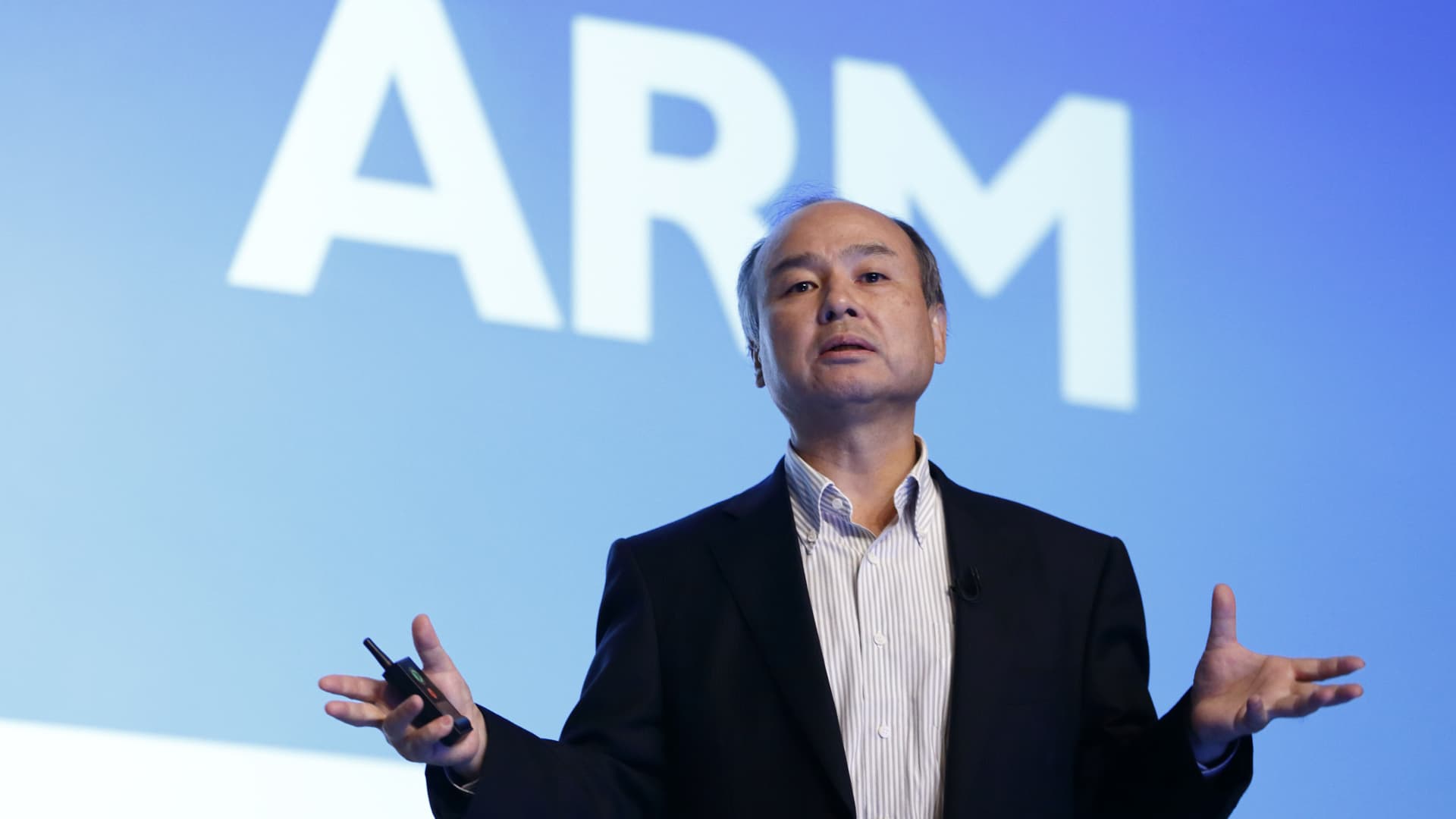

Billionaire Masayoshi Son, Chairman and CEO of SoftBank Group Corp., spoke at a press conference in Tokyo on July 28, 2016, in front of a screen displaying the ARM Holdings logo. ARM, which is owned by SoftBank, has recently filed for its initial public offering (IPO). This IPO will be a significant test for the market, which has seen a decline in new listings due to rising interest rates and a decrease in appetite for risky assets.

ARM is a crucial player in the technology industry, with its chip designs being used in almost all smartphones, including Apple iPhones and most Android devices. The company’s IPO is not only a significant event for the market, but also has important implications for SoftBank.

SoftBank has been facing challenges in the tech market and has been focusing on artificial intelligence (AI) to recover. ARM’s listing is a part of SoftBank’s strategy to embrace AI, which is currently hot in the tech world.

ARM, headquartered in Cambridge, England, is responsible for designing the architectures of chips found in 99% of all smartphones. The company’s history can be traced back to Acorn Computers, with its spin-off company, Advanced RISC Machines, being formed in 1990. ARM is known for its low-energy chip designs and is widely used in smartphones, server processors, and laptop processors.

In recent years, ARM has expanded its semiconductor business to include connected cars and other applications. The company’s business model involves licensing its intellectual property for chip architectures, as well as selling its own designed processors. SoftBank acquired ARM in 2016, aiming to establish a presence in the growing IoT sector.

However, ARM has faced challenges due to a slowdown in demand for smartphones, leading to a decline in net sales and a loss in the second quarter. SoftBank initially planned to sell ARM to Nvidia, but faced regulatory pushback. As a result, SoftBank has decided to list ARM as an independent company and is looking to acquire the remaining stake in ARM from its Vision Fund.

ARM’s listing in New York instead of London has sparked concerns over “tech sovereignty” in the UK. The British government has been supporting the country’s chip industry, and the sale of ARM to foreign hands has raised questions about dependence on foreign technology.

Despite the uncertain state of the US markets, SoftBank is moving forward with the IPO of ARM. ARM’s valuation is not yet clear, but reports suggest it could be between $60 billion and $70 billion. ARM’s role in the chip industry and its focus on AI make it an important player to watch in the coming years.

ARM continues to develop new chipsets for machine learning applications, with a focus on faster performance and energy efficiency. These high-powered chips are crucial for AI applications, and ARM’s investments in this area align with SoftBank’s vision of leveraging AI for growth.

Overall, ARM’s IPO and its focus on AI highlight the evolving landscape of the technology industry. SoftBank’s involvement in ARM and its AI investments demonstrate its strategy to navigate the changing market and drive growth.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.