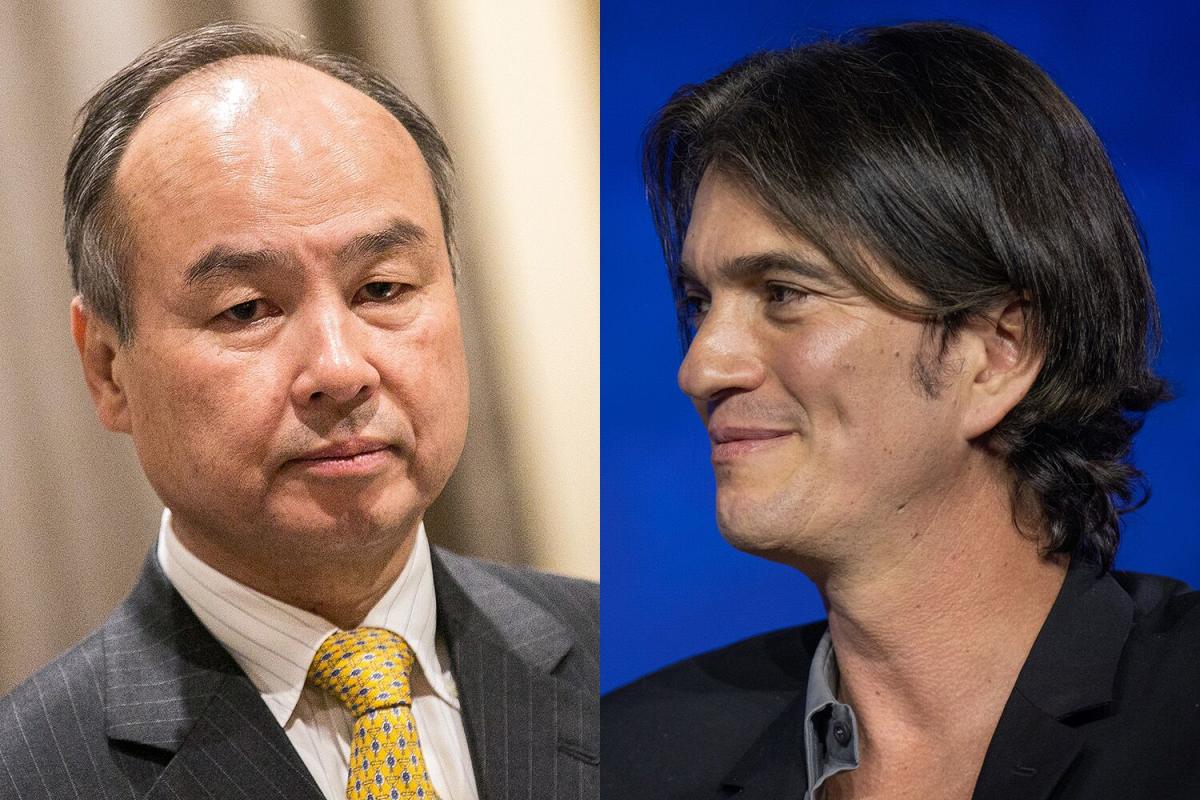

(Bloomberg) — WeWork Inc.’s bankruptcy filing marks the conclusion of a fascinating chronicle that exposed alarming flaws in the investment strategy of Japanese billionaire Masayoshi Son. The fallout extends beyond mere financial loss and has tarnished his professional standing for the foreseeable future.

Overriding objections from his advisors, Son allocated billions of dollars from both SoftBank Group Corp. and the Vision Fund to WeWork founder Adam Neumann, bolstering the co-working office space’s valuation to an astronomical $47 billion in 2019. However, just a few months later, the staggering losses and conflicts of interest uncovered in WeWork’s IPO filings prompted investors to recoil.

SoftBank now faces an estimated $11.5 billion equity loss and another $2.2 billion in debt exposure due to WeWork’s precipitous decline. This, coupled with the Vision Fund’s record $32 billion loss in the previous year, has severely dented Son’s reputation as a savvy investor, overshadowing his early triumph with Alibaba Group Holding Ltd.

Aswath Damodaran, a professor at New York University’s Stern School of Business, expressed skepticism about Son’s ability to recover from the perception of incompetence, stating, “You can recover from mistakes, but how do you recover from the perception that you don’t know what you’re doing? His actions say, ‘I am arrogant.'” Damodaran also suggested that Son’s success prior to the WeWork ordeal might have clouded his judgment.

Despite the looming bankruptcy, WeWork is poised to continue operations while striving to stabilize its finances. SoftBank and existing creditors have hammered out a restructuring deal that will alleviate more than $3 billion of the company’s debt.

SoftBank’s Vision Fund was conceived to be the world’s foremost technology investor, with over $140 billion funneled into hundreds of startups by Son. However, Son’s tendency to inflate valuations and provide founders with more resources than initially requested drew rebuke from Silicon Valley peers.

Son’s avowal of gut instinct and anecdotal references to intuitive decisions may have clouded his judgment, leading him to disregard red flags and opposition from his advisors, as recounted by former officials from SoftBank and WeWork.

One of Son’s statements disclosed his profound attachment to WeWork, even amidst stern warnings from his board. Son took partial responsibility for encouraging Neumann’s ambitious pursuits, stating, “I may be more at fault than Adam, for telling him to be more aggressive.”

Even after WeWork’s failed IPO, SoftBank extended a $9.5 billion rescue package, defending its decision with an optimistic presentation on WeWork’s hypothetical path to profitability.

Son’s infatuation with WeWork and other startups was exacerbated by the initial $60 billion commitment from the Saudi and Abu Dhabi sovereign wealth funds, propelling valuations to unprecedented levels and sowing the seeds for the impending crash.

The mounting losses prompted Son to curtail investment activities, cut Vision Fund jobs, and impose stricter due diligence. This reticence, coupled with Arm Holdings Plc’s $4.9 billion IPO on Nasdaq in September, has provided the impetus for SoftBank to regain momentum.

As the bankruptcy formally concludes the downturn for Vision Fund 1 and offers Vision Fund 2 a fresh start, interest now veers toward Son’s future investments, rather than lingering on the losses in the portfolio.

Yet, Aswath Damodaran remains dubious about Son’s propensity to change his investment style, positing that SoftBank essentially applies a venture capitalist’s mindset to late-stage investments, albeit on a grander scale.

Damodaran elaborated, “By having tens of billions, hundreds of billions of dollars behind you, you make every overreach you do even bigger. That might explain how you make mistakes as big as WeWork.”

(Updates to add SoftBank comment on WeWork’s debt agreement in the seventh paragraph.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.