The Philippines now boasts its own sovereign wealth fund called the Maharlika Investment Fund (MIF). According to recent reports, the Landbank of the Philippines and the Development Bank of the Philippines have deposited P50 billion and P25 billion, respectively, as their initial contribution to the MIF.

It’s worth noting that globally, there are approximately 100 sovereign wealth funds managing a staggering $11 trillion in assets. The top 5 funds include the China Investment Corp with $1.35 trillion, Norges Bank Investment Management with $1.14 trillion, Abu Dhabi Investment Authority with $993 billion, State Administration of Foreign Exchanges with $980 billion, and Kuwait Investment Authority with $769 billion. (Source: www.statista.com)

Among these funds, Norges Bank Investment Management from Norway stands out as the best performer, with a remarkable 14.5 percent return on investment for 2021. Furthermore, it is estimated that the fund holds approximately $244,000 for every Norwegian citizen. (Source: www.reuters.com)

The declared policy of the MIF is to generate, preserve, and grow national wealth. Its primary objectives include job creation, trade and investment promotion, technological transformation, enhanced connectivity, expanded infrastructure, and achieving energy, water, and food security. (Sec. 2 of Republic Act No. 11954)

Administering the MIF is the Maharlika Investment Corp (MIC), which has an authorized capital stock of P500 billion. Out of this amount, P125 billion will be initially subscribed and paid in by government financial institutions. (Sec. 6, RA 11954)

Although the initial capital may seem relatively small compared to other sovereign wealth funds, the law allows the MIC to issue bonds, debentures, and other securities. This flexibility enables the fund to significantly increase its assets and investible funds. (Sec. 10, RA 11954)

The law outlines specific areas where the MIF can invest, including cash, foreign currencies, metals, tradeable commodities, fixed income instruments, corporate bonds, equities, Islamic investments, joint ventures, real estate, infrastructure projects, and various programs and projects that contribute to sustainable development. The law also emphasizes high-impact projects approved by the appropriate body to align with the government’s socioeconomic development program. (Sec. 14, RA 11954)

If utilized effectively, the MIF can make a substantial and positive contribution to the Philippine economy and gross domestic product. In 2019, the Philippines ranked higher than Malaysia and Vietnam in terms of GDP. However, in 2022, Malaysia and Vietnam overtook the Philippines. (Source: www.statista.com/statistics/796245/gdp-of-the-asean-countries/)

As lawyers working with clients ranging from small to large enterprises, both local and foreign, we have received inputs and observations regarding the potential utilization of the MIF resources to enhance the Philippine economy:

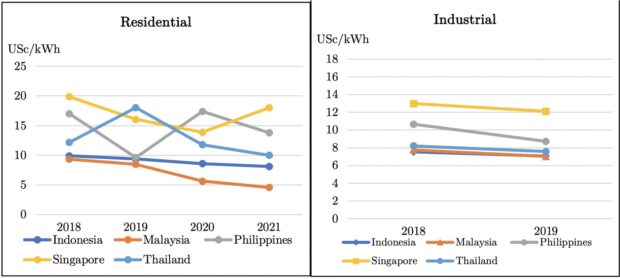

- Power/Electricity: The Philippines has one of the highest electricity prices among ASEAN countries. Lowering electricity rates through investments in power generation, transmission, and distribution will attract businesses to the country and benefit existing enterprises. (Source: The Nature and Causes of High Philippine Electricity Price and Potential Remedies, Majah-Leah V. Ravago, Ateneo de Manila Department of Economics, Ateneo Center for Research and Economic Development, Jan 19, 2022)

- Infrastructure: Investing MIF resources in improving infrastructure is crucial. Metro Manila suffers from severe congestion due to its role as the centralized hub for business and activity. Efforts to decentralize commerce and industry to surrounding areas must be supported by enhancing accessibility through road networks, alternative transportation, and reliable communication systems.

- Agriculture: The agricultural sector requires significant investment for advancements in technology and efficiency. Capital and training are necessary to keep up with global advancements and ensure sustainability.

- Skills training: Building the skills of the Filipino workforce is essential. Clients have expressed concerns about the quality and proficiency of local suppliers and service providers. Enhancing the skills of our workforce will enable them to remain competitive and attract more investments.

In conclusion, the Maharlika Investment Fund holds immense promise for the Philippines. It is our hope that this fund will be deployed efficiently and effectively to maximize its benefits for the country. (The author, Atty. John Philip C. Siao, is a practicing lawyer and Founding Partner of Tiongco Siao Bello & Associates Law Offices, an Arbitrator of the Construction Industry Arbitration Commission of the Philippines, and teaches law at the De La Salle University Tañada-Diokno School of Law. He may be contacted at [email protected]. The views expressed in this article belong to the author alone.)

Your subscription could not be saved. Please try again.

Your subscription has been successful.

Read Next

Don’t miss out on the latest news and information. Subscribe to INQUIRER PLUS to get access to The Philippine Daily Inquirer & other 70+ titles, share up to 5 gadgets, listen to the news, download as early as 4am & share articles on social media. Call 896 6000.

Denial of responsibility! Vigour Times is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.