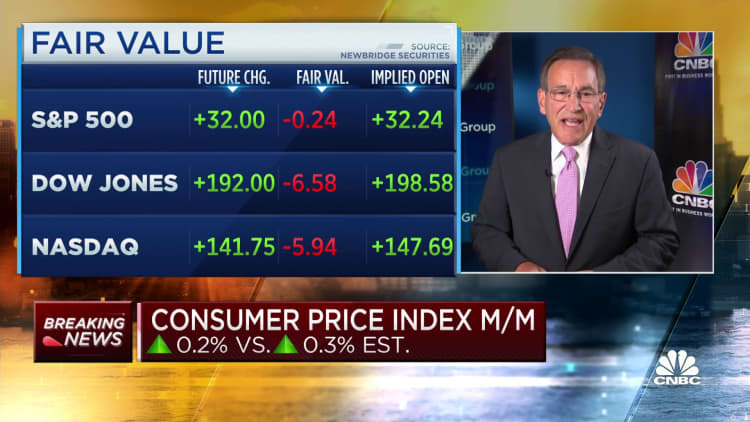

In June, inflation reached its lowest annual rate in over two years. This decline can be attributed to a slowdown in costs and comparatively lower price increases compared to the past four decades. Consumer price index recorded a 3% increase from the previous year, marking the lowest level since March 2021. On a monthly basis, the index rose by 0.2%. These figures were slightly below the expected estimates of 3.1% and 0.3% respectively as predicted by Dow Jones.

When excluding volatile food and energy prices, the core CPI experienced a 4.8% increase from the previous year and a 0.2% increase on a monthly basis. These figures were slightly lower than the expected estimates of 5% and 0.3%. These numbers provide the Federal Reserve with some breathing room as it aims to reduce inflation. Previously, inflation rates were at around 9% annually, the highest since November 1981.

George Mateyo, Chief Investment Officer at Key Private Bank, stated, “There has been significant progress made on the inflation front, and today’s report confirmed that while most of the country is dealing with hotter temperatures outside, inflation is finally cooling. The Fed will embrace this report as validation that their policies are having the desired effect – inflation has fallen while growth has not yet stalled.”

However, central bank policymakers tend to focus more on core inflation which remains above the Fed’s 2% annual target. Mateyo believes that the report is unlikely to prevent the central bank from raising rates later this month. Fed officials anticipate a continued decline in the inflation rate, particularly in housing costs. However, the shelter index rose by 0.4% last month and 7.8% annually. This increase accounted for about 70% of the headline CPI’s overall increase, according to the Bureau of Labor Statistics.

Lisa Sturtevant, Chief Economist at Bright MLS, mentioned, “Housing costs, which account for a large share of the inflation picture, are not coming down meaningfully. Because rates had been pushed so low by the Fed during the pandemic and then increased so quickly, the Federal Reserve’s rate increases not only reduced housing demand — as intended — but also severely limited supply by locking homeowners into homes they would have otherwise listed for sale.”

Wall Street reacted positively to this report, with futures tied to the Dow Jones Industrial Average increasing by nearly 200 points. Treasury yields experienced a decline across the board. Traders anticipate a quarter percentage point rate hike by the Fed during its July 25-26 meeting. However, market pricing indicates that this could be the last increase while officials pause to observe the effects of previous hikes on the economy.

Despite a 0.6% increase in energy prices for the month, the headline CPI had a muted increase due to a 16.7% decrease in the energy index from the previous year. Food prices only increased by 0.1% on a monthly basis, while used vehicle prices, a major factor in the inflation surge earlier in 2022, declined by 0.5%. Airline fares also fell by 3% for the month and 8.1% annually.

The easing in the CPI has contributed to a boost in worker paychecks. Real average hourly earnings, adjusted for inflation, increased by 0.2% from May to June and saw a 1.2% increase on a year-over-year basis. During the peak of the inflation surge last June, worker wages consistently fell behind the cost of living increases.

This is breaking news. Please check back here for updates.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.