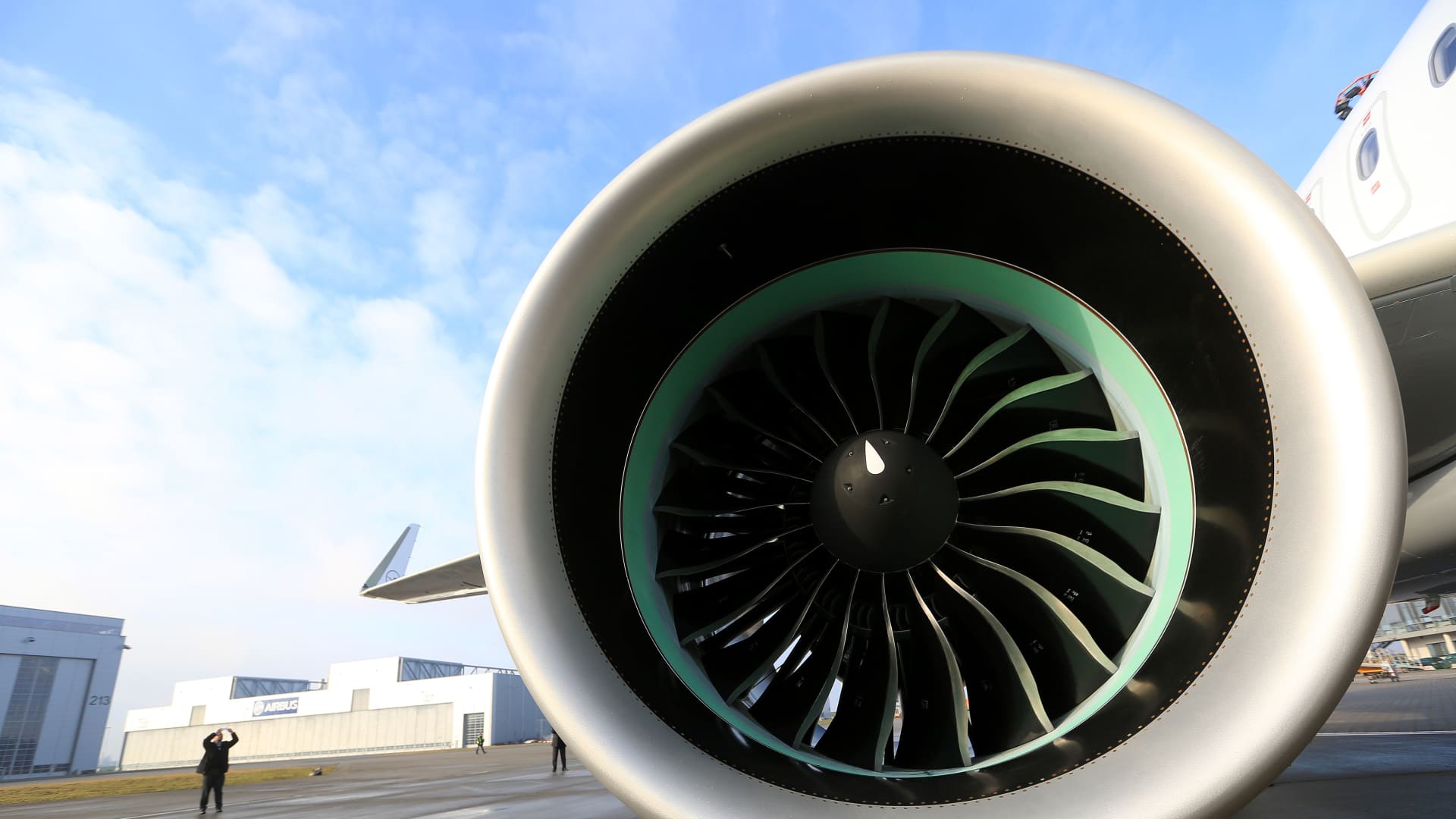

A Pratt & Whitney PW1000G turbofan engine sits on the wing of an Airbus A320neo aircraft during a delivery ceremony outside the Airbus Group SE factory in Hamburg, Germany, on Friday, Feb. 12, 2016.

Bloomberg | Krisztian Bocsi

Shares of RTX dropped by 10% on Tuesday following the announcement by the aerospace giant that it will need to perform “accelerated” inspections on approximately 200 engines due to a manufacturing problem.

The issue stems from the use of powdered metal in certain engine parts, as disclosed by RTX, the parent company of Pratt & Whitney, during a quarterly earnings call. However, engines currently in production are unaffected by this problem.

As a result of this issue, RTX has revised its cash flow outlook for the year and lowered it by $500 million to $4.3 billion.

“It’s going to be an expensive endeavor,” stated RTX CEO Greg Hayes during the earnings call. “We’re committed to compensating the airlines for the disruption we will cause them.”

This problem compounds the challenges faced by airlines, including delayed aircraft deliveries, as they aim to capitalize on the travel boom while facing limited availability of planes.

Furthermore, Pratt & Whitney anticipates having to remove approximately 1,000 more engines from airline fleets within the next nine to twelve months.

Noah Poponak, an aerospace and defense equities analyst at Goldman Sachs, mentioned that the impact of this issue could extend into next year and even reach as far as 2025, depending on how many of the approximately 1,000 engines require immediate repairs.

“I believe the stock reaction is justified,” added Poponak, who assigned a neutral rating to RTX with a 12-month price target of $102. The closing price of RTX shares on Tuesday was $87.10.

Poponak also highlighted additional challenges faced by these engines, particularly when operating in hot climates, requiring regular maintenance.

RTX has assured that it will continue to deliver new aircraft engines and parts. A spokesperson confirmed that flight safety remains unaffected by this issue.

This manufacturing problem will impact certain A320neos, which are narrow-body planes and among the most popular aircraft in the world. They compete with the Boeing 737 Max.

The Federal Aviation Administration (FAA) has acknowledged the issue and is in communication with Pratt & Whitney and the affected airlines.

“The agency will ensure that appropriate measures are taken,” stated the FAA.

Delta Air Lines, a major Airbus customer, is currently investigating the issue. Airbus has yet to provide comments. A JetBlue Airways spokesperson stated that they are “working with Pratt to assess the impact to our fleet.”

Meanwhile, General Electric, a competitor in the engine manufacturing industry, saw its shares rise by more than 6% on Tuesday to reach a five-year high. This surge follows the conglomerate’s upward revision of its revenue and cash flow forecast for the year, driven partly by strong demand for jet engines.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.