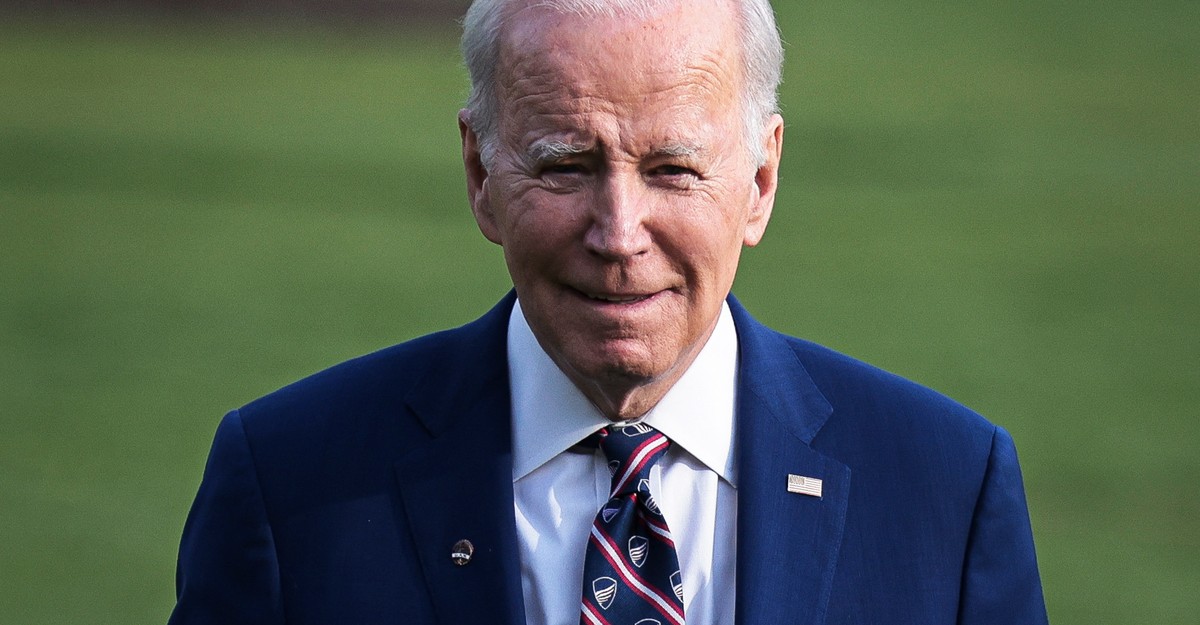

When President Joe Biden arrives in South Carolina today to highlight a new solar-energy manufacturing facility, he will bring attention to an interesting trend: some of the biggest beneficiaries of his economic agenda are Republican-leaning areas whose political leaders have consistently opposed his initiatives.

Built upon a trio of bills signed by Biden in his first two years, the president’s economic program has sparked what could be the most concentrated wave of public and private investment since the 1960s. The two bills signed in 2022 to promote domestic clean energy production and semiconductor manufacturing have already generated around $500 billion in private investment for new factories and the expansion of existing ones, according to the administration’s estimates. Meanwhile, the federal government is investing billions more in repairing infrastructure like roads and bridges through the 32,000 projects already funded by the bipartisan infrastructure bill passed in 2021. Recent analysis from the Treasury Department shows that companies are now spending twice as much on constructing new manufacturing facilities compared to just two years ago.

White House Chief of Staff Jeff Zients expressed his satisfaction with these investments, stating, “We had high expectations, and we are meeting or exceeding those expectations, particularly with regards to these investments acting as a catalyst for private-sector investment.”

This surge in investment has the potential to impact the economy for years to come. It could revive domestic manufacturing, bring new opportunities to communities that have suffered from plant closures and disinvestment since the 1970s, and potentially boost the nation’s productivity, a crucial factor for sustained growth.

However, the political implications of this investment for Biden and other Democrats are less clear. Polls indicate that for most Americans, the persistent pain of inflation overshadows the positive news of new factory openings. Additionally, analyses carried out by organizations like Brookings Metro reveal that this private investment is largely flowing into areas that did not vote for Biden in 2020 and are unlikely to support him in 2024. Many of these communities are represented by congressional Republicans who initially opposed the federal incentives promoting these investments and even voted to repeal some of them more recently.

