Stay informed about the War in Ukraine with our free updates.

Every morning, receive a myFT Daily Digest email summarizing the latest news on the War in Ukraine.

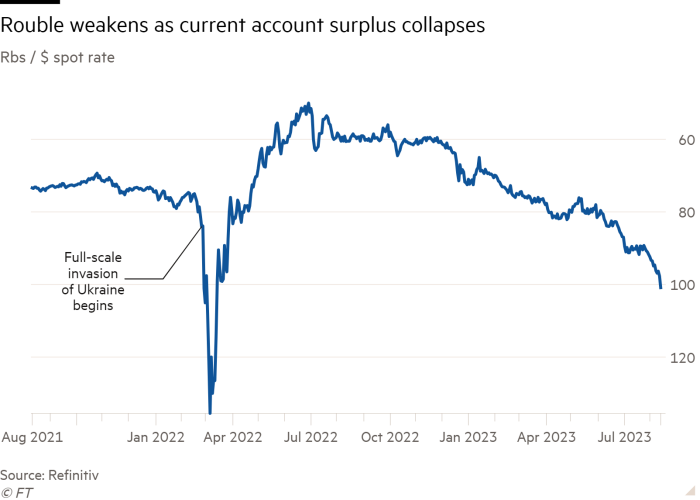

The Russian rouble has hit a 16-month low against the US dollar due to increased military spending and a decline in export revenues. The currency has already lost 25% of its value this year and fell below 100 roubles per dollar on Monday. This drop is largely attributed to the ongoing war with Ukraine, which has offset the previous year’s gains when oil and gas prices surged following Russia’s initial invasion. Recent weeks have seen a further acceleration of the rouble’s decline as western sanctions limited capital inflows and European countries reduced their reliance on Russian energy supplies.

The increase in government spending on defense and social commitments, such as compensating the families of fallen soldiers, has boosted the domestic economy but also widened the budget deficit, putting further pressure on the currency. As a result, imports have risen by 20% in the first half of this year. Vladimir Milov, a former deputy energy minister, explains that the scarcity of currency in the country has led to a “currency famine” where few are willing to accept roubles for goods produced outside the country.

The significant reduction in interest rates last year has also contributed to the rouble’s decline. The Central Bank of the Russian Federation has cut rates from 20% to 7.5% in less than a year. Natalia Lavrova, senior economist at BCS Global Markets, explains that both government spending and loose monetary policy have boosted imports, further weakening the currency.

Amidst the criticism, the Central Bank of Russia has been blamed for the rouble’s depreciation. Russian propaganda has targeted the head of the bank, Elvira Nabiullina, accusing her of being too liberal with the currency’s devaluation. The depreciation of the rouble is a cause for concern, particularly with the upcoming Russian presidential election in March.

The decline in foreign trading of the rouble has made trade flows the primary driver of its movements. Official figures indicate that Russia’s current account surplus, which measures the difference between exports and imports, has fallen by 85% in the first seven months of this year compared to the same period last year. The pressure on the current account threatens to further weaken the currency and contribute to inflation as import costs rise. Economists suggest that a stable rouble requires a current account surplus of at least $5 billion, but in July, the surplus fell to $1.8 billion.

Last week, the Central Bank of Russia suspended a budget rule that involves buying or selling foreign currency from its sovereign wealth funds to stabilize the rouble when oil and gas revenues are above or below a certain level. However, there is a glimmer of hope as oil and gas revenues began to rebound in July, surpassing Rbs800 billion for the first

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.