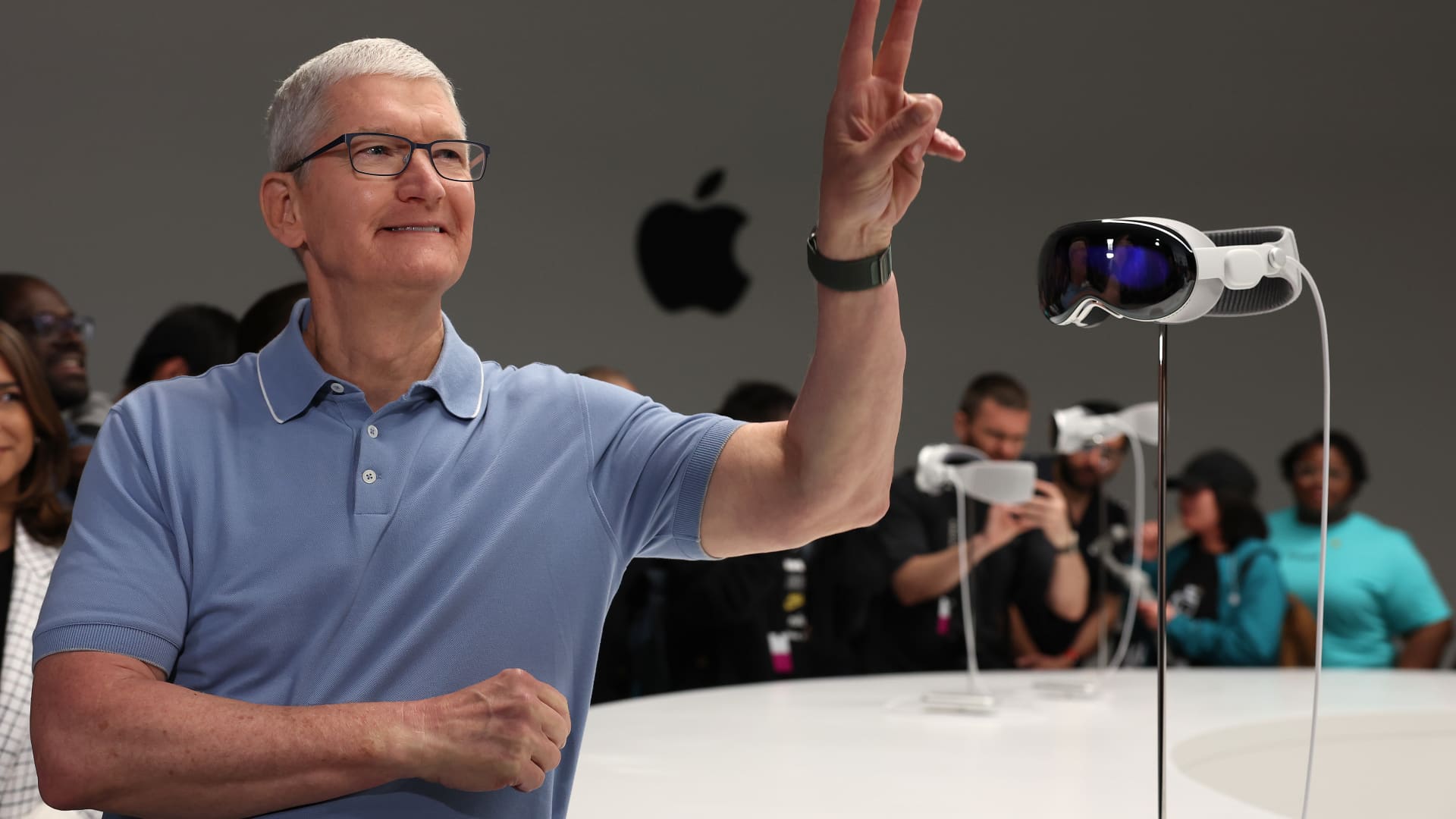

Apple CEO Tim Cook proudly presented the new Apple Vision Pro headset at the Apple Worldwide Developers Conference in Cupertino, California on June 5, 2023 (Justin Sullivan | Getty Images).