Biden presents the red-leaning nature of these investment patterns as a source of pride, evidence that he is fulfilling his promise to govern in the interest of all Americans. He stated, “I promised to be a president for all Americans, whether or not they voted for me or whether or not they voted for these laws. These investments will help all Americans. We’re not going to leave anyone behind.”

While many Democrats see this as an important economic commitment and a potent political argument, some within the party are concerned that the administration is not paying enough attention to the fact that companies are directing a significant portion of their investments, sparked by federal incentives, toward Republican-leaning states and counties.

This concern is rooted in the belief that voters in these places are unlikely to credit Biden for promoting new factories and facilities or to hold Republicans accountable for initially opposing the incentives that made them possible. Another challenge is that many of these new jobs are being created in states where workers historically receive lower wages and benefits compared to the more heavily unionized blue states. Michael Podhorzer, the former political director of the AFL-CIO, explained, “They are sending the money to the states with the lowest worker protections, lower worker standards. It’s putting pressure on blue-state employers to lower their standards to be competitive.”

The potential magnitude of the Biden boom in investment is significant. Three bills are contributing to this surge: the Inflation Reduction Act, which offers extensive subsidies for domestic clean-energy manufacturing and deployment, the CHIPS and Science Act, which provides billions of dollars to encourage the domestic production of semiconductors, and the bipartisan infrastructure bill, which funds traditional infrastructure projects as well as new initiatives like the broadband program and a nationwide network of electric vehicle chargers. Biden also hopes to boost the impact of these bills through other policies that encourage companies to prioritize American-made materials for their projects.

The administration estimates that these three bills will generate approximately $3.5 trillion in investment over the next decade. Public spending, both directly on infrastructure projects and through tax and grant incentives for semiconductors and clean-energy projects, will account for about two-fifths of this total, with private companies providing the rest. If these bills inspire such a high level of new public and private investment, it would represent a substantial increase, potentially up to 7% annually, in the current level of investment in the economy, which is around $5 trillion per year.

The influx of spending from companies these bills are expected to unlock is crucial because it refutes the traditional conservative argument that public investments discourage private investments. Jared Bernstein, the new chair of the Council of Economic Advisers, emphasized this point, stating, “The idea that public investment crowds out private investments turns out to be ‘bass-ackwards,’ and that is an important insight of Bidenomics.”

However, there is no guarantee that the bills will generate as much net new investment as the administration hopes. If the surge in investment contributes to overheating the economy, the Federal Reserve Board may raise interest rates, which could reduce investment levels in other areas. Jason Furman, former chair of the Council of Economic Advisers under President Barack Obama, explained that if more investment is directed to certain areas, there will be less available for other sectors. Nonetheless, Bernstein believes that increased investment will expand the economy’s capacity to produce more output without causing inflation. He stated, “These are investments in the supply side; they are ways to give yourself a little more room to grow… If you are truly establishing a domestic industry that was not there before, that’s new capacity, and in the long run, that reduces inflationary pressures.”

Regardless of whether the Biden agenda generates the full amount of investment the administration projects, it is likely to represent the most ambitious effort by the federal government since the Cold War to upgrade the nation’s physical infrastructure and foster technologically advanced strategic industries. Economic development experts, such as Joseph Parilla from the Brookings Metro think tank, suggest that the closest historical comparison to Biden’s investment agenda may be the federal initiatives from the mid-1950s to the late 1960s, including the construction of the interstate highway system, a focus on higher education and scientific research, advancements in nuclear weapons capability, and the successful moon landing. These efforts facilitated the development of crucial technologies like semiconductors, computers, and the internet, which form the foundation of the modern digital economy.

Biden has indicated that he expects similar long-term economic benefits from his agenda, which features greater public and private investment compared to the combined funds spent on the interstate highway system and the Apollo moon-landing program. Some Democrats view Biden’s interlocking set of policies to increase public and private investment as the party’s most comprehensive response to the GOP’s longstanding argument, dating back to the Ronald Reagan era, that lower taxes and reduced regulation drive economic growth.

However, the distribution of this investment and the potential consequences on workers, wages, and political dynamics further complicate the picture.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.