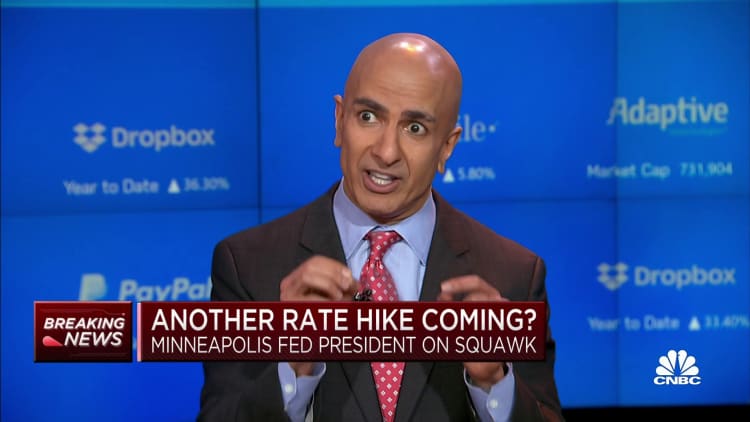

Minneapolis Federal Reserve President Neel Kashkari expressed uncertainty on Wednesday about whether the central bank has increased interest rates adequately enough to control inflation.

Just a day after writing an essay proposing that rates may need to rise “significantly higher” from their current levels to combat rising prices, Kashkari told CNBC that the neutral rate of interest, which neither hinders nor stimulates the economy, may have risen.

When asked if the current federal funds rate target range of 5.25%-5.5% is “sufficiently restrictive” to achieve the Fed’s 2% inflation target, he replied, “I don’t know. Given the dynamics of the economy reopening, it’s possible that the neutral rate may have increased.”

One of Kashkari’s concerns arises from the observation that sectors of the economy usually influenced by rate hikes appear to be disregarding them.

“So, one thing that makes me cautious about our level of restriction is that consumer spending remains strong, while GDP growth continues to exceed expectations,” Kashkari explained. “The auto and housing sectors, which are typically the most responsive to interest rate hikes, are showing signs of stabilization and, in some cases, recovery. This caution leads me to believe that we may not be as restrictive as we initially thought.”

These comments come a week after the Federal Open Market Committee (FOMC), in which Kashkari plays a voting role, chose not to increase interest rates but indicated a potential quarter-point hike before the end of the year, while revising its outlook to two reductions next year, half of the previous forecast in June.

Many on Wall Street fear that the ongoing tightening of monetary policy could trigger an economic downturn.

However, Kashkari emphasized that a recession is not the Fed’s objective.

“If we have to maintain higher rates for a longer period, it’s because the economic fundamentals are even stronger than I realize, and the economic flywheel is spinning,” he stated. “To me, it’s not clear that this means a recession is more likely. It might simply mean that we need a steeper rate trajectory to bring inflation back down to 2%.”

Nonetheless, Kashkari admitted, “we just don’t know right now” whether the Fed has done enough, and added that “we all want to avoid a hard landing” for the economy.

Denial of responsibility! Vigour Times is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.