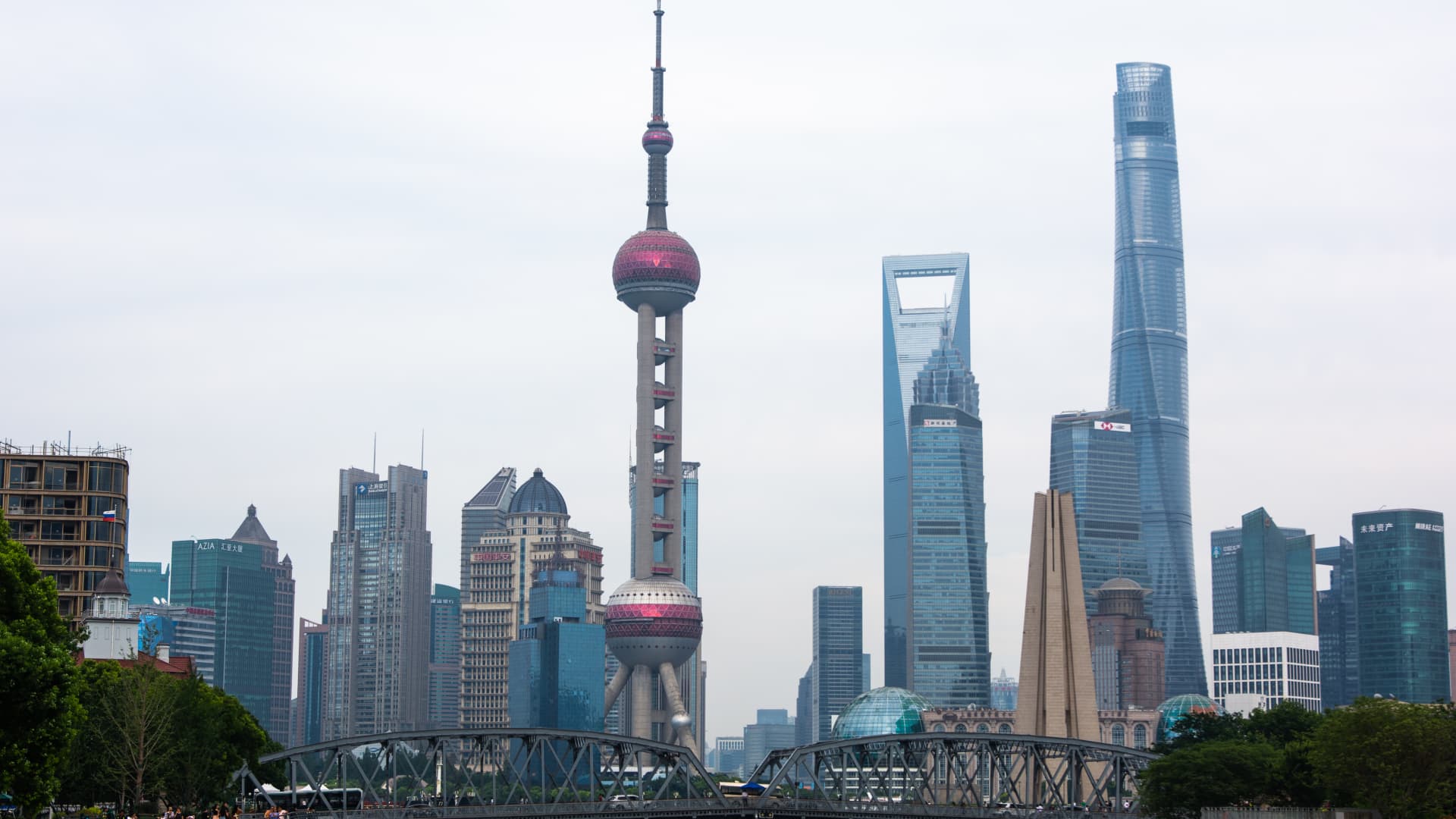

A picturesque scene of high-rise buildings lining the Suzhou Creek in Shanghai, China was captured on July 5, 2023. This view not only represents the booming Chinese economy but also signifies a potential shift in the country’s growth trajectory. After 45 years of rapid expansion and globalization, China may now be facing a prolonged period of lower growth, which could have global implications.

To combat these challenges, the Chinese government is implementing a range of measures to stimulate the economy. Leaders have pledged to adjust and optimize policies to support the struggling property sector while prioritizing stable employment. Additionally, there are plans to boost domestic consumption demand and address local debt risks. These efforts aim to counter the disappointing 6.3% year-on-year growth in the second quarter of 2023, which fell short of market expectations and was attributed to the lifting of Covid-19 restrictions.

While there are some positive indicators such as an increase in industrial production growth, the ruling Chinese Communist Party has set a modest growth target of 5% for 2023. This target is lower than the usual average of 9% annual GDP growth that China has experienced since opening up its economy in 1978.

Recent announcements by the authorities have outlined various sector-specific measures and promised a more favorable investment environment. However, these pledges have lacked specific details, and the most recent Politburo meeting on economic affairs did not introduce any major new initiatives. This has led to concerns among experts that policymakers may be struggling to develop suitable measures to support economic growth.

The Chinese economy continues to grapple with the “triple shock” of the ongoing pandemic, the challenges facing its property sector, and the regulatory shifts associated with President Xi Jinping’s vision for “common prosperity.” Without adequate policy responses, these issues could become entrenched and contribute to a significant slowdown in China’s growth rate.

While some anticipate a stabilization of the Chinese economy by late 2023, it is likely that the country will experience a longer-term structural slowdown. This slowdown may result in a shift away from the property sector towards advanced manufacturing, particularly in areas such as electric vehicles, robotics, and semiconductors. As China reduces its reliance on the property sector, there may be ripple effects in commodities and the global industrial cycle.

For international companies, exposure to the Chinese market remains essential due to its status as the largest consumer market in the world. However, the slowdown in China’s growth could impact investment flows and manufacturing, leading to a potential decoupling from Western economies.

As China navigates this transition, there will be second-order impacts on the global economy. China’s focus on advanced manufacturing and higher-quality goods will not only decrease demand for commodities but also intensify global competition in these sectors.

The path forward for Chinese households, private enterprises, and state-owned companies is still uncertain as the country moves away from its property-driven model. However, China is at a pivotal point and is undergoing a transformation in its political economy. This transition will result in a new version of the Chinese economy with different drivers and idiosyncrasies.

In conclusion, China’s economic landscape is evolving, and the country is implementing measures to address lower growth. However, the lack of specific policy details and the challenges posed by the triple shock may hinder immediate progress. Nevertheless, China’s transition to advanced manufacturing and the reshaping of its economy will have wide-ranging implications for the global stage.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.