VMware at the New York Stock Exchange, December 14, 2021.

Source: NYSE

A Chinese payment processor’s compliance chief has been accused by both the U.S. Securities and Exchange Commission and New York federal prosecutors of violating insider trading laws. This accusation stems from the individual secretly accessing his girlfriend’s computer to gain information about meetings between investment bankers and companies.

Steven Teixeira, who held the position of chief compliance officer for the U.S. branch of LianLian Global, a Chinese company, has pleaded guilty to the federal charges as part of a cooperation agreement. However, the charges brought by the SEC have not been resolved yet, according to the agency’s statement on Thursday.

Teixeira allegedly obtained insider information, including advance knowledge of Broadcom’s planned $61 billion acquisition of VMware in 2022, and shared it with an associate for personal gain. The SEC claims that Teixeira acquired this information through the Outlook calendars and files of his girlfriend, who worked as an executive assistant at an unidentified New York-based investment bank.

This nonpublic information consisted of term sheet data and deal planning by several technology companies, including the VMware deal and Thoma Bravo’s intended purchase of Proofpoint. Teixeira allegedly made over $730,000 in profits using this information.

The complaint states that Teixeira’s girlfriend asked him to check her work email while she was away, and to inform her if any important emails arrived.

Proofpoint was taken private in a $12.3 billion deal by private equity firm Thoma Bravo in 2021, during the period when Teixeira is alleged to have traded using insider information. Teixeira bought options on Proofpoint stock on April 22, 2021, prior to the official announcement. Broadcom’s acquisition of VMware has faced regulatory delays.

Teixeira supposedly shared the insider information with his associate, Jordan Meadow, who is also facing charges of violating federal insider trading laws.

Meadow allegedly used this information in his capacity as an investment advisor, guiding his clients towards profitable opportunities and earning “hundreds of thousands” of dollars in commissions, as per the SEC’s allegations.

Furthermore, Meadow is also facing separate federal charges, unveiled on Thursday, in the Southern District of New York.

Scott Thompson, the SEC’s Philadelphia associate regional director, commented in a press release, “Our complaint alleges brazen betrayals of trust by Teixeira, who misappropriated information from his girlfriend’s laptop to make a quick buck, and by industry-veteran Meadow, who was all too eager to use the information to line his pockets.”

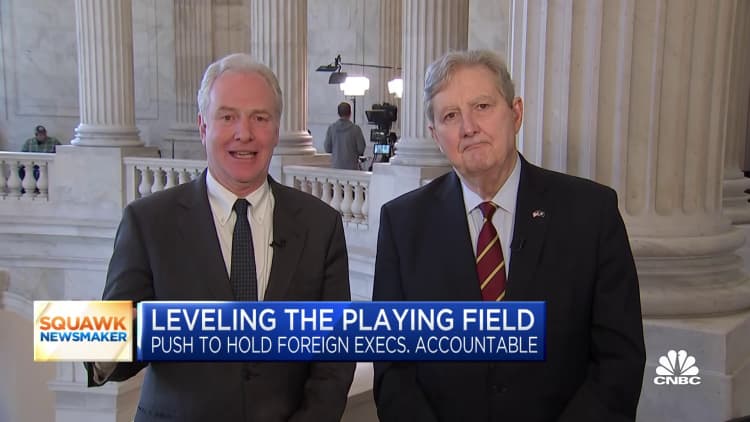

WATCH: Senators Kennedy and Van Hollen introduce a bill to prevent foreign executives from engaging in insider trading.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.