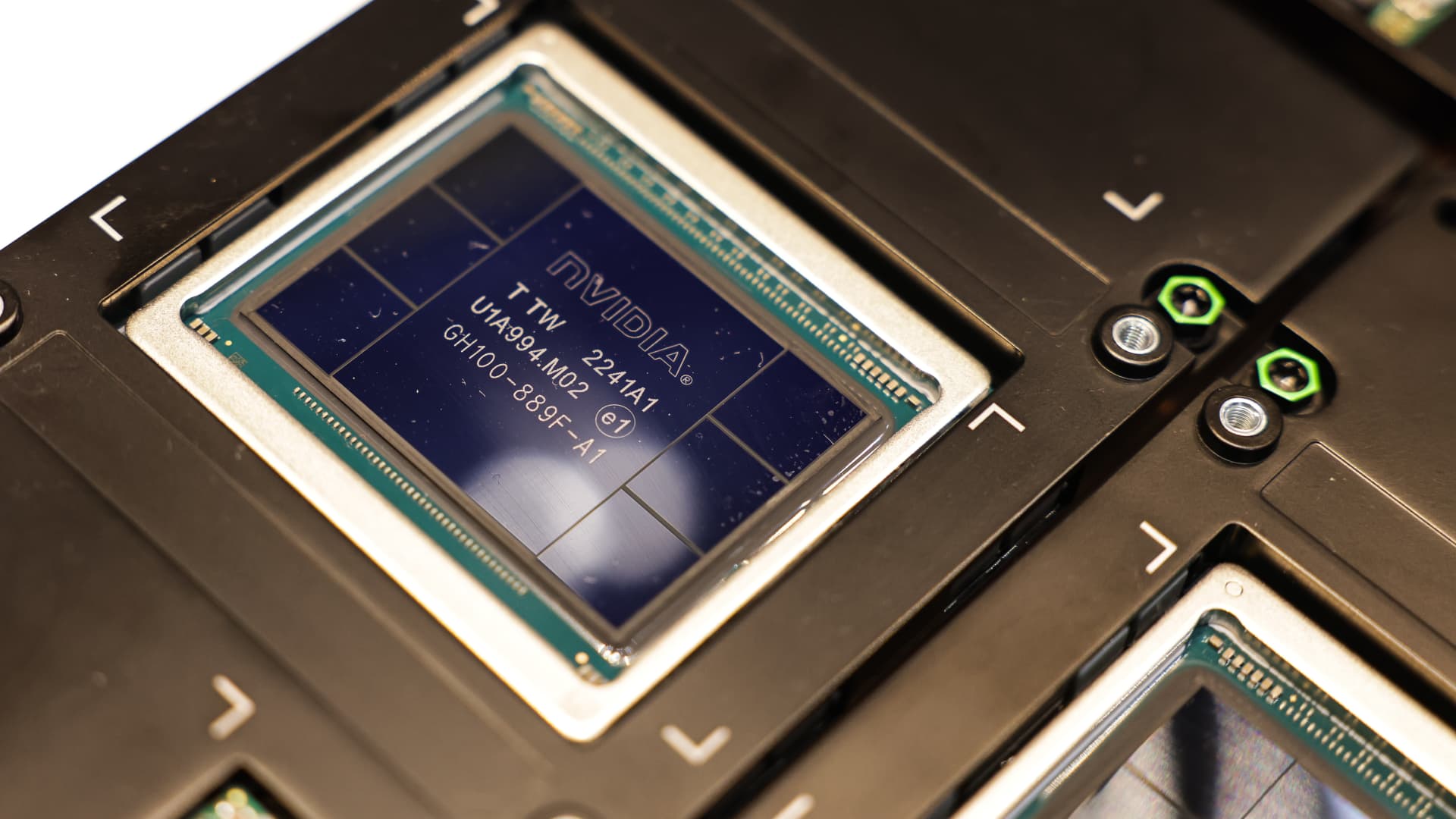

China’s artificial intelligence stocks experienced a decline on Wednesday following the news report by the Wall Street Journal stating that the U.S. plans to impose restrictions on the export of AI chips to China. The Journal highlighted that prominent U.S. chip makers like Nvidia may be affected, and these restrictions could be implemented as early as July.

Nvidia, known for its production of graphics chips powering OpenAI’s ChatGPT and Alphabet’s Bard chatbots, would be significantly impacted. As a result of this news, China’s CSI artificial intelligence index dropped by 3% in Asia on Wednesday. Furthermore, the shares of Inspur Electronic Information Industry, a Shenzhen-traded company, plunged by 10%, while Chengdu Information Technology of Chinese Academy of Sciences witnessed an 8% decline. These companies primarily focus on computer and software production.

Other Chinese AI players also experienced a decline in their stock prices. Alibaba, which introduced its own version of the viral chatbot ChatGPT, saw its Hong Kong-listed shares drop by approximately 1.6%. Similarly, Tencent, which is developing its own AI model, witnessed a decline of 1.58%.

According to sources familiar with the matter cited by the WSJ, the U.S. has growing concerns about China’s advancements in AI technology. In an effort to address these concerns, the U.S. Commerce Department is considering the possibility of halting the shipment of chips made by Nvidia and other chip manufacturers to China and other countries of concern, without obtaining the necessary license.

The Commerce Department has not yet responded to CNBC’s request for comments after regular business hours. If implemented, this move would further expand Washington’s efforts to restrict China’s access to advanced chip technology. In October, the U.S. already implemented rules to prevent China from obtaining advanced chip equipment.

It should be noted that in May, Beijing banned Chinese operators from purchasing products from Micron Technology, a U.S. memory chipmaker, due to alleged security risks. Additionally, there are reports suggesting that Washington has urged South Korea not to fill Micron’s void in China by allowing its domestic chip manufacturers to step in.

In conclusion, these potential restrictions on AI chip exports to China reflect the U.S.’s concerns about China’s technological progress in the field of AI. The impact of these restrictions is evident in the decline of Chinese AI stocks, indicating the significance of the AI industry in the global market.

[Read more about tech and crypto from CNBC Pro]

The content confirms that the U.S. Commerce Department could restrict the shipment of AI chips made by Nvidia and other manufacturers to China and other countries of concern without obtaining a license. This action aligns with previous efforts by the U.S. to limit China’s access to advanced chip technology. It also highlights China’s response, such as banning Chinese operators from purchasing products from Micron Technology and the U.S.’s attempt to dissuade South Korea from filling the void. The article concludes by emphasizing the impact of these potential restrictions on Chinese AI stocks, demonstrating the significance of the AI industry globally.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.