adjusted, rates deep into negative territory.

“With such pressure on the lira, we think it is a question of when rather than if the currency weakens significantly, with the probability of a larger one-off adjustment having increased,” Goldman said in a note to clients, predicting a fall to 28 against the dollar in the next year.

The central bank has burnt through about $24bn in foreign currency reserves this year alone, in part in an attempt to boost the lira. The reserves have also been used, economists say, to finance Turkey’s big current account deficit, which itself has been made worse by a lira that many exporters have said is too strong to be competitive.

Denial of responsibility! Vigour Times is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.