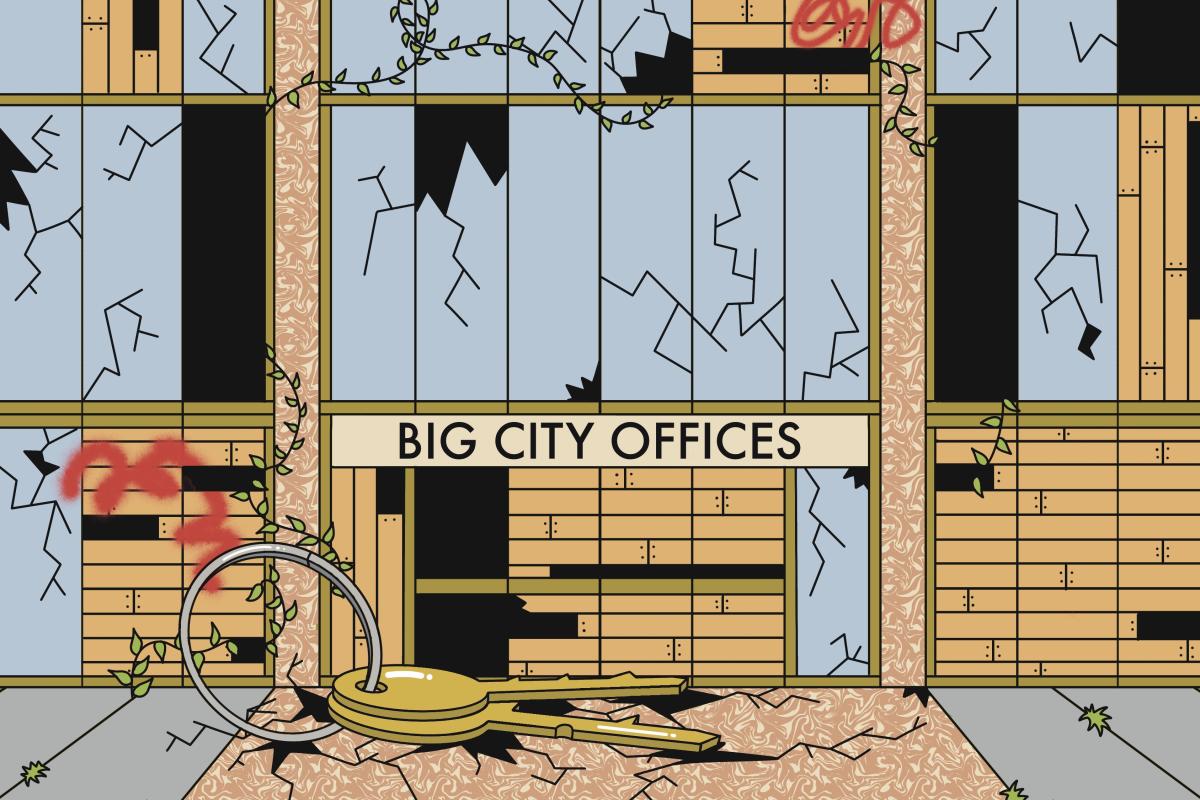

Amid the work-from-home revolution, office landlords are now resorting to a drastic measure in the real estate world: “handing back the keys.”

This involves the landlord ceasing to pay the mortgage on the office building or declining to refinance it, leading the bank or investors who made the loan to repossess the building.

Notable names in commercial real estate, such as Brookfield and Blackstone, have defaulted on mortgages and initiated the process of relinquishing ownership of office towers. This strategy highlights the extent of the challenges in the office market and the capability of large property companies to shift much of the financial burden onto others, particularly banks and lenders.

Since the onset of the pandemic, office employees have demonstrated their ability to work from home, leading many to be resistant to returning to the office. Additionally, companies have realized significant cost savings by renting less office space, rendering many office towers unprofitable for their owners and turning business districts into ghost towns. A report by Avison Young, a real estate services firm, revealed that about 23% of office space in the United States was vacant or available for sublet at the end of November, compared with 16% before the pandemic.

While “handing back the keys” may seem extreme, it is a strategic move to limit a landlord’s losses on a building. For example, a property company that purchased an office tower for $100 million before the pandemic, with 75% of the investment borrowed, may find that the building’s value has declined significantly. In such cases, defaulting on the loan allows the lenders to take possession of the struggling building, potentially incurring a significant loss.

The concept of “handing back the keys” is reminiscent of the term “jingle mail,” which gained notoriety after the 2008 financial crisis when homeowners abandoned their homes and sent the keys back to their banks due to the substantial depreciation of their property value compared to their mortgage debt.

However, unlike homeowners facing similar financial difficulties, big property companies can continue operating after defaulting and are often lauded for divesting distressed buildings. Homeowners, on the other hand, experienced a profound impact on their credit ratings and had to find alternative housing.

Source: The New York Times