When it comes to rating the national economy, some people base their opinions on their own financial situation or personal experiences. While this may seem peculiar, considering that they are just one individual in a multi-trillion-dollar economy, the personal lens often provides the most prominent insight into the larger abstract forces at play. For many of us, it is the bills and budgets that we meticulously review at the kitchen table, rather than the latest Federal Reserve briefing.

Today, inflation’s impact shines a spotlight on this phenomenon. It has become the primary reason people express negativity about the economy, with prices being their chief complaint. Despite the inflation rate slowing down, the prices that surged after the pandemic have remained significantly higher than before. The recent release of the Consumer Price Index (CPI) report only adds to these increases.

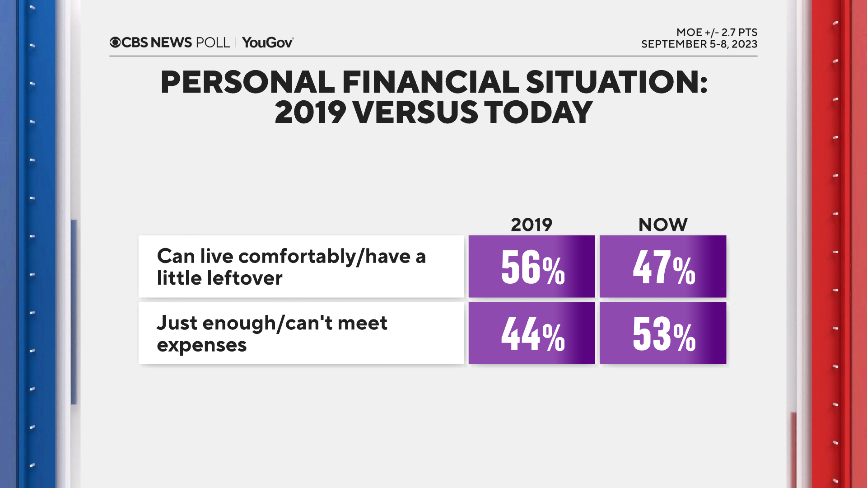

Given this, the pandemic serves as a valuable reference point for measuring personal financial recovery and comparing the current situation to the pre-pandemic period. What we discover is a lagging personal recovery. Today, the number of people who describe themselves as “living comfortably and able to save” is still lower than it was in the summer of 2019. Similarly, the number of people who describe themselves as meeting expenses with a little left over is also lower. These indicators serve as a rough proxy for the idea of “getting ahead,” and they have not yet returned to pre-pandemic levels.

In contrast, more people report struggling today compared to four years ago. Half of Americans say they are either just meeting their expenses or cannot meet them—a nine-point increase from the summer of 2019. This represents millions of people facing financial challenges.

These personal financial dynamics have implications for national economy ratings. Just as it was four years ago, the better individuals perceive their own financial situation, the higher they rate the national economy. Conversely, the worse their personal financial situation, the lower they rate the national economy.

There is a particularly dramatic change in how the middle-income range perceives their financial situation today. Over half of those in the income bracket of $50,000 to $100,000 say they have something left over after expenses, which is a nineteen-point decrease compared to 2019.

In the lower-income bracket of under $50,000, we might have expected significant change due to the impact of absolute prices. However, there hasn’t been much change. Perhaps this is because many people in this income bracket were already struggling. In both 2019 and today, only a third of those in this income bracket say they have something left over after expenses.

(It is worth noting that this particular measure may not capture other factors related to income and expenditures, such as adjustments in expenses or increased debt to cover them. While lower expenses may make these figures appear more stable over time, it is possible that living standards have declined, possibly contributing to negative views in either case.)

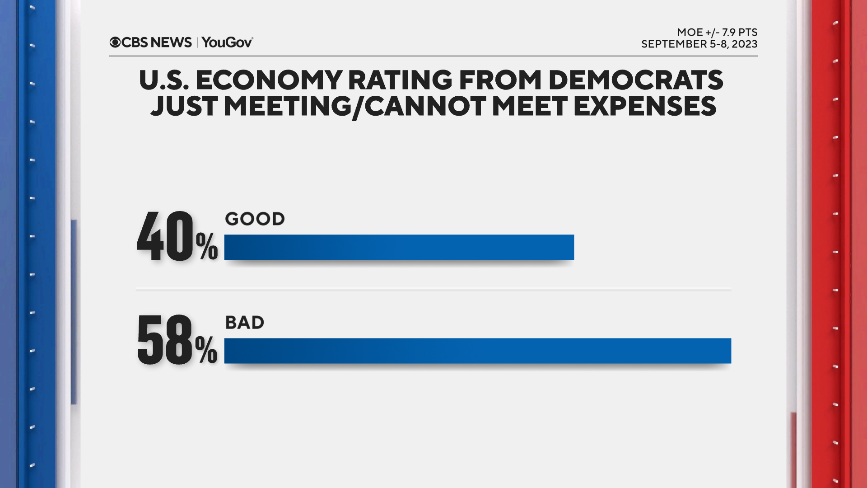

One final note with political implications is that individuals who are just getting by or struggling financially today have a significantly worse perception of the U.S. economy compared to individuals in similar financial situations back in 2019. However, the reason for this difference lies more in partisan affiliations.

When Democrats are just getting by or struggling today—which is the case for a significant portion of them—they are critical of the national economy, despite their party being in power. On the other hand, when Republicans were in similar financial situations in 2019, they were not as critical of their own party in power. However, today, these Republicans are certainly critical of the economy.

As a result, President Biden’s economy and inflation ratings are remaining low. He is not receiving the overwhelming approval within his own party that one might expect in this hyper-partisan era.

Despite the macro-level indicators suggesting a recovery from the pandemic’s impact, many individuals still do not feel a personal recovery. This basic and personal assessment indicates that a significant portion of the population is still facing financial challenges.

This CBS News/YouGov survey was conducted with a nationally representative sample of 2,335 U.S. adult residents interviewed between September 5-8, 2023. The sample was weighted according to gender, age, race, and education based on the U.S. Census American Community Survey and Current Population Survey, as well as past vote. The margin of error is ±2.7 points.

Denial of responsibility! Vigour Times is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.