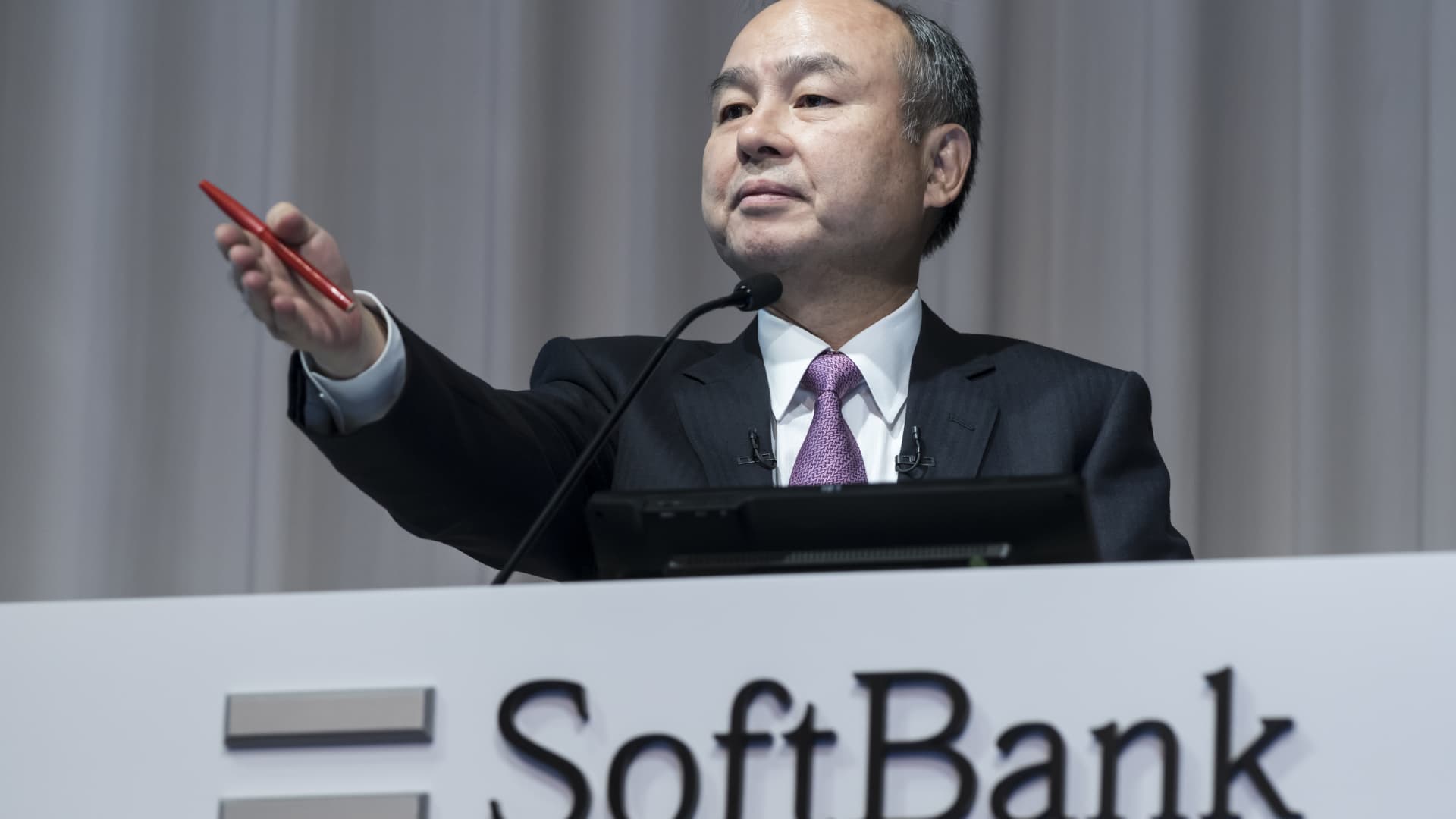

During a recent earnings presentation, SoftBank Founder Masayoshi Son (pictured here in 2019) stated that the company will adopt a “defense” strategy due to numerous challenges that have disrupted global markets.

Tomohiro Ohsumi | Getty Images

Softbank’s Vision Fund filed a lawsuit against the founders of one of its portfolio companies on Monday, accusing them of artificially inflating user metrics, deceiving the fund about performance, and defrauding the fund for millions.

The complaint, filed in San Francisco federal court, alleges that the buzzy social media startup IRL, which launched in April 2021, was touted as “one of the fastest growing social media apps for Generation Z.”

Softbank invested in the company based on its supposed low cost and “strong” user engagement, believing it was well-positioned for further viral growth, much like Facebook and Twitter, according to the complaint.

In May 2021, SoftBank invested $150 million in IRL through one of its high-spending Vision Funds, purchasing $125 million in shares from the company and an additional $25 million from insiders, including CEO Abraham Shafi, Noah Shafi, and Yassin Aniss, the complaint alleges.

SoftBank thought that IRL had 12 million monthly active users (MAUs).

However, the complaint claims that these numbers were false. IRL allegedly manipulated its platform with a swarm of bots, creating the illusion of a thriving social network, when in reality, it was a scheme to deceive investors.

The deception came to light when the Securities and Exchange Commission launched an investigation into IRL in late 2022. Abraham Shafi was suspended as CEO in April 2023, and the company was dissolved in June.

The lawsuit raises concerns about SoftBank’s scrutiny of its portfolio companies. When an independent assessment of user numbers fell significantly below IRL’s claims, SoftBank representatives reportedly accepted Abraham Shafi’s explanation that they were inaccurate.

SoftBank’s track record includes major investments in allegedly fraudulent crypto exchange FTX and devalued property company WeWork. The conglomerate’s Vision Funds have suffered since the market highs of 2021, leading to a full-year loss of $32 billion for the fiscal year ended March 31, 2023.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.