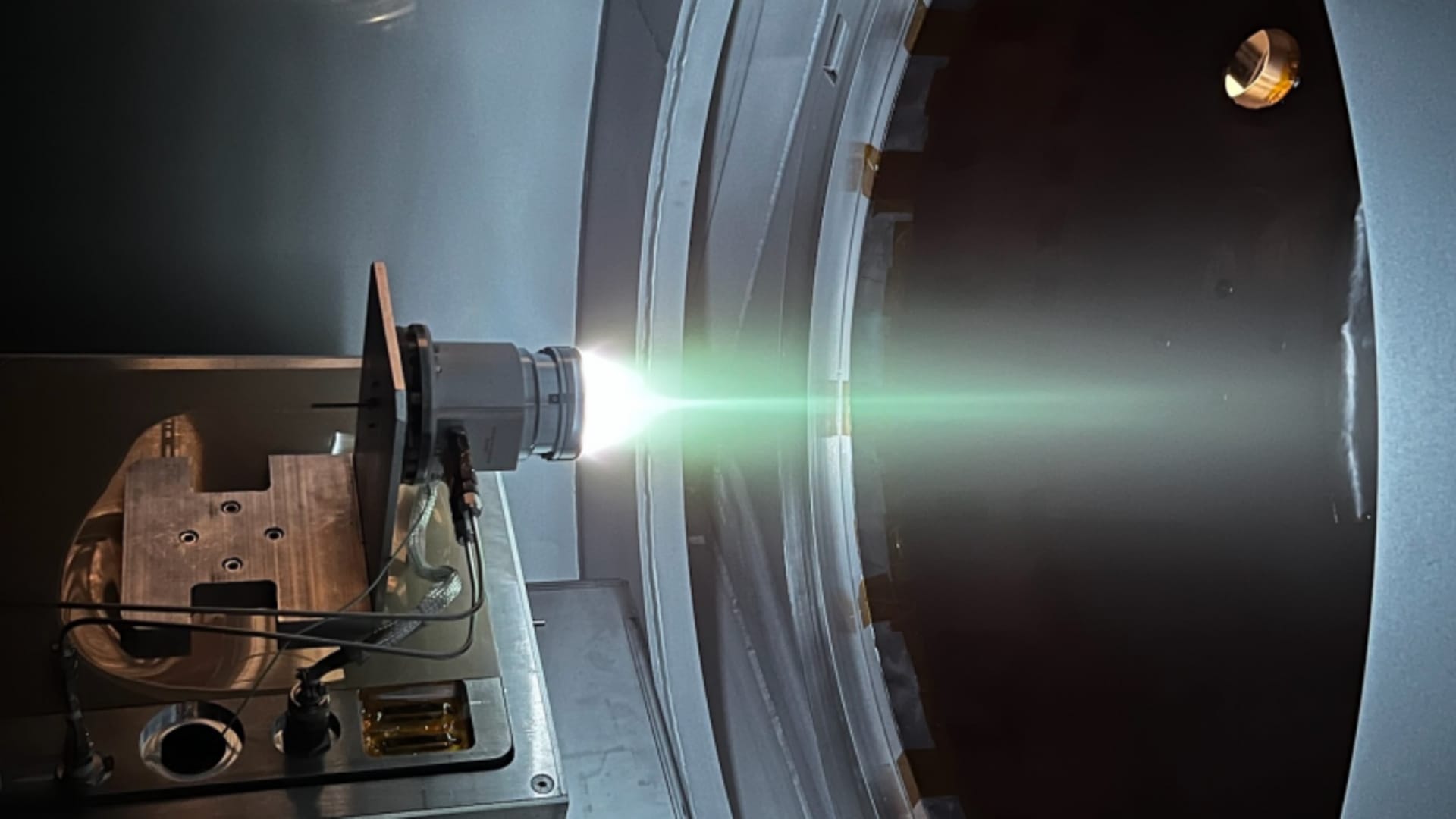

An Astra Spacecraft Engine during testing.

Astra

Struggling space company Astra is implementing a 25% reduction in its workforce, as announced on Friday. The company aims to restructure and give more emphasis to its spacecraft engine business, which will result in a delay in the development of its small rocket.

Astra is presently cutting approximately 70 employees, while also reallocating around 50 personnel from its rocket development program to its space products unit, which focuses on building the company’s spacecraft engines.

Astra’s chairman and CEO, Chris Kemp, stated, “We are fully committed to meeting our customers’ expectations. This includes ensuring that we have adequate resources and financial stability to pursue our immediate opportunities.”

The reduction in workforce is anticipated to generate $4 million in quarterly cost savings, starting from the fourth quarter. Astra reported that it had received a total of 278 spacecraft engine orders, valued at around $77 million in contracts, as of four months ago. The company is optimistic about fulfilling the majority of these orders by the end of 2024.

Additionally, Astra disclosed that it raised $10.8 million in net proceeds from selling debt to investment group High Trail Capital.

Astra stock remained relatively unchanged in after-hours trading on Friday, following its closing price of 38 cents per share.

Sign up here to receive weekly editions of CNBC’s Investing in Space newsletter.

Last year, Astra shifted its focus away from Rocket 3.3 to prioritize the development of the upgraded Rocket 4.0, after a failed mid-launch of Rocket 3.3. While the company initially aimed for the first launch of Rocket 4 by the end of this year, a securities filing by Astra emphasized that the spacecraft engine business will impact the timing of future test launches.

“The ability of the Company to conduct paid commercial launches in 2024 and beyond will depend on the timing and success of the initial test launches, which is in turn reliant on the resources allocated to Launch Systems development in upcoming quarters,” warned Astra.

The company has also released preliminary results for the second quarter. Astra expects revenue of $1 million or less, a net loss ranging between $13 million and $15 million, and available cash and securities of approximately $26 million. Finalized second-quarter results will be reported on August 14th.

Last month, Astra finalized plans for a reverse stock split at a ratio of 1 to 15. Moreover, the company aims to raise up to $65 million through an “at the market” offering of common stock with the assistance of Roth Capital. Astra also terminated a prior agreement with B. Riley to sell up to $100 million in common stock, a deal that was signed a year ago.

In their recent filing, Astra announced the hiring of PJT Partners as a financial advisor to explore additional opportunities for raising capital.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.