Get the latest updates on European banks for free!

Every morning, we’ll send you a comprehensive email, called myFT Daily Digest, summarizing the latest news on European banks.

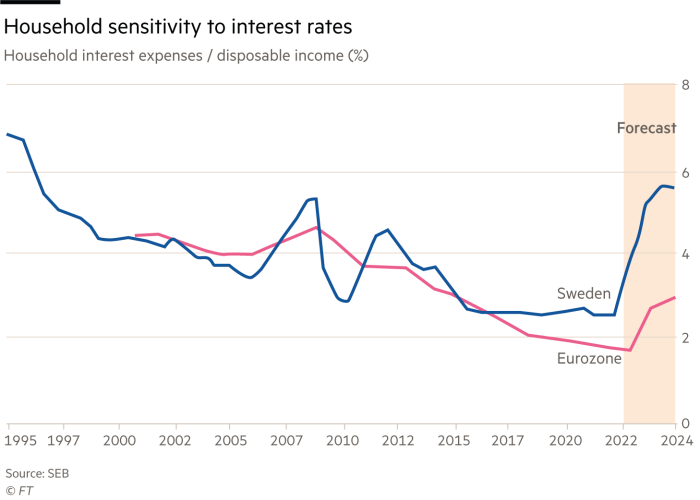

Scandinavia is renowned for its saunas, but in Sweden, property owners are dealing with a different kind of heat. Rising debt costs have led to a real estate bubble burst, causing homeowners and commercial landlords significant distress. However, Swedish lenders, such as Swedbank and SEB, offered a more cautious assessment of the situation on Tuesday.

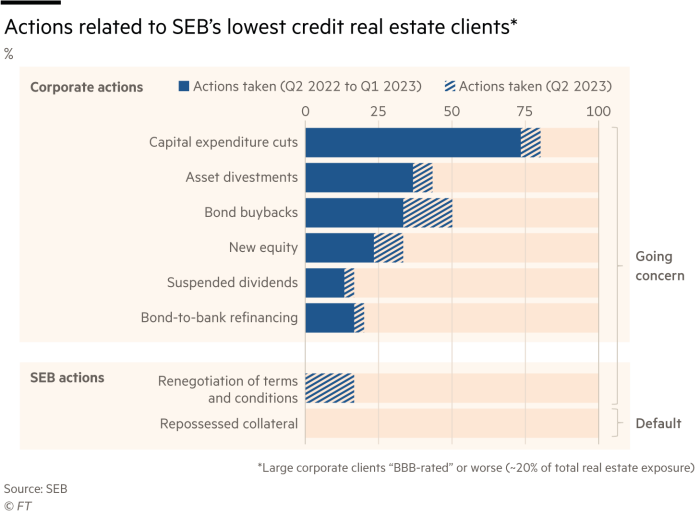

The focus on commercial real estate risk intensified after the collapse of regional banks in the United States earlier this year. Swedish lenders face considerable exposure in this sector, further compounded by a significant stock of variable-rate mortgages.

In contrast, the largest mortgage lender in the country, Swedbank, reported a doubling of net profits due to improved interest margins. Johan Torgeby, the CEO of SEB, echoed this sentiment and highlighted minimal new provisions made for bad loans.

However, this contradicts the experiences of past property crashes. Banks typically do not anticipate substantial losses in property lending, but the risk of default is present.

SEB has only added 2 basis points to its expected loan losses this year, compared to 26 basis points during the pandemic – 13 times more. Swedbank has increased its expected losses by 10 basis points in 2021

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.