June saw a moderation in employment growth, which has been remarkable in recent times. According to the Labor Department, nonfarm payrolls increased by 209,000, and the unemployment rate remained at a favorable 3.6%. Expectations were slightly higher, with market consensus predicting growth of 240,000 jobs and an unemployment rate of 3.6%.

Although the numbers are still strong compared to historical data, June’s figures represent a significant decline from May’s revised total of 306,000. This marks the slowest month for job creation since December 2020 when payrolls dropped by 268,000. However, there was a slight decline of 0.1 percentage point in the unemployment rate.

Wages, on the other hand, showed slightly stronger growth than anticipated. Average hourly earnings increased by 0.4% for the month and 4.4% over the past year. Additionally, the average work week increased by 0.1 hour to reach 34.4 hours.

“The job market is exceptionally strong and is returning to a sustainable level,” commented Austan Goolsbee, President of the Chicago Federal Reserve, during an interview on CNBC’s “Squawk on the Street.”

Without an increase in government jobs, the overall employment growth would have been weaker. Government jobs grew by 60,000, primarily at the state and local levels. Other sectors that showed significant gains include healthcare (41,000), social assistance (24,000), and construction (23,000).

The leisure and hospitality sector, which had been a strong source of job growth in recent years, only added 21,000 jobs in June. The sector has experienced a notable slowdown in the past three months. Retail saw a loss of 11,000 jobs, while transportation and warehousing declined by 7,000.

Expectations were high for the jobs report following the strong growth reported by ADP, a payrolls processing firm. ADP reported a growth of 497,000 private sector jobs on Thursday.

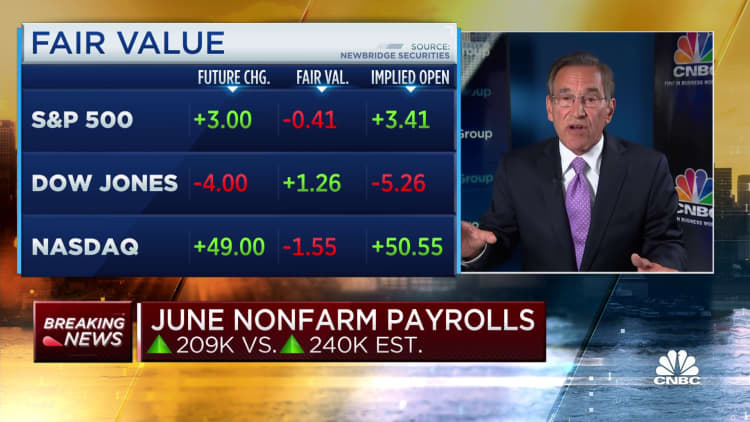

Stock markets reacted negatively to the jobs report, with Dow Jones Industrial Average futures dropping nearly 90 points. Longer-term Treasury yields saw a slight increase.

“While a 209,000 increase in payrolls is not weak by any means,” said Seema Shah, chief global strategist at Principal Asset Management, “investors may be disappointed after yesterday’s ADP report raised expectations for an even stronger jobs number.”

The labor force participation rate, a key metric for evaluating the balance between labor supply and demand, remained unchanged at 62.6% for the fourth consecutive month, still below pre-Covid levels. However, the participation rate for individuals aged 25 to 54 rose to 83.5%, the highest in 21 years.

A broader measure of unemployment, including discouraged workers and part-time workers, increased to 6.9%, the highest since August 2022. Furthermore, the unemployment rate for Blacks rose by 0.4 percentage points to 6%, and for Asians, it increased by 0.3 percentage points to 3.2%.

In addition to revising May’s count downward by 33,000, the Bureau of Labor Statistics also revised April’s total down by 77,000 to 217,000. This brings the six-month average to 278,000, a significant decrease from the 399,000 average in 2022.

“This is a strong labor market, with a clear trend of demand for higher-paying jobs,” commented Joseph Brusuelas, chief economist at RSM. “Therefore, it is no longer appropriate to discuss an imminent recession, given the strong job and wage growth.”

The jobs report plays a crucial role in shaping the Federal Reserve’s monetary policy decisions.

Policymakers consider the robust employment market and supply-demand imbalances as contributing factors to inflation, which in 2022 reached its highest level in 41 years. The Fed has been implementing interest rate increases in an attempt to cool down the economy, but the labor market has consistently defied their tightening efforts.

Although the June report suggests some easing of labor market conditions, analysts still expect the Fed to raise rates later this month. Market traders currently project a 92.4% chance of a quarter percentage point increase at the July 25-26 meeting, which would bring the Fed’s benchmark borrowing rate to a targeted range of 5.25%-5.5%.

“The downward trend in wage growth may be stalling,” noted Andrew Hunter, deputy chief U.S. economist at Capital Economics. “However, this is unlikely to prevent the Fed from raising rates again later this month.”

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.