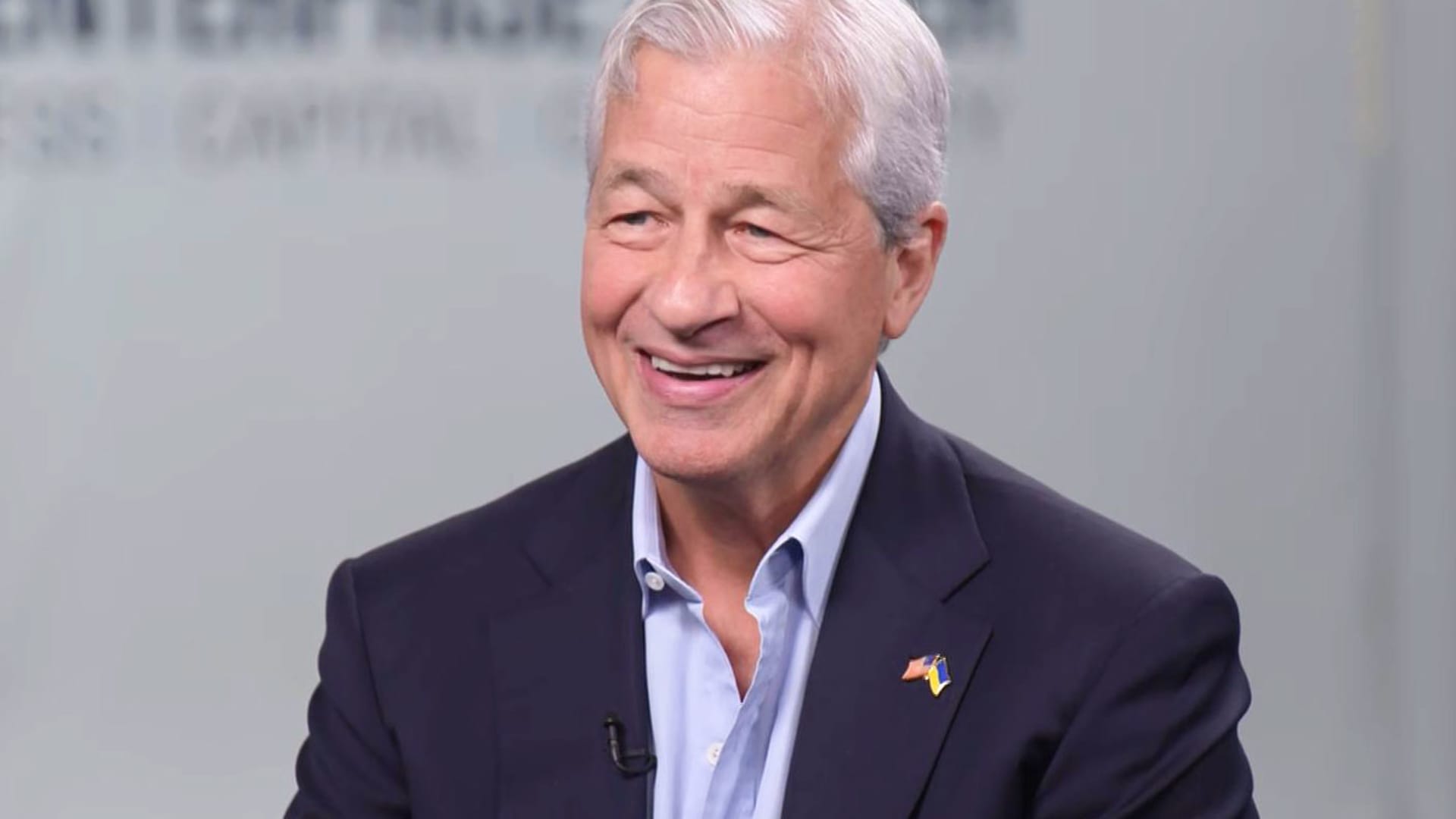

Jamie Dimon, CEO of JP Morgan Chase, was interviewed by Jim Cramer on February 23, 2023.

CNBC

Leading US banks, including JPMorgan Chase, Wells Fargo, and Morgan Stanley, announced on Friday their plans to increase their quarterly dividends after passing the Federal Reserve’s annual stress test.

JPMorgan intends to raise its payout from $1 to $1.05 per share, pending board approval, starting in the third quarter, according to a statement by the bank based in New York.

JP Morgan CEO Jamie Dimon said in a press release, “The results of the Federal Reserve’s 2023 stress test indicate that banks are resilient, even in the face of severe shocks, and continue to be a source of strength for the financial system and the broader economy. The Board’s proposed dividend increase represents a sustainable and slightly higher level of capital distribution to our shareholders.”

On Wednesday, the Federal Reserve published the results of its annual stress test, revealing that all 23 participating banks had passed the regulatory hurdle. The test determines the amount of capital that banks can distribute to shareholders through buybacks and dividends. This year’s exam simulated a “severe global recession” with a 10% unemployment rate, a 40% decrease in commercial real estate values, and a 38% drop in housing prices.

After passing the test, Wells Fargo announced it would increase its dividend from 30 cents to 35 cents per share, while Morgan Stanley stated its intention to raise its payout from 77.5 cents to 85 cents per share.

Goldman Sachs unveiled the largest per-share dividend increase among major banks, raising its payout from $2.50 to $2.75 per share.

Citi’s Smaller Increase

In contrast, Citigroup will raise its quarterly payout from 51 cents to 53 cents per share, the smallest increase among its peers.

This is likely due to the fact that while JPMorgan and Goldman achieved better-than-expected results, allowing for smaller capital buffers, Citigroup was one of the banks that saw their buffers increase after the stress test.

“While we would have preferred not to see an increase in our stress capital buffer, these results still demonstrate Citi’s financial resilience in all economic environments,” said Citigroup CEO Jane Fraser in a company statement.

All major banks refrained from announcing specific plans for share repurchases. JPMorgan and Morgan Stanley mentioned the possibility of buying back shares through previously announced repurchase plans, while Wells Fargo stated that it had the capacity to repurchase common stock over the next year.

Analysts predict that banks will likely be more conservative with their capital-return plans this year due to the finalization of international banking regulations, which is expected to increase the capital requirements for major global firms like JPMorgan.

Other factors contributing to banks’ desire to retain capital include the potential for higher standards for regional banks following the collapse of Silicon Valley Bank in March and the potential impact of a future recession on industry loan losses.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.