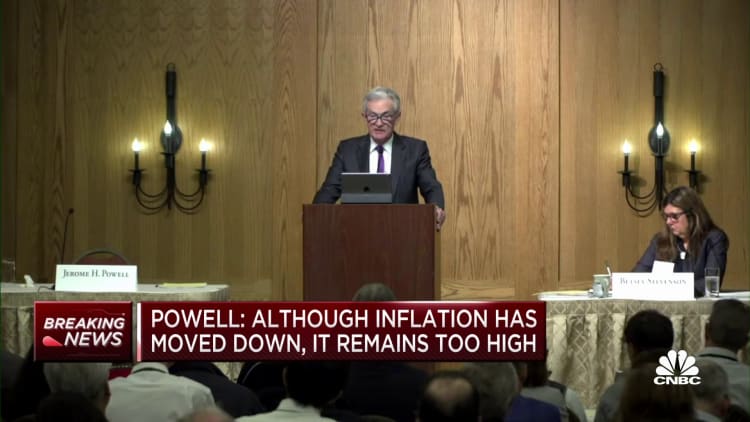

Federal Reserve Chair Jerome Powell emphasized the need for increased vigilance in addressing inflation during his keynote speech at the Kansas City Fed’s annual retreat in Jackson Hole, Wyoming. Powell warned that further interest rate hikes could be necessary to curb inflation, which remains higher than desired levels. While the central bank remains open to flexibility, Powell indicated that policy tightening will continue until inflation is sustainably reduced.

This speech mirrored Powell’s remarks from the previous year’s Jackson Hole retreat, where he acknowledged the likelihood of some economic challenges during the process of curbing inflation. However, Powell emphasized the importance of not prematurely declaring victory, as inflation data in recent months has shown mixed results.

Powell recognized the inherent risks of both doing too much and too little in monetary policy. He emphasized the need to carefully navigate the uncertain economic landscape to avoid long-term inflationary pressures or unnecessary harm to the economy.

Following Powell’s speech, financial markets reacted with volatility, with the Dow Jones Industrial Average losing its earlier gains and Treasury yields rising. This response differed from the previous year, where stocks experienced a significant drop after Powell’s speech.

A cautious approach

In light of the Federal Reserve’s 11 consecutive interest rate hikes, bringing the key interest rate to its highest level in over 22 years, Powell stressed the importance of proceeding carefully in future policy decisions. The reduction of the Fed’s balance sheet and the expiration of approximately $960 billion worth of bonds since June 2022 have further contributed to the tightening of monetary policy.

While the market currently expects no further rate hike in September, there is speculation about a potential final increase in November. Powell did not provide a clear indication of the Fed’s decision, stating the need to carefully consider incoming data and the evolving economic outlook.

Although Powell did not suggest the possibility of a rate cut, he highlighted the risk of strong economic growth amid widespread recession expectations.

Key factors in policymaking

In his speech, Powell delved into the factors that play a crucial role in Fed policymaking. He emphasized that the Fed primarily focuses on core inflation, excluding volatile food and energy prices. Additionally, Powell reiterated the reliance on the personal consumption expenditures price index as a key measure of inflation, rather than the consumer price index.

He identified three broad components of inflation: goods, housing services, and nonhousing services. While there has been progress across all three categories, nonhousing services pose the greatest challenge in terms of interest rate sensitivity. Powell emphasized the necessity of further progress in this sector to restore price stability.

Maintaining the inflation target

Addressing market and political considerations, Powell rejected the idea of raising the Fed’s 2% inflation target, emphasizing its commitment to the existing target. He also chose not to engage in the debate surrounding the neutral rate of interest, acknowledging the uncertainty surrounding this concept.

Furthermore, Powell noted that the effects of previous tightening measures have likely not fully materialized, highlighting the need for caution in future policy decisions.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.