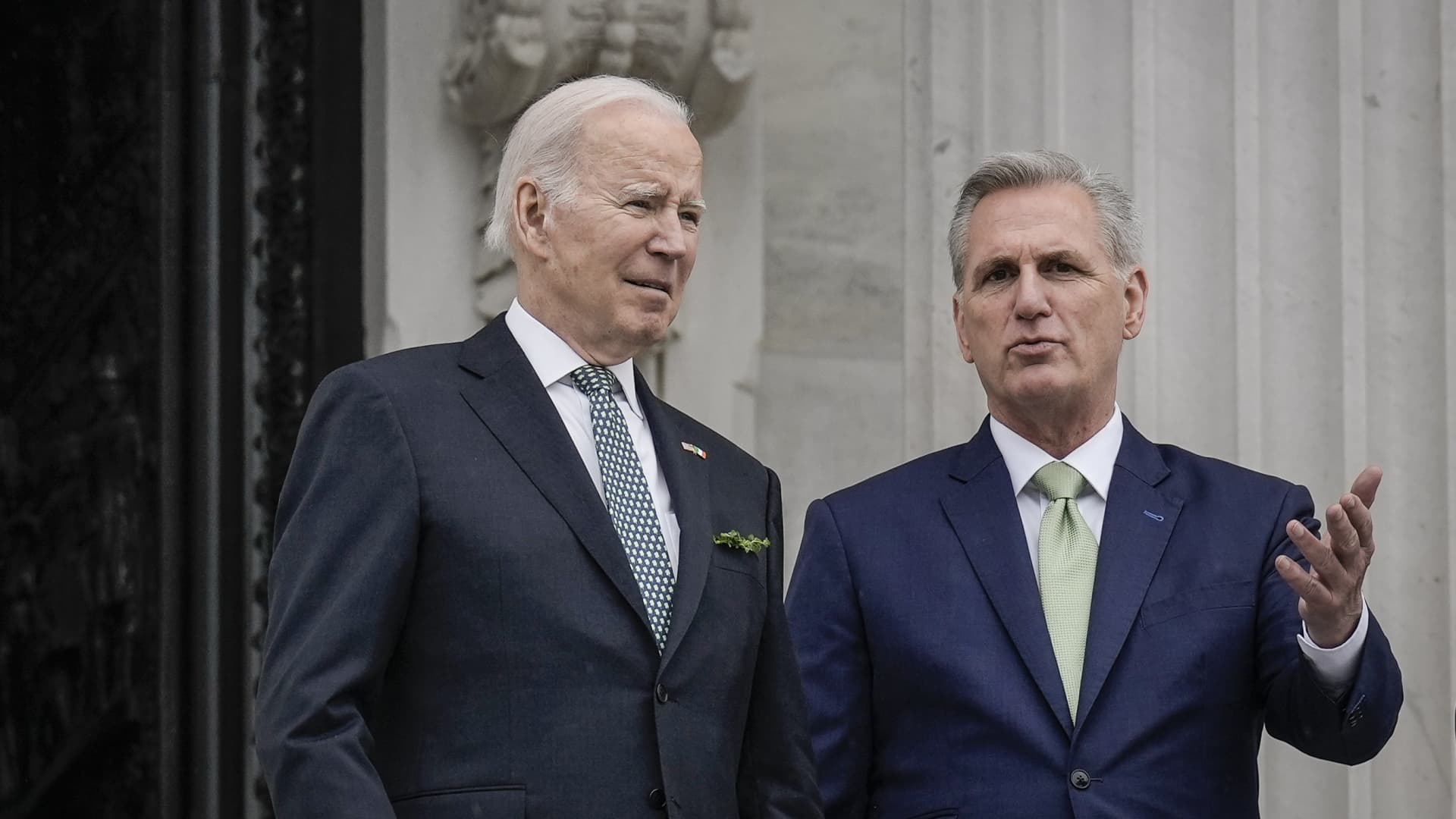

Washington, D.C. – March 17, 2023: President Joe Biden and House Speaker Kevin McCarthy speak outside the Annual Friends of Ireland Luncheon at the U.S. Capitol.

Drew Angerer | Getty Images News | Getty Images

The United States finds itself in a more vulnerable position now compared to when S&P downgraded its sovereign credit rating in 2011, as stated by the former chairman of the agency’s Sovereign Rating Committee.

The world’s largest economy is once again on the verge of a government shutdown unless legislators in Washington can successfully pass a spending bill before the October 1 deadline.

House Speaker Kevin McCarthy is facing a crucial test as he cannot afford to lose more than four votes from fellow Republicans in the House of Representatives. However, he faces resistance from hard-right members within his caucus, who are demanding deeper cuts in domestic spending.

Moody’s recently warned that a government shutdown would negatively impact the country’s credit rating. This comes after Fitch downgraded the long-term U.S. sovereign credit rating by one notch in August due to the latest political standoff over raising the debt ceiling.

In a controversial move, S&P downgraded the long-term credit rating from AAA to AA+ as early as 2011, citing political polarization following another debt ceiling dispute in Washington.

John Chambers, the former chairman of the Sovereign Rating Committee at S&P Global Ratings during the 2011 downgrade, informed CNBC’s “Capital Connection” on Tuesday that a government shutdown is likely and that this entire situation is a clear indication of weak governance.

This factor played a role in S&P’s downgrade in 2011, and Chambers states that the U.S.’s fiscal position is currently even weaker than it was back then.

“Currently, the general government’s deficit, which includes both the federal and local governments, amounts to over 7% of GDP, and the government debt is at 120% of GDP. At the time, we predicted it might reach 100% of GDP, and the government dismissed us for being overly alarmist,” he said.

“The external position is relatively similar, but I believe the governance has deteriorated, and the divisiveness in the political landscape is much worse. This has resulted in government shutdowns, concerns of government defaulting on its debt due to the debt ceiling, and the failed coup attempt on the 6th of January, 2021,” Chambers explained.

House Speaker McCarthy needs the support of nearly all his Republican colleagues, but the Freedom Caucus, which had 49 members in January, has impeded budget negotiations by insisting on more severe cuts to domestic spending.

McCarthy might seek assistance from Democrats to secure the necessary votes and avoid a shutdown. However, hardline Republicans have discussed removing him as Speaker if such a compromise is reached.

In May of this year, another standoff between the White House and opposition Republicans over raising the U.S. debt limit once again pushed the world’s largest economy to the brink of defaulting on its bills, before President Joe Biden and House Speaker Kevin McCarthy reached a last-minute agreement.

In its August downgrade, Fitch mentioned “expected fiscal deterioration over the next three years” and a decline in governance due to “repeated debt-limit political standoffs and last-minute resolutions.”

However, many prominent bank executives and economists dismissed the downgrade as largely insignificant.

Denial of responsibility! Vigour Times is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.