Stay informed about the latest updates on US-China relations by subscribing to our free newsletter.

Every morning, receive a myFT Daily Digest email summarizing the most recent news on US-China relations.

Following President Joe Biden’s announcement of a ban on US investment in certain key tech industries in China, the founder of a Shanghai-based semiconductor start-up felt compelled to take action.

“After the news broke, I made the decision to relocate at least part of the team out of China,” the individual said, requesting anonymity due to the sensitivity of the subject. “Otherwise, our financing options would be severely limited.”

The executive order, unveiled on Wednesday and set to be implemented next year, aims to prevent China’s military from accessing American funding and know-how by prohibiting investment in quantum computing, advanced chips, and artificial intelligence.

Meanwhile, US investors are assessing the potential impact of Biden’s order on their investments in China and considering compliance or divestment strategies.

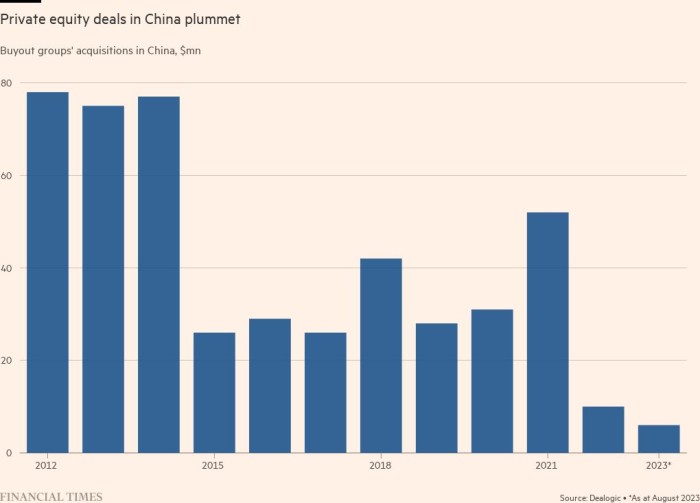

In recent years, private equity firms General Atlantic, Warburg Pincus, and Carlyle Group have invested billions in China, betting on the country’s rise as a technological superpower. However, many of them have already scaled back their investments. Dealogic figures show that buyout deals in China dropped from $47 billion in 2021 to just $2.4 billion in 2022 and $2.8 billion so far this year.

Sequoia Capital made one of the most drastic moves by separating its China arm from its US and European operations and spinning off its India business in June.

“The era of American venture capital firms investing in China is over now,” remarked a European venture capital investor.

General Atlantic, which has invested in ByteDance and fast-fashion retailer Shein, stated in June that China still offered great opportunities.

The US order focuses on three specific sectors, a strategy referred to as “small yard, high fence” by national security adviser Jake Sullivan. These sectors are already extensively covered by China’s foreign investment screening rules implemented in 2021.

However, the inclusion of artificial intelligence (AI) in the order could deter US investors from investing in a wide range of Chinese companies, as AI is widely used in various sectors.

“Artificial intelligence is pervasive, and most of it has dual use capabilities. You can’t confine it to a specific box,” explained Marcia Ellis, global co-chair of Morrison Foerster’s private equity practice.

For example, Ellis mentioned that US investors might question whether they can invest in a warehouse company that utilizes AI if the same technology is employed by the military.

There is also uncertainty surrounding the role of “limited partners,” such as US public pension funds, which provide capital for private equity and venture capital funds. The administration does not plan to impose restrictions on limited partnerships unless the LP’s contribution is purely financial and has no influence on the Chinese fund’s decision-making and operations.

This could enable Chinese venture capital groups, such as HongShan, a firm spun off from Sequoia and led by Neil Shen, to continue raising and investing funds from American LPs. However, there will likely be a specific investment threshold determined as the administration further develops the final rule.

US officials stated that their focus extends beyond joint ventures and includes American private equity and venture capital firms. These firms can provide valuable “intangible” benefits to Chinese groups, such as introductions to experts and other companies in their investment networks.

Some Republicans have called on the Biden administration to expand the scope of the restrictions, arguing that they will not effectively slow down China’s military modernization. The Financial Times reported that Mike Gallagher, the Republican chair of the House China committee, urged Biden to include public market investments in the executive order.

Jonathan Gafni, head of the US foreign investment practice at Linklaters, stated that lobbyists will have ample time to consider the final rules in the coming months.

“The administration is not taking a firm stance yet, as they are aware that a broad application will face significant opposition,” Gafni explained.

Nevertheless, the new ban is likely to make US investors more cautious about investing in new private equity funds in China.

“I believe they will carefully consider new investments and include side-letters stating that their capital will not be utilized

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.