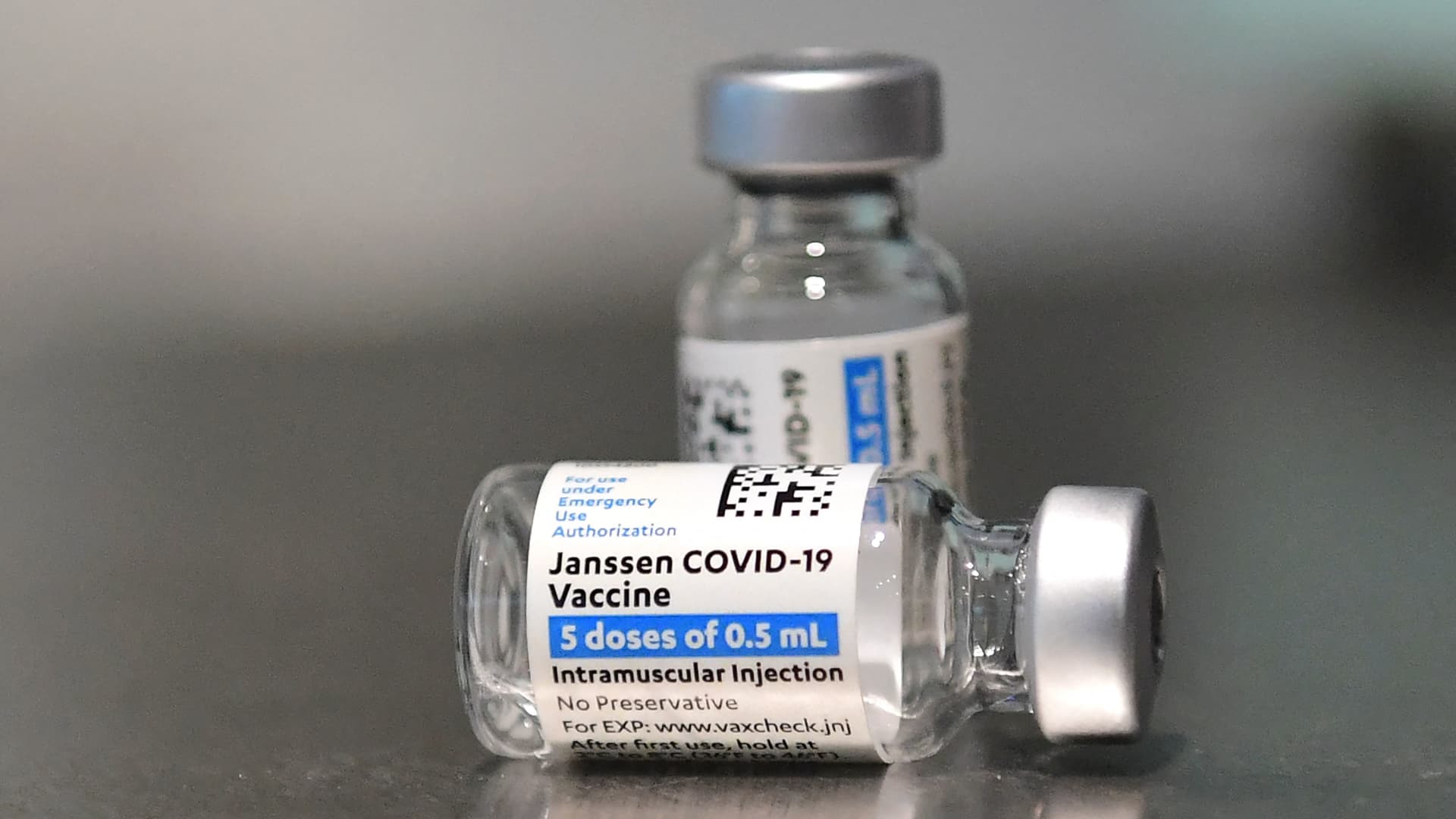

Johnson & Johnson Covid-19 vaccines are seen on a table on May 7, 2021 in Los Angeles, California.

Frederic J. Brown | AFP | Getty Images

Discover the latest market movers during midday trading.

Netflix — Netflix’s stock declined by over 8% following its mixed quarterly results. While the company exceeded earnings per share expectations in the second quarter, its revenue of $8.19 billion fell short of the anticipated $8.30 billion.

Tesla – Tesla’s shares plummeted by more than 6%. Although the electric vehicle manufacturer surpassed Wall Street’s expectations for both revenue and earnings, the company experienced a decline in operating margins due to recent price cuts and incentives.

American Airlines – Despite strong quarterly results and an improved profit outlook for 2023, American Airlines’ stock dropped by over 6%. The airline reported adjusted earnings of $1.92 per share and $14.06 billion in revenue, surpassing analysts’ expectations. However, analysts had anticipated higher earnings per share of $1.59 on revenues of $13.74 billion.

IBM — The tech giant’s stock rose by more than 3% after reporting second-quarter earnings that exceeded analysts’ estimates. IBM’s expansion of its gross margin contributed to this success, although the company did fall short in terms of revenue due to a decline in the infrastructure division.

Johnson & Johnson — The healthcare company’s stock jumped by 6%, driving up the Dow Jones Industrial Average. This was in response to Johnson & Johnson’s second-quarter revenue and adjusted earnings exceeding Wall Street’s expectations, with a significant increase in sales from the company’s medtech business.

Abbott Laboratories — Shares of the healthcare products company rose by nearly 4% after surpassing estimates for both earnings and revenue in the second quarter. Abbott reported adjusted earnings per share of $1.08 on $9.98 billion in revenue, surpassing the anticipated $1.05 per share on $9.70 billion in revenue.

Discover Financial Services — The company’s stock tumbled 14% after missing analysts’ estimates for both revenue and earnings in the second quarter. Additionally, the Federal Deposit Insurance Commission is conducting a probe into a “card product misclassification issue.”

Zion Bancorp — The regional bank’s shares surged by 8.3% after reporting second-quarter earnings that were in line with expectations. Although the bank’s net interest income fell below expectations, it achieved $1.11 earnings per share, aligning with the Refinitiv forecast.

Travelers — The insurance company’s stock gained 3% following its second-quarter earnings announcement. Its adjusted earnings per share stood at 6 cents, while its revenue of $10.32 billion exceeded expectations of $10.02 billion.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.