Cloud stocks are experiencing a decline on Tuesday following a decrease in full-year revenue guidance from prominent cloud company Datadog. This decrease is attributed to organizations engaging in cost-saving exercises.

One cloud-oriented exchange-traded fund, the WisdomTree Cloud Computing Fund, is down 3% for the day, marking its fifth day of declines in the past six trading sessions.

Initially, cloud-computing companies experienced higher demand due to the shift to remote work caused by the Covid pandemic. However, the rise in inflation and interest rates led investors to sell their holdings in fast-growing cloud stocks and invest in safer options. Additionally, some sectors like real estate have shown signs of weakness due to higher rates, prompting management teams to seek cost savings in cloud infrastructure and other technologies.

In response, executives at many cloud companies have reduced overhead, including layoffs. Recent developments in generative artificial intelligence services, like OpenAI’s ChatGPT chatbot, have also sparked investor interest in similar technologies and additional tools to facilitate the transition. While cloud stocks have begun to recover, many, including Datadog, have yet to reach their record highs from 2021.

Currently, some of the fastest-growing companies in the cloud sector are facing challenges.

Datadog’s revenue grew almost 83% year over year in the first quarter of 2022. However, the company recently announced a revised full-year revenue projection of $2.05 billion to $2.06 billion, down from the previous range of $2.08 billion to $2.10 billion provided in May. This implies a lower fourth-quarter revenue growth of 15%, compared to the previous forecast of 23%. Analysts had anticipated $2.081 billion in revenue for the full year.

Olivier Pomel, Datadog’s CEO, explained that the growth in usage from existing customers was not as high as in previous quarters, as larger spending customers scrutinize costs.

Datadog’s third-quarter revenue guidance of $521 million to $525 million fell short of analysts’ expectations of $533 million. However, Pomel noted that the company has adopted a conservative approach to its outlook.

Despite the decline in stock value, Bernstein Research analysts, who have a buy rating on Datadog, expressed confidence in the company’s growth potential. They believe that as enterprise spending budgets recover and venture capitalists resume investing in startups, growth will resume.

Datadog shares, which debuted on the Nasdaq in 2019, experienced their largest single-day decline since March 2020, dropping as much as 21% on Tuesday.

In addition to Datadog, many stocks in the WisdomTree cloud fund also experienced declines on Tuesday.

On Monday, cloud communications software maker RingCentral announced a CEO succession plan that led to a decline in its stock. Hewlett Packard Enterprise’s finance chief, Tarek Robbiati, will replace co-founder Vlad Shmunis as CEO. RingCentral shares were down as much as 18% following the news.

RingCentral’s CFO, Sonalee Parekh, attributed the slower sales and upsell within their existing customer base to elevated sales cycles and additional layers of approval in customer buying decisions.

Similarly, Everbridge, a company specializing in emergency response software, lowered its growth expectations for the full year and expects a larger loss compared to its previous projection.

The weaker economy has resulted in slower sales and fewer large deals for Everbridge.

Other cloud companies, such as Enfusion, Snowflake, Monday.com, Domo, SentinelOne, Smartsheet, Elastic, Zscaler, and GitLab, also experienced declines of at least 5% in Tuesday’s trading session.

Overall, the cloud sector is facing challenges due to cost-saving measures, economic factors, and slower growth. However, analysts remain hopeful that as conditions improve, cloud stocks will regain their momentum.

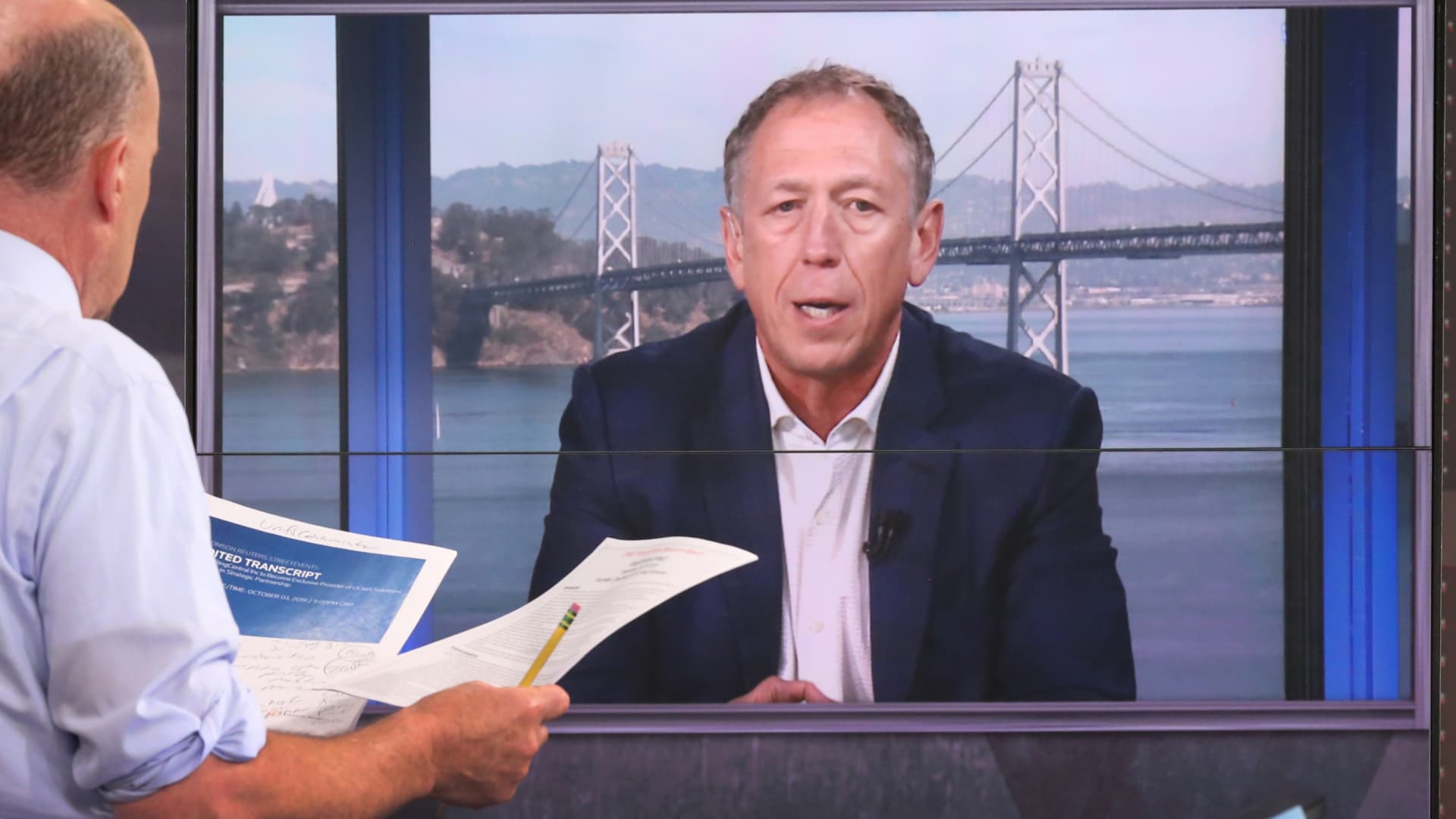

WATCH: Cramer’s Mad Dash on Datadog: The market has no appetite for a company like that

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.