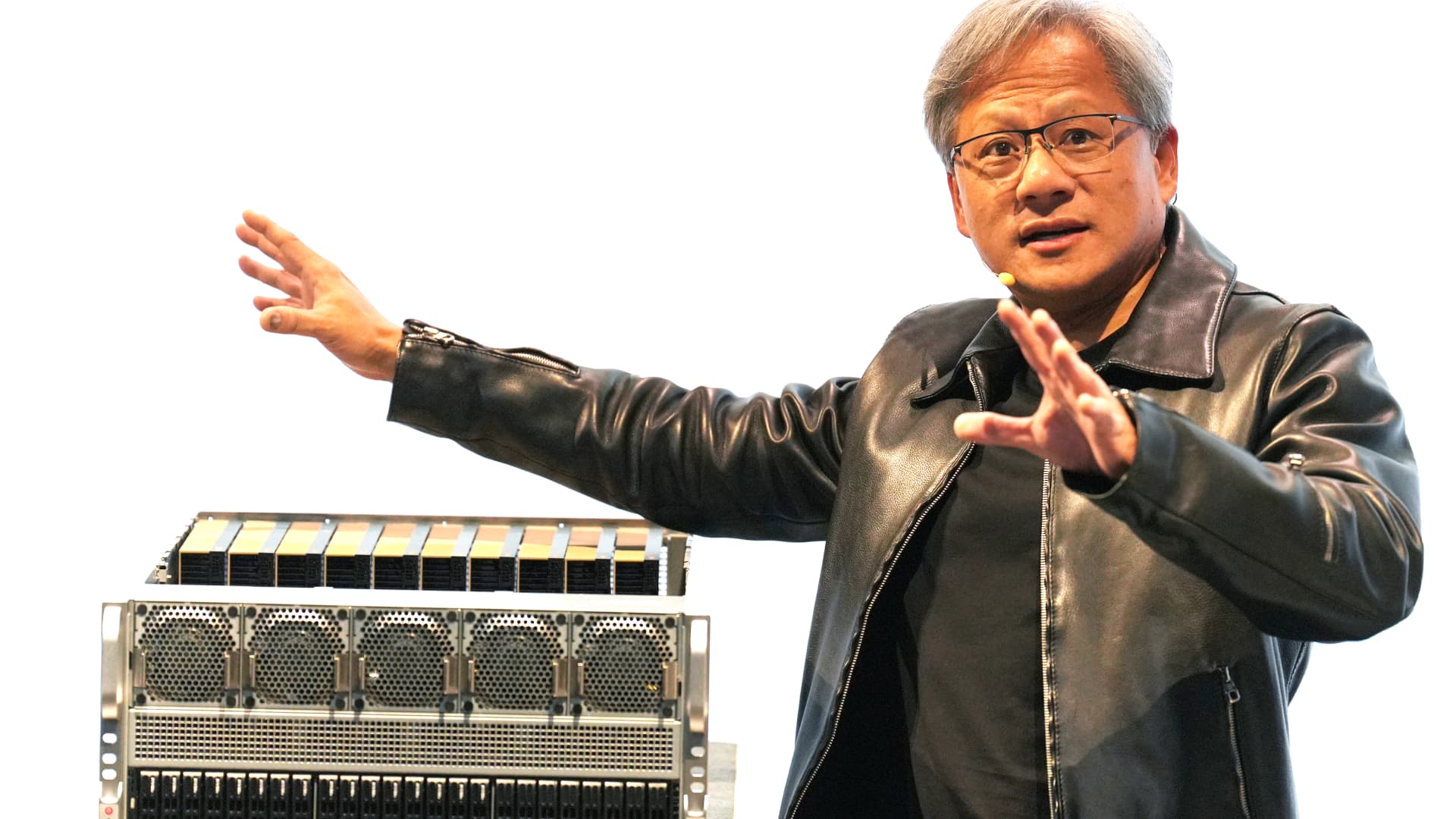

Nvidia’s CEO Jensen Huang recently spoke at the Supermicro keynote presentation during the Computex conference in Taipei on June 1, 2023. Following a market route in tech stocks last year, most of the industry’s big names have rebounded in 2023. However, Nvidia has surpassed them all in performance.

Due to their dominance in artificial intelligence chips and software, Nvidia shares have soared by 180% this year, surpassing all other members of the S&P 500. The only other company that comes close is Meta, the parent company of Facebook, with a 151% increase.

With a valuation of over $1 trillion, Nvidia is now the fifth-most valuable U.S. company, just behind tech giants like Amazon, Apple, Microsoft, and Alphabet. Although Nvidia may not have the same level of brand recognition as its peers, its core technology plays a crucial role in the highly influential ChatGPT, an OpenAI chatbot that is disrupting various industries.

ChatGPT and other AI models heavily rely on Nvidia’s graphics processing units (GPUs) for training. Nvidia’s GPUs are considered the best for this purpose, leading to high demand and strong financial forecasts.

Despite Nvidia’s success, there are still expectations for continued growth, including a doubling of sales in the coming quarters and a nearly quadrupling of net income this fiscal year. However, this has led some investors to view the stock as overvalued. Nvidia’s price-to-earnings ratio stands at 220, much higher than other tech companies like Amazon and Tesla.

Nevertheless, if Nvidia meets analysts’ expectations, the stock’s current price appears more reasonable compared to other tech companies. Its projected price-to-earnings ratio for the next 12 months is 42, while Amazon’s is 51 and Tesla’s is 58.

When Nvidia reports its earnings later this month, analysts anticipate quarterly revenue of $11.08 billion, marking a 65% increase from the previous year. This surpasses Nvidia’s own guidance of around $11 billion. Investors are optimistic that Nvidia will continue to thrive in the AI industry, despite growing competition and potential supply challenges.

However, there are also risks associated with such a rapid rise in stock price. This week, Nvidia shares fell 8.6%, the steepest decline since September of last year, without any apparent bad news. This leads investors to question if the stock’s current performance has already priced in all the positive expectations surrounding Nvidia.

Nvidia’s stock rally this year is impressive, and its growth over the past decade is even more astonishing. A decade ago, Nvidia’s market value was only a fraction of Intel’s. Today, Nvidia is worth over 11,170% more than its rival, making it seven times more valuable. Nvidia’s CEO, Jensen Huang, has also seen his net worth soar to $38 billion.

Before the rise of AI, Nvidia was primarily known for its technology in the video game industry. However, the company quickly pivoted to AI and developed CUDA, a software package crucial for training and running AI models. By focusing on AI chips and securing partnerships with key manufacturers like Taiwan Semiconductor Manufacturing Co., Nvidia has solidified its position as the leader in the AI chip market.

Nvidia’s investments in AI-focused startups aim to further fuel its growth and diversify its customer base. The company’s latest high-end AI chip, the H100, is in high demand, and Nvidia is selling nearly every unit it produces. Cloud providers like Google, Microsoft, and Amazon have also expressed their commitment to expanding their data centers using Nvidia GPUs.

Overall, Nvidia’s success in the AI industry has propelled its stock price, making it one of the most valuable companies in the U.S. There are still challenges and risks ahead, but investors remain optimistic about Nvidia’s future prospects.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.