-

Bonds are looking more attractive than stocks for the first time in years.

-

The 10-year Treasury yield topped 5% for the first time since 2007 this week.

-

There are three reasons why it could be a good time to plow cash into ultra-safe Treasurys.

For the first time in years, bonds are looking attractive relative to stocks as yields soar on ultra