(Bloomberg) — Treasury bond yields surged following data showing a continued rise in consumer year-ahead inflation expectations, prompting some traders to take profits on dovish Federal Reserve wagers.

Most Read from Bloomberg

Despite thin trading ahead of the Thanksgiving holiday, two-year US yields reached over 4.9%. The S&P 500 saw a slight increase. Amazon.com Inc. climbed in anticipation of Black Friday and Cyber Monday sales. Microsoft Corp. gained momentum on the news of Sam Altman’s return to lead OpenAI. Nvidia Corp. saw a drop after its results. The dollar strengthened and oil slid.

According to the final November reading from the University of Michigan, Americans now expect inflation to rise by an annual rate of 4.5%, up from the earlier expectation of 4.4% earlier this month. Data shows they anticipate costs to increase by 3.2% over the next five to 10 years.

“For a data-dependent Fed, this is not good news as they do not want to see consumer inflation expectations become unanchored, since historically it becomes increasingly difficult to reset consumer psychology towards a lower inflationary environment,” said Quincy Krosby, chief global strategist for LPL Financial.

In other economic news, US jobless benefit applications declined last week, offering some relief in what has otherwise been a gradually cooling labor market. Also, durable goods orders dropped in October by more than expected.

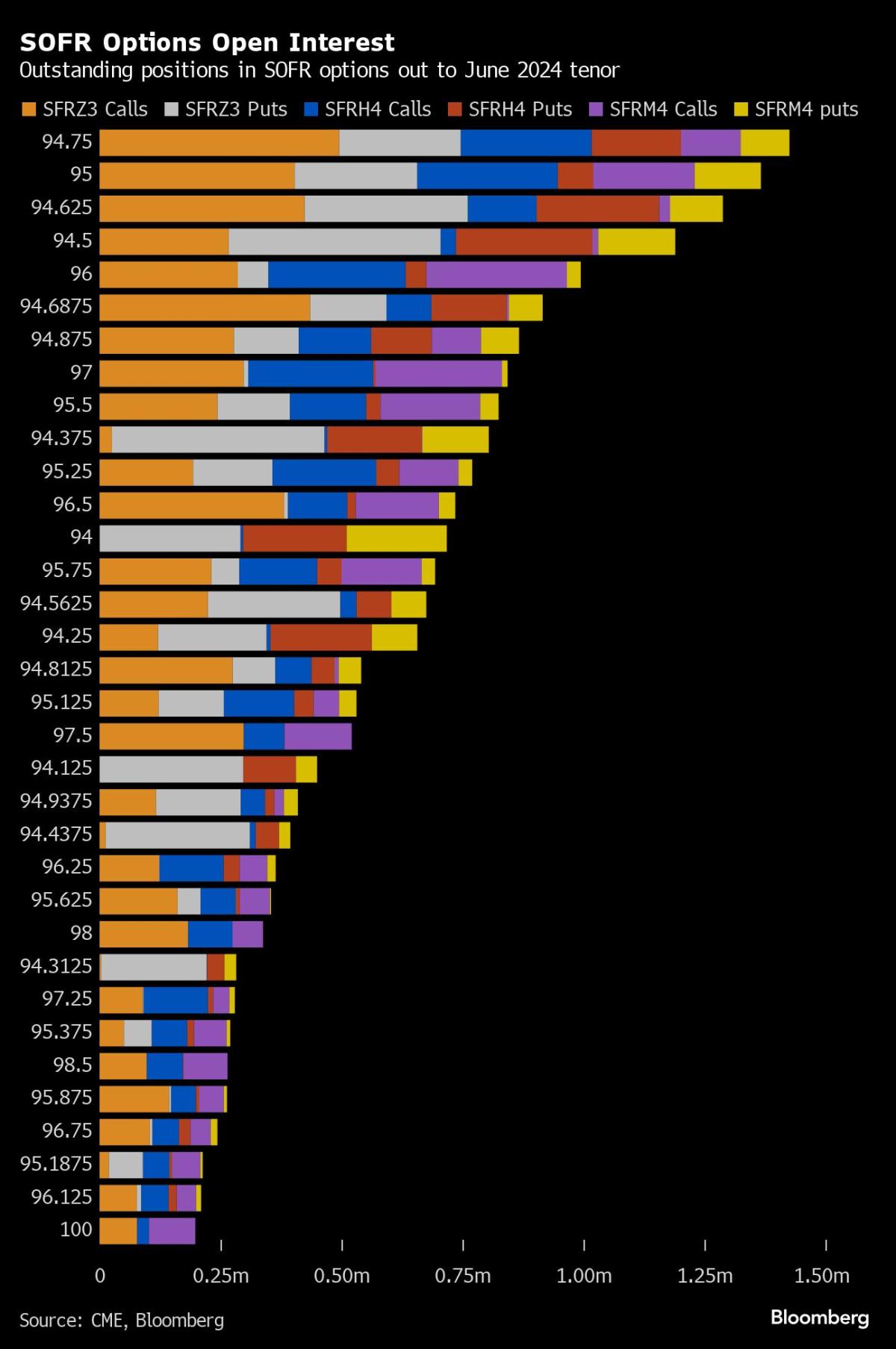

In the SOFR options market, a noticeable trend Wednesday was the liquidation of dovish hedges, indicating traders are taking profits on dovish Fed wagers placed as far back as September.

Equities continued to show November gains. Positive sentiment and resilient valuations are expected to help the S&P 500 rally to a record high next year, according to Lori Calvasina at RBC Capital Markets.

“The sentiment set up is constructive for now,” Calvasina wrote in a note, saying that an indicator of investor appetite that’s proved reliable in 2023 is sitting in a range typically followed by 10% gains in the S&P 500 over 12 months. “Valuations can stay higher than many investors realize,” as cooling inflation should support price-to-earnings multiples, she wrote.

