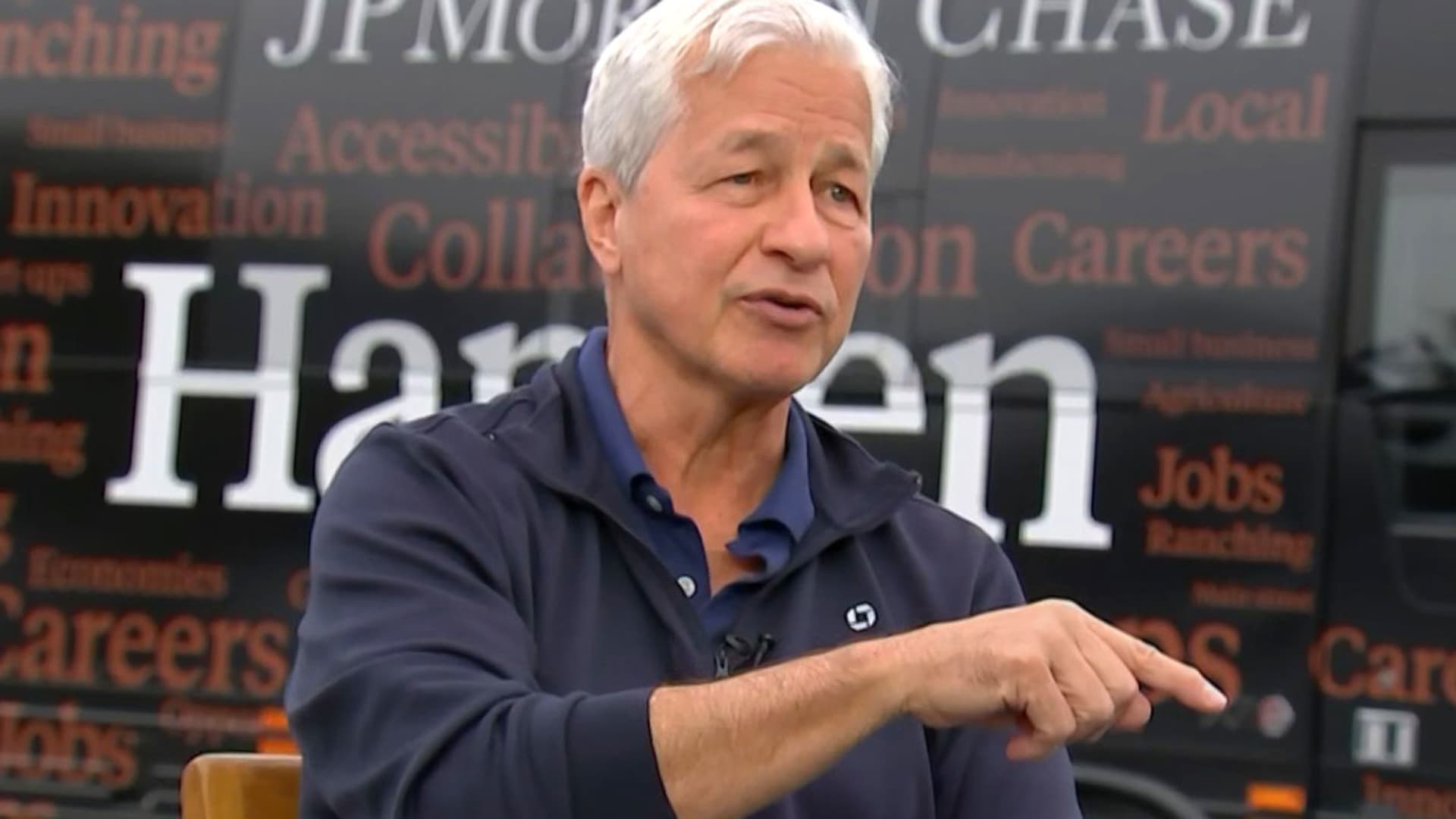

In an exclusive interview with CNBC, JPMorgan Chase CEO Jamie Dimon dismissed the significance of the recent Fitch Ratings downgrade of the United States’ long-term credit rating. Dimon stated that the downgrade does not have much impact as borrowing costs are determined by the market, not rating agencies. However, Dimon criticized the fact that other nations with less stable economies have higher credit ratings than the U.S. He emphasized that the U.S. remains the most prosperous and secure nation on the planet.

Fitch downgraded the U.S. rating to AA+ from AAA, citing expected fiscal deterioration, erosion of governance, and increasing debt burden. This decision comes after the U.S. faced near-default when members of Congress clashed over raising the debt ceiling. Dimon expressed his support for eliminating the debt ceiling, as its use by both parties creates uncertainty for markets.

Fed, A.I., and Ukraine

In the interview, Dimon also discussed artificial intelligence (A.I.), the U.S. economy, bank regulation, and geopolitical risks. He praised A.I. technology, such as ChatGPT, as a “game changer” that can improve future generations’ quality of life. However, Dimon expressed concerns about the potential misuse of A.I. by bad actors.

Regarding the U.S. economy, Dimon highlighted its strength, supported by consumer and business resilience, low unemployment, and healthy balance sheets. He acknowledged the presence of potential storm clouds, referring to his previous warning on the economy, which mentioned the Ukraine war and the Federal Reserve’s quantitative tightening.

Consumer Impact

Dimon criticized regulators’ recent proposals to tighten standards on U.S. banks, describing them as “hugely disappointing.” He warned that increased capital requirements would lead to nonbank players dominating the industry, adversely affecting consumers. Dimon cited the example of the U.S. mortgage market, which is currently dominated by firms like Rocket Mortgage.

Additionally, Dimon expressed skepticism about the Federal Reserve’s models, pointing out their failure to predict inflation and rising interest rates. He urged caution in relying too heavily on these models and called for a reevaluation of their accuracy.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.