New York (AP) — “Junk fees” are deceptive charges that increase the overall cost of various goods and services, such as concert tickets, hotel rooms, and utility bills. The Biden administration aims to address this issue through a new Federal Trade Commission (FTC) rule, along with regulations from the Consumer Finance Protection Bureau and the Department of Labor. By staying vigilant, challenging last-minute add-ons, and comparison shopping, consumers can also avoid these fees.

Here’s what you should know:

WHAT QUALIFIES AS A JUNK FEE?

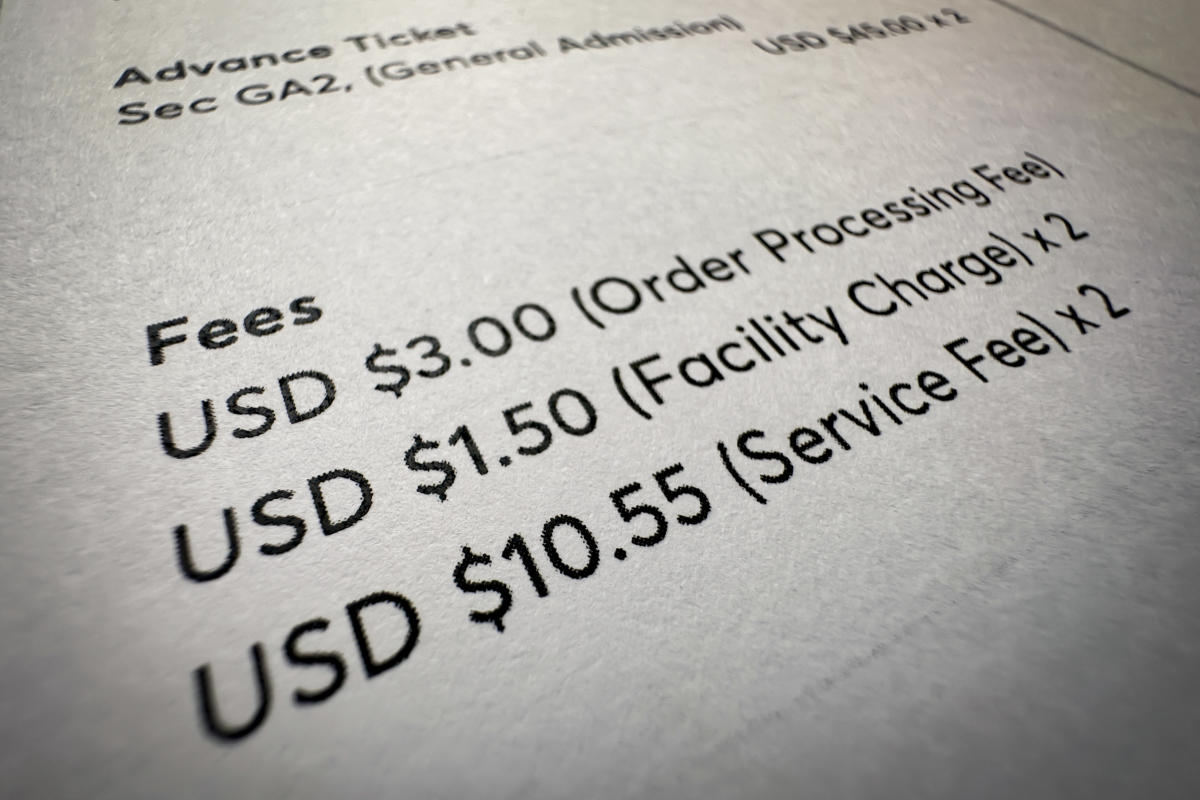

Junk fees often pop up during the final stages of the checkout process when purchasing concert tickets, airline tickets, hotel stays, or other products with additional “processing charges”. These fees may also appear late in the payment process when it comes to housing, such as when renting a property, or when purchasing services for incarcerated individuals (e.g., phone calls, emails, money transfers). Increased transparency will enable consumers to avoid sellers who inflate prices, though this may not always apply to incarceration. The rule will also save consumers time by providing them with the actual price upfront.

“The law will require upfront disclosure of fees and prohibit misrepresenting the total cost, nature, and purpose of the fee,” says Ariel Nelson, a staff attorney at the National Consumer Law Center. “If you come across charges that don’t make sense or you’re paying for something that wasn’t included in the original price, report it to the FTC and your state’s attorney general.”

To report an opaque fee or unethical business practice, visit https://reportfraud.ftc.gov/. You can find your state attorney general at https://www.usa.gov/state-attorney-general.

The rule will also make it mandatory for companies to disclose whether their fees are refundable. It applies to various industries, including hotels, energy providers, internet services, car rentals, apartment rentals, and entertainment tickets. Non-compliant companies may face fines, penalties, and the obligation to provide refunds.

WHAT IS THE WHITE HOUSE DOING?

The proposed crackdown on junk fees is part of a series of initiatives by the Biden administration aimed at protecting consumers. However, Republican lawmakers and some business groups argue that these efforts could lead to increased regulatory costs and harm the economy.

“The proposed rule would prevent corporations from inflating costs, ensuring honest pricing and encouraging honest competition,” stated FTC Chair Lina Khan. “Violators will face civil penalties and will be required to reimburse affected Americans.”

The Consumer Financial Protection Bureau also plans to prevent major banks from charging junk fees for basic customer services.

In addition, the Department of Labor has proposed a new rule that requires financial advisers to provide retirement advice in the best interest of the saver, closing a regulatory loophole that was previously overseen by the Securities and Exchange Commission. This rule will reduce junk fees for retirement savings advice, although it does not typically cover commodities or insurance products like fixed index annuities, which are often recommended to individuals saving for retirement.

HOW CAN I AVOID PAYING JUNK FEES?

If the FTC rule is approved as proposed, it will help consumers understand the costs involved more quickly, promoting fair competition, according to Nelson.

As things currently stand, here are some steps you can take to avoid bogus charges, as advised by the consumer watchdog Public Interest Resource Group:

– Question any costs that are unclear from the start. This could include additional “company charges” on phone or utility bills or buried “service fees” in terms and conditions. Sometimes, these optional charges are given official-sounding names to discourage questioning.

– If you’re unsure about a fee, request a clear explanation in writing.

– Comparison shop to determine if a fee is necessary. Another seller may offer a more reasonable price without hidden charges.

– Use a credit card for payment. Disputing questionable or undisclosed fees is easier when paying by credit.

– Keep records of receipts, emails, texts, and other communications. In case you encounter an unexpected fee, you can easily file a complaint with the company, your state attorney general, or the FTC.

HOW MUCH DO THESE FEES COST CONSUMERS?

According to Lael Brainard, director of the White House National Economic Council, research shows that hidden fees can cause consumers to pay up to 20% more than they would have if they had known the total cost upfront and comparison-shopped. The FTC estimates that consumers spend 50 million hours annually searching for the total price of tickets and lodging. The rule is expected to save consumers around $1 billion each year in time saved when it comes to these two categories.

___

The Associated Press receives support from the Charles Schwab Foundation for educational and explanatory reporting, aimed at improving financial literacy. Please note that the independent foundation is separate from Charles Schwab and Co. Inc. The AP is solely responsible for its journalism.