Nurphoto | Nurphoto | Getty Images

Delta Air Lines announced on Tuesday that it has raised its second-quarter forecast and projected full-year adjusted earnings of $6 per share, which falls within the upper range of its previous estimates given in April this year. The airline attributes this positive outlook to robust travel demand and customers opting for more expensive fare classes.

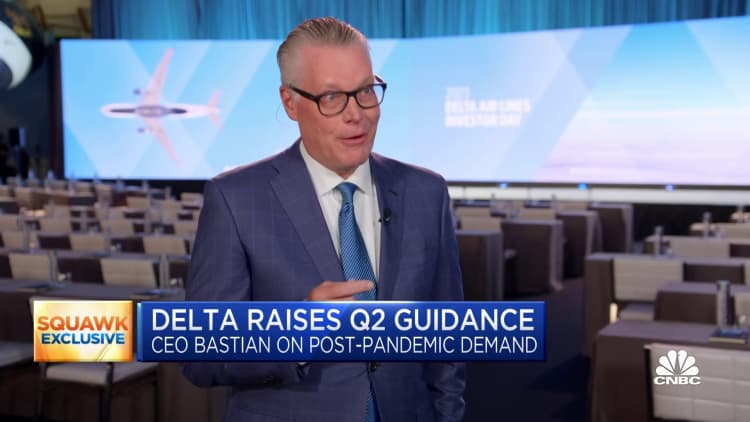

For the second quarter, Delta forecasts adjusted earnings per share of $2.25 to $2.50, up from the previous range of $2 to $2.25 per share. CEO Ed Bastian expressed confidence in the company’s Q2 earnings, stating that they have the potential to be the highest ever recorded for the April-June period.

In an interview with CNBC’s “Squawk Box,” Bastian mentioned that there is a significant surge in demand for travel, apparent to anyone who is currently traveling, labeling it as extraordinary.

During an investor day presentation, Delta also raised its estimate for free cash generation this year to $3 billion, up from $2 billion. Earlier this month, the airline reintroduced its quarterly dividend.

Delta and its competitors have all reported strong travel demand, particularly for international trips, unlike other sectors that have struggled due to inflation and other challenges. The airline industry also faces growth constraints such as air traffic controller shortages, delays in new aircraft, and shortages of new pilots. These factors have contributed to keeping fares stable.

In addition to resilient demand, airlines are benefiting from a 30% decrease in jet-fuel prices compared to last year.

Furthermore, Delta predicts that its revenue per available seat mile, a key indicator of an airline’s financial performance, will increase by up to 18% compared to last year, surpassing its previous forecast of 15% to 17% growth.

The company has consistently highlighted the willingness of customers to upgrade to more expensive seats, from those with extra legroom to first class. Premium revenue is expected to reach approximately $19 billion this year, accounting for 35% of total revenue, up from 24% in 2014.

Delta also recognizes the growing success of its partnership with American Express credit cards, which is projected to generate around $6.5 billion this year, compared to $4 billion in 2019.

In premarket trading on Tuesday, Delta shares rose more than 1%.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.