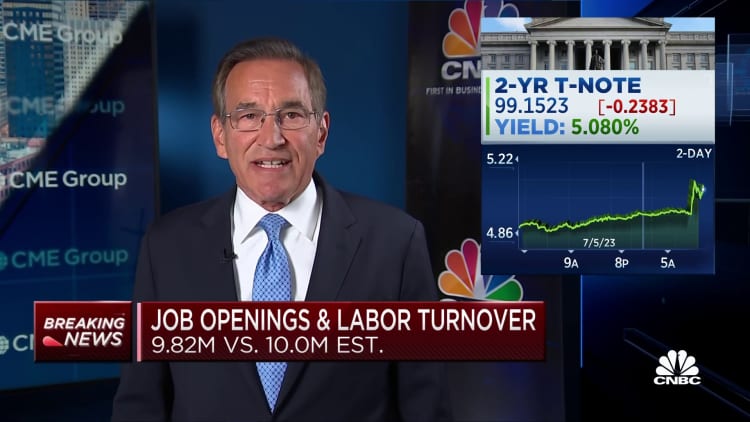

In May, there was a decrease of approximately half a million job openings compared to the previous month, indicating a potential relaxation in the ultra-tight labor market, according to a report by the Labor Department. The Job Openings and Labor Turnover Survey, which is closely monitored, revealed that listings declined to 9.82 million, a decrease of 496,000 from April and below the consensus estimate of 9.9 million from FactSet. For the month, openings exceeded the available labor pool with a ratio of 1.6 to 1, which is a decrease from the previous rate of around 2 to 1.

If it were not for the increase of around 61,000 government-related positions, the decrease in job openings would have been even greater. Openings in health care and social assistance decreased by 285,000, while finance and insurance saw a decrease of 139,000 openings.

This report comes amidst conflicting signals about the direction of the labor market. Earlier in the day, ADP, a payroll services firm, reported a remarkable 497,000 new private sector jobs in June, which was more than double the Dow Jones estimate of 220,000. This report has raised concerns that the Federal Reserve may need to remain vigilant against inflation and continue to raise interest rates.

In a speech at Columbia University in New York, Dallas Fed President Lorie Logan expressed her concern about the pace of inflation reduction and the need for more restrictive monetary policies to address labor market imbalances. She stated, “Job openings remain significantly higher than in 2019, and layoffs remain low. There are no signs of a sudden deterioration in labor market conditions. Given the continued projection of above-target inflation and a stronger-than-expected labor market, more restrictive monetary policy is warranted.”

The JOLTS report revealed an increase in the quits level, which often indicates a tight labor market where workers are confident enough to leave their current jobs for better opportunities. Quits increased by 250,000, resulting in a rate of 2.6%, representing a 0.2 percentage point increase.

Hires experienced a slight increase, while layoffs and discharges slightly decreased. In a separate report, the ISM services index for June unexpectedly rose to 53.9, indicating expansion. This is up from 50.3 in May and above the estimated 51.3. The employment index also returned to expansion, rising 3.9 points to 53.1. However, the prices index decreased by 2.1 points to 54.1. Business activity and production saw a significant jump to 59.2, an increase of 7.7 points.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.