A construction in a multifamily and single family residential housing complex is shown in the Rancho Penasquitos neighborhood, in San Diego, California, September 19, 2023.

Mike Blake | Reuters

In theory, achieving the Federal Reserve’s target of 2% inflation doesn’t seem too challenging.

While services and shelter costs are the main culprits, other components show signs of easing. Focusing on these two areas of the economy doesn’t appear to be an overwhelming task compared to the summer of 2022 when prices were rapidly rising.

However, in practice, it may be more difficult than anticipated.

Prices in services and shelter have proven to be more resistant to change compared to other items like food, gas, used and new cars, which tend to fluctuate with the broader economy.

Instead, gaining better control over rents and medical care services, among others, could be a challenging task.

“You need a recession,” stated Steven Blitz, chief U.S. economist at GlobalData TS Lombard. “You won’t magically achieve a 2% inflation rate.”

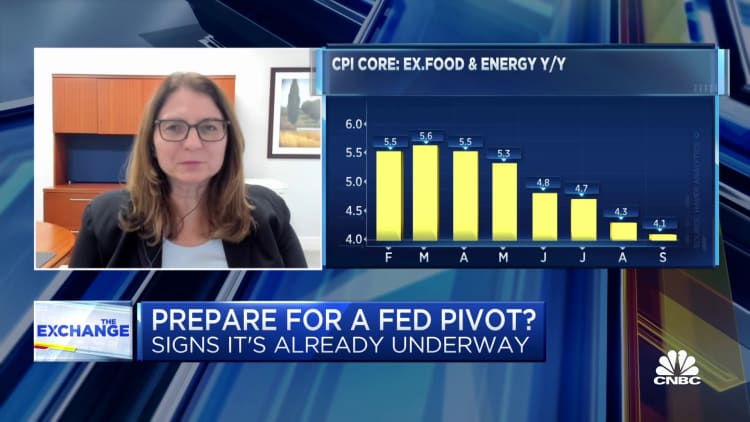

In September, annual inflation measured by the consumer price index fell to 3.7%, or 4.1% excluding volatile food and energy costs, which have been steadily increasing. While these numbers are still above the Fed’s target, they do represent progress compared to the past when inflation was much higher.

The CPI components reveal uneven progress. Used vehicle prices and medical care services have eased, but there have been significant increases in shelter (7.2%) and services (5.7% excluding energy services).

Specifically, rental prices have risen by 7.2%, rent for primary residence increased by 7.4%, and owners’ equivalent rent, a pivotal figure in the CPI calculation, rose by 7.1%, including a 0.6% gain in September.

Without progress in these areas, it is unlikely that the Fed will achieve its target in the near future.

Uncertainty Ahead

“The forces driving disinflation among various components of the index eventually give way to the broader macro force, which is rising due to above-trend growth and low unemployment,” explained Blitz. “Eventually, a recession will come and that’s when inflation will finally decrease.”

On the positive side, Blitz, along with many Wall Street economists, including Goldman Sachs, predicts that any recession will be shallow and short-lived. However, uncertainty remains in the meantime.

“Sticky-price” inflation, which includes rents, services, and insurance costs, remained at a 5.1% pace in September, down from 6.1% in May, while flexible CPI, including food, energy, vehicle costs, and apparel, increased at just a 1% rate. While there has been progress, the target has not been achieved yet.

Markets are unsure about the Fed’s next move. Will policymakers implement another rate hike before the end of the year? Or will they stick to their current strategy while monitoring inflation dynamics?

“Inflation stuck at 3.7%, combined with a strong September employment report, could prompt the Fed to go for one more rate hike this year,” suggested Lisa Sturtevant, chief economist for Bright MLS. “Housing is the key driver of the elevated inflation numbers.”

Higher interest rates have had the most impact on the housing market in terms of sales and financing costs. However, prices remain high, and there are concerns that the high rates will discourage the construction of new apartments and limit supply.

These factors “will lead to higher rental prices and worsening affordability conditions in the long run,” wrote Christopher Bruen, senior director of research at the National Multifamily Housing Council. “Rising rates threaten the strength of the broader job market and economy, which has not yet fully absorbed the rate hikes enacted.”

Longer-term Concerns

One factor that could keep the Fed from raising rates is the idea that the economy still needs to cool down before inflation can be brought under control.

While pandemic-related effects have largely dissipated, other factors remain.

“Pandemic-era effects have had an impact on the economy, but bringing inflation down to the 2% target requires economic cooling, which is no easy task given fiscal easing, strong consumer spending, and the financial health of corporations,” explained Marta Norton, Chief Investment Officer for the Americas at Morningstar Wealth.

Fed officials anticipate the economy to slow down this year, although they have backed down from their earlier expectation of a mild recession.

The Fed has been counting on rental leases being renegotiated at lower prices once they expire, which would help bring down shelter inflation. However, the rising shelter and owners equivalent rent numbers indicate that this could be a lengthy process, even though asking rent inflation is slowing down, according to Stephen Juneau, U.S. economist at Bank of America.

“Therefore, we must wait for more data to see if this is just a blip or if there is something more fundamental driving the increase, such as higher rent increases in larger cities offsetting softer increases in smaller cities,” Juneau stated in a note to clients. He also highlighted that the CPI report “serves as a reminder that we don’t have good historic examples to rely on” for long-term patterns in rent inflation.

Denial of responsibility! Vigour Times is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.

Denial of responsibility! Vigour Times is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.