During the Goldman Sachs Financial Services Conference in New York on December 6, 2022, CEO David Solomon announced that his bank will disclose markdowns on commercial real estate holdings as the industry faces challenges posed by higher interest rates.

According to Solomon, Goldman Sachs will report impairments on loans and equity investments tied to commercial real estate in the second quarter. These impairments reflect loan defaults and falling valuations, impacting the bank’s quarterly results.

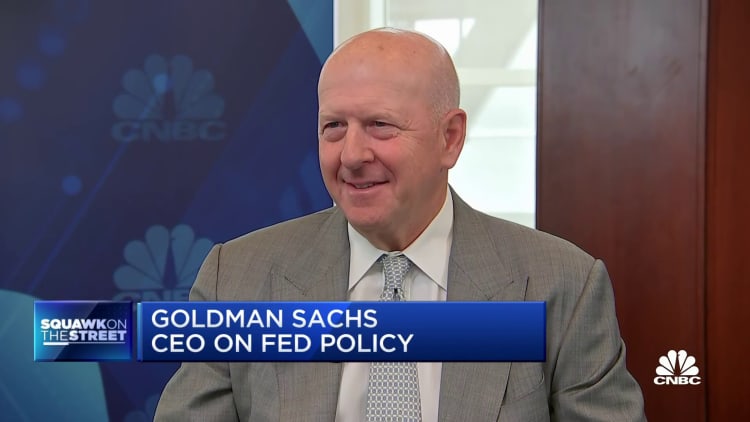

Goldman Sachs CEO David Solomon said Monday that his bank will disclose markdowns on commercial real estate holdings as the industry grapples with higher interest rates.

Solomon told CNBC’s Sara Eisen the New York-based firm will post impairments on loans and equity investments tied to commercial real estate in the second quarter. Financial firms recognize loan defaults and falling valuations as write-downs that affect quarterly results.

related investing news

“There’s no doubt that the real estate market, particularly commercial real estate, is under pressure,” he said during an interview on CNBC’s “Squawk on the Street.” “This quarter, you’ll see impairments in lending that will impact our wholesale provision.”

After years of low interest rates and high valuations for office buildings, the industry faces a challenging adjustment to increased borrowing costs and decreased occupancy rates due to remote work. Some property owners have chosen to walk away from their holdings rather than refinancing their loans. Bank results are now starting to reflect these defaults. According to Solomon, Goldman Sachs reported nearly $400 million in impairments on real estate loans in the first quarter.

In addition to lending activities, Goldman Sachs has also invested directly in real estate as part of its alternative investments in the past decade, Solomon mentioned.

“Given the current environment, we and others are marking down those investments this quarter and in the future,” Solomon explained.

While the write-downs present a challenge for the bank, Solomon believes they are manageable within the context of Goldman Sachs’ overall business.

However, smaller banks may struggle more. Solomon stated that approximately two-thirds of the industry’s loans are originated by regional and midsize institutions.

“We will need to work through these challenges,” he said. “There will likely be some bumps and pain along the way for many participants.”

In the wide-ranging interview, Solomon expressed his surprise at the resilience of the U.S. economy and noted the emergence of positive signs after a period of subdued capital markets activities.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.