China is still grappling with deflationary pressures, which highlights the fragility of its economic recovery in the final months of 2023, according to Bloomberg. Economists surveyed by the publication anticipate that data due on Thursday will show consumer prices in China slipping into deflation in October. Producer prices are also expected to decline for the 13th consecutive month. The consumer price index has been consistently weak this year, dipping into deflation in July and showing intermittent negative year-on-year growth since then. The People’s Bank of China previously stated that prices would rebound from their rough patch in the summer, but another drop in prices would challenge that optimistic assessment. Morgan Stanley has warned that China could be facing a prolonged battle against falling prices as it transitions from an overextended, credit-fueled growth model.

Weak inflation figures would add further uncertainty to China’s growth outlook following an unexpected contraction in factory activity and slowing growth in the services sector in October. Experts have noted that China’s consumption demand remains weak, with the country’s widest measure of prices, the GDP deflator, likely to be negative in the final quarter of the year. Bloomberg estimates based on official data suggest that the GDP deflator has already declined for two consecutive quarters, the first time since 2015.

Additional reports due in the coming days may provide more insight into the trajectory of China’s economic recovery. Export figures are expected to show a narrowing drop in October, partly due to a lower comparison base in 2022 when China was still dealing with pandemic-related lockdowns. Credit data for last month may also be released and is anticipated to show increased overall financing due to a surge in government bond issuance. Analysts are increasingly expecting the central bank to provide more liquidity support by cutting the reserve requirement ratio.

China’s Premier Li Qiang has promised to expand access to markets and increase imports, aiming to address the decline in imports this year. In other news, central bankers from the Federal Reserve, European Central Bank, and other institutions are making public appearances, including Federal Reserve Chair Jerome Powell and European Central Bank President Christine Lagarde. Important economic events include Bloomberg’s New Economy Forum in Singapore, which focuses on critical issues facing the global economy.

In the US and Canada, the focus will be on Federal Reserve Chair Jerome Powell, who is participating in a panel discussion on Thursday. Other Fed officials are also returning to the speaking circuit following the central bank’s decision to leave rates unchanged on November 1. Economic releases to watch for include the University of Michigan’s preliminary November consumer sentiment index and Thursday’s report on weekly jobless claims. The Bank of Canada will publish a summary of its deliberations that led to the decision to hold rates steady last month.

In Asia, the Reserve Bank of Australia is expected to raise borrowing costs to a 12-year high on Tuesday. Bank of Japan Governor Kazuo Ueda may provide more clarity on recent decisions when he speaks on Monday. GDP figures for the third quarter are expected to show a slowdown in Indonesia’s economy and a rebound in the Philippines’ economy. Inflation numbers from Thailand, the Philippines, and Taiwan are all expected to show slowing price growth.

In Europe, Germany’s economy is expected to show contractions in factory output and industrial production in September. Market participants will be interested in hearing the views of Bundesbank President Joachim Nagel on the European Central Bank’s next steps, as well as other members of the Governing Council scheduled to speak. The ECB will also publish its monthly survey of consumers’ inflation expectations. European Union finance ministers will meet to discuss the EU’s deficit rules, which are set to come back into force in 2024.

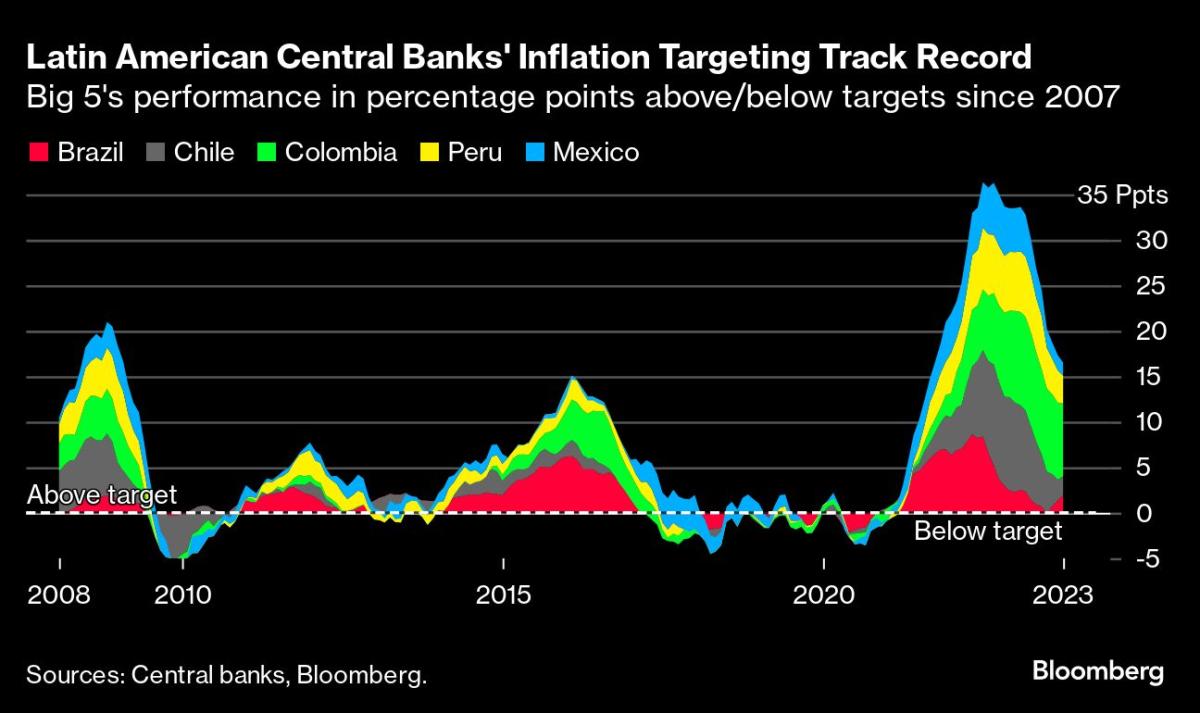

Latin American countries including Brazil, Chile, Colombia, and Mexico will report October inflation data, with a downward trend expected in all five economies. Brazil’s central bank will meet to discuss interest rates, while Chile, Colombia, and Mexico are expected to continue their pause.