Meanwhile, oil prices slumped as the OPEC+ meeting originally set for the weekend was delayed, lowering traders’ expectations for interventions to tighten supplies.

Read: Base Metal Markets Across LME Are Showing Signs of Surplus

Corporate Highlights:

-

Boeing Co.’s largest 737 Max variant gained type-inspection authorization by the Federal Aviation Administration, clearing the path for the next phase of flight testing after delays.

-

Broadcom Inc. completed its takeover of software maker VMware Inc. following an unexpectedly drawn-out 18-month process that culminated in the deal getting approval in China.

-

Deere & Co. forecast smaller-than-expected profits next year due to slowing equipment demand from farmers, weighing on the world’s largest tractor maker.

-

Autodesk Inc. was downgraded by Piper Sandler after the company’s tepid growth rate and tempered margin expectations.

-

Guess? Inc., a clothing company, reported net revenue that missed estimates.

-

Nordstrom Inc., a department store chain, reported total revenue that missed estimates.

-

Urban Outfitters Inc., a clothing retailer, reported comparable sales for its namesake banner that missed estimates.

-

Virgin Galactic Holdings Inc. was downgraded by Morgan Stanley, which noted the rocket company has no planned revenue-generating flights from mid-2024 to 2026.

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 0.2% as of 2:46 p.m. New York time

-

The Nasdaq 100 rose 0.3%

-

The Dow Jones Industrial Average rose 0.4%

-

The MSCI World index was little changed

Currencies

-

The Bloomberg Dollar Spot Index rose 0.3%

-

The euro fell 0.3% to $1.0881

-

The British pound fell 0.4% to $1.2486

-

The Japanese yen fell 0.8% to 149.63 per dollar

Cryptocurrencies

-

Bitcoin rose 1% to $37,211.9

-

Ether rose 4.2% to $2,069.05

Bonds

-

The yield on 10-year Treasuries advanced three basis points to 4.42%

-

Germany’s 10-year yield was little changed at 2.56%

-

Britain’s 10-year yield advanced five basis points to 4.15%

Commodities

-

West Texas Intermediate crude fell 1.2% to $76.86 a barrel

-

Spot gold fell 0.4% to $1,990.49 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Rob Verdonck, Tassia Sipahutar, Robert Brand, Sagarika Jaisinghani and Edward Bolingbroke.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.