The Nasdaq, heavily influenced by the technology sector, ended the first half of 2023 with a 1.5% rally, resulting in a 32% gain for the year so far. This marks the highest first-half jump for the index since 1983, when it rose by 37%.

This achievement is astonishing considering the changes and developments that the tech industry has undergone over the past four decades. From the PC software boom sparked by Microsoft’s IPO in 1986 to the rise of internet browsers in the 1990s and the emergence of mega-cap trillion-dollar companies in the past decade, the tech industry has consistently experienced periods of sustained growth. However, none of these eras have seen a start to the year as impressive as 2023.

Even more remarkable is the fact that this surge is occurring while the U.S. economy is still at risk of recession and coping with a banking crisis. The collapse of Silicon Valley Bank, a critical financial institution for the venture and startup world, in March highlighted the challenges faced by the industry. Additionally, the Federal Reserve has steadily increased interest rates to the highest level since 2007. Despite these obstacles, momentum continues to drive the technology industry, and investors remain wary of missing out on potential opportunities, even when valuations appear frothy.

After a challenging year in 2022, which saw a 33% decline in the Nasdaq, the focus shifted to cost-cutting and efficiency. Major tech companies, including Alphabet, Meta, and Amazon, implemented mass layoffs to improve their earnings. As a result, these companies experienced a rebound in their stock prices and a more realistic outlook for future growth. Despite enduring significant losses the previous year, Meta and Tesla have more than doubled in value in 2023. Alphabet has also seen a remarkable recovery, with a 36% increase in its stock price after a 39% decline in 2022.

These companies, including Meta and Tesla, which did not exist during the last promising start to the year for the Nasdaq, have benefited from the growing interest in artificial intelligence (AI). In particular, generative AI chatbots powered by companies like Microsoft-backed OpenAI have captured the imagination of investors. Nvidia, known for its AI chips, has experienced a 190% surge in its stock price in the first half of 2023, propelling the company’s market cap beyond $1 trillion. This further emphasizes the focus and excitement surrounding AI in the tech industry.

Bryn Talkington, a managing partner at Requisite Capital Management, believes that tech will continue to dominate due to the ongoing fascination with AI. She highlights Nvidia’s unique story and its essential role in the AI gold rush. Large companies heavily invested in AI rely heavily on Nvidia’s technology, giving the company a significant advantage in the market.

While Apple’s gains are not as dramatic as others in the tech sector, the company’s stock has surged by 50% this year, pushing its market cap to $3 trillion. Apple’s latest foray into virtual reality with the announcement of the Vision Pro headset has reinvigorated investor enthusiasm. This product launch, the company’s first major one since 2014, has generated significant interest.

When comparing today’s prices to those of the past, it’s interesting to note that the initial Lisa computer, released by Apple 40 years ago, started at a staggering $10,000. To put this into perspective, Apple’s revenue in 1983 was approximately $1 billion, equivalent to its average daily revenue in the first quarter of 2023.

While the tech industry is thriving, other sectors of the economy face challenges. The S&P 500 gained 16% in the first half of the year, while the Dow Jones Industrial Average rose by only 2.9%. Concerns about the global economy persist, fueled by uncertainties around the war in Russia and Ukraine and ongoing trade tensions with China. Additionally, short-term interest rates have climbed above 5%, providing investors with safer alternatives to tech investments.

Another cause for concern is the absence of significant tech IPOs, as emerging companies remain cautious and wait for more predictable market conditions. There hasn’t been a notable venture capital-backed tech IPO in the U.S. since late 2021, indicating that the second half of the year may remain quiet in terms of new tech stock offerings.

Jim Tierney, chief investment officer of U.S. concentrated growth at AllianceBernstein, also shares his reservations about the AI industry’s impact on overall corporate performance. He believes that AI must benefit all companies, but he’s uncertain if this will happen in the second half of the year.

Furthermore, economic data is mixed, with surveys indicating that the majority of Americans are cutting back on spending due to persistent inflationary pressures. These factors suggest that the fundamentals of the economy may be stretched.

As the tech industry continues to thrive, it remains to be seen how the wider economic landscape and emerging challenges will impact its trajectory.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.