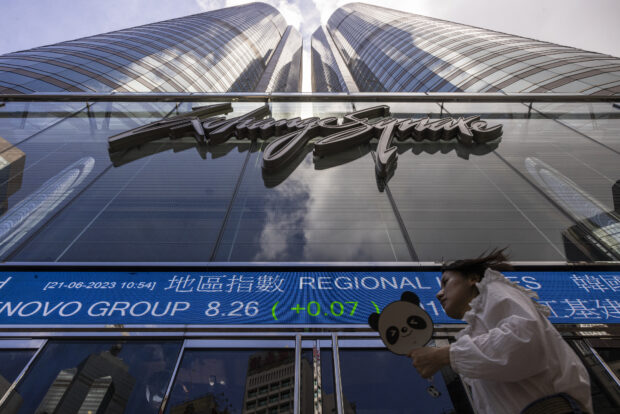

Hong Kong experienced a rise in the market on Monday as investors hoped that Beijing’s crackdown on the tech sector was coming to an end. However, this early rally in Asia was dampened by inflation data revealing further weaknesses in China’s economy. Ant Group, after undergoing a lengthy investigation, was hit with a nearly $1 billion penalty for “illegal acts,” while Tenpay was ordered to pay over $400 million. Despite the significant fines, traders were encouraged by the possibility that these companies could refocus on their businesses. The China Securities Regulatory Commission stated that most of the financial issues concerning platform enterprises have been resolved.

As a result of this news, the shares of Alibaba and Tencent, listed in New York, experienced a surge, which was followed by a similar increase in their Hong Kong stocks on Monday. Market sentiment was positive as the scrutiny on these companies seemed likely to come to an end, and the fine, although substantial, was manageable for such large corporations. Vey-Sern Ling, a representative from Union Bancaire Privee, mentioned that the market viewed this development favorably. The fine imposed on Ant was even lower than its profit for the December quarter, as reported by Bloomberg News.

The impact of the investigation on the industry was evident as Ant announced plans to repurchase up to 7.6 percent of its equity, valuing the company at less than a quarter of its 2020 value. This drastic drop in valuation occurred when the Alibaba affiliate attempted to launch an initial public offering in Hong Kong, which was ultimately prevented by China. The surge in the tech giants’ stock prices had a positive effect on the Hang Seng Index, increasing it by more than two percent at the opening. Shanghai also experienced gains. However, these advances were moderated by data indicating stagnant consumer inflation and a decline in producer prices, signaling ongoing struggles for the second-largest economy in the world.

According to OANDA’s Kelvin Wong, the fear of a deflationary spiral in China has reached a critical point with the June consumer inflation rate flattening. He further noted that Chinese policymakers need to act quickly to avoid a steep decline in domestic demand, which could lead to a loss of confidence for both consumers and businesses. This situation may ultimately result in a liquidity trap scenario, where monetary policies become less effective in stimulating real economic growth.

In other parts of Asia, gains were seen in Mumbai, Singapore, Manila, Jakarta, and Bangkok, while Tokyo, Sydney, Seoul, Taipei, and Wellington experienced declines. London, Paris, and Frankfurt saw marginal increases in the morning. On Wall Street, the three main indexes fell following a mixed US jobs report. Although fewer jobs were created last month compared to predictions, wage growth remained strong, causing inflation concerns. The reading of 209,000 new jobs in June, although lower than May’s 306,000, was still considered robust and unlikely to deter the Federal Reserve from resuming its rate hike campaign.

US Treasury Secretary Janet Yellen’s visit to China over the weekend provided some reassurance to traders. Yellen reported that the visit had improved relations between the two countries, paving the way for a stable economic relationship and cooperation on shared global challenges. However, concerns regarding inflation persist, and the Federal Reserve is expected to maintain unchanged interest rates for the remainder of 2023 due to slowing payrolls and easing inflation.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.