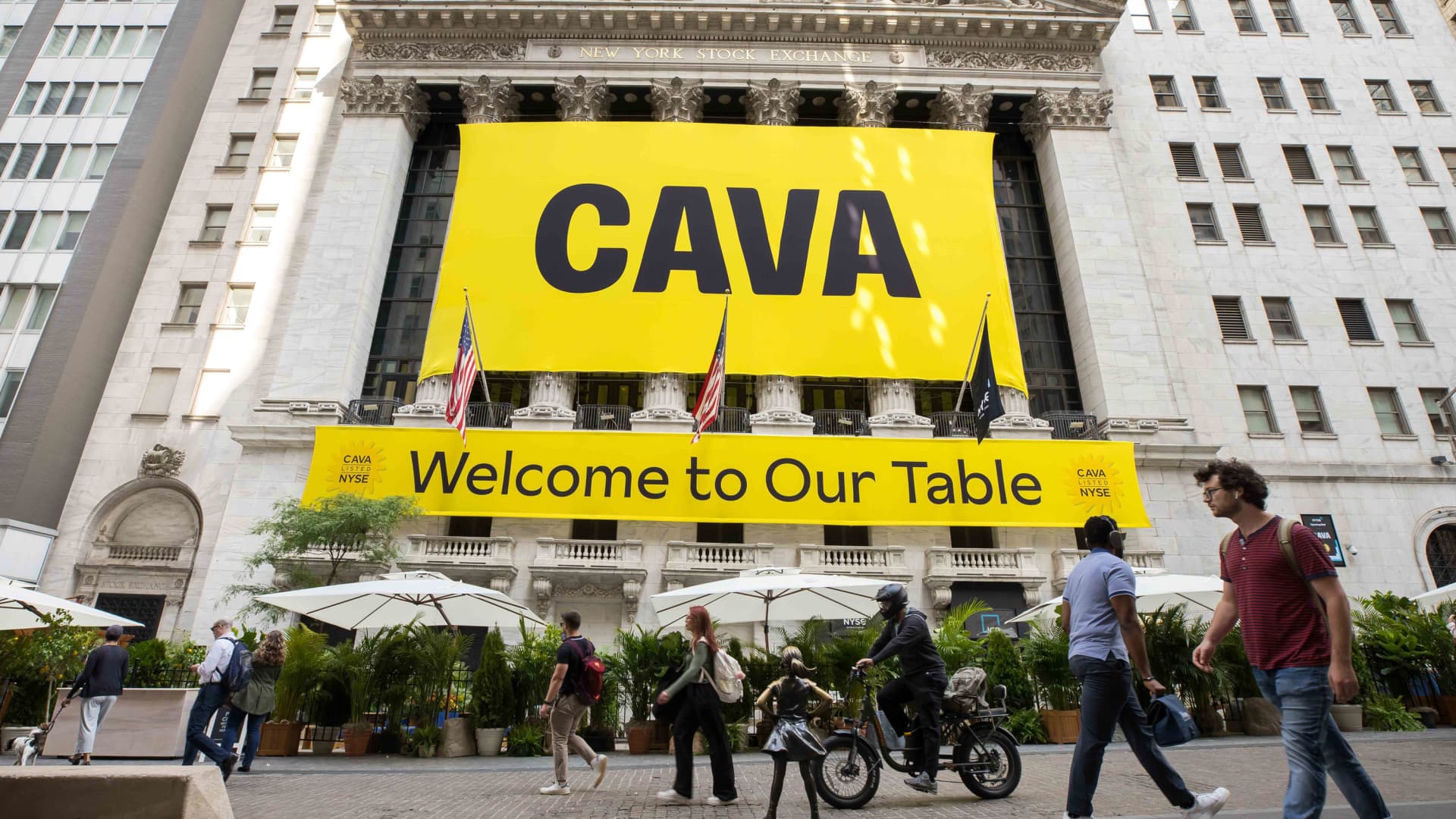

CAVA, at the New York Stock Exchange during its initial public offering, June 14, 2023.

Source: NYSE

Discover the noteworthy companies making significant moves in the middle of the day.

Cava Group — Shares experienced an impressive 91% surge during midday trading on its first day as a publicly traded company. Cava Group set its IPO price at $22 per share and commenced trading at $42 per share on Thursday.

SkyWest — The airline stock rose by 5.7% after receiving an upgrade from Deutsche Bank, shifting its rating from hold to buy. The Wall Street firm expressed optimism for a “significant improvement” in the company’s return on invested capital over the next two to three years. Deutsche Bank also upgraded Allegiant, which saw a 1.4% increase in midday trading.

Domino’s Pizza — The pizza chain experienced a 6.2% rise after Stifel upgraded its stock from hold to buy. The firm predicted a stabilization of delivery sales and an increase in carryout sales in the coming year.

Kroger — Shares declined by 3%. During the company’s earnings call on Thursday, Kroger CEO Rodney McMullen stated, “The economic environment is significantly impacting our budget-conscious shoppers.” The company reaffirmed its identical sales, excluding fuel, and adjusted earnings-per-share guidance for the full year. Kroger also reported revenue slightly below Wall Street’s expectations, with sales for the first quarter amounting to $45.17 billion, compared to analysts’ forecast of $45.26 billion, according to FactSet.

Target — The shares of the retail giant surged by nearly 3% after Bernstein reiterated its outperform rating on the stock. The Wall Street firm advised investors to take advantage of the recent decline in Target shares, which have dropped by 15% over the past month.

Lennar — The shares of the homebuilder rose by over 3% on Thursday. Lennar reported better-than-expected results for the fiscal second quarter on Wednesday evening, with earnings per share of $3.01 and revenue of $8.05 billion. Analysts had projected earnings per share of $2.33 on revenue of $7.22 billion, according to FactSet. The company’s earnings were boosted by gains on technology investments, but even excluding that benefit, Lennar surpassed expectations. Lennar also increased its full-year guidance for home deliveries.

SoFi Technologies — The financial technology stock experienced a 4.2% decline following a downgrade by Oppenheimer, which shifted its rating from outperform to perform. Although the Wall Street firm expressed long-term bullishness, it believed that the stock price had appreciated more strongly than what was observed in the broader market.

AutoZone

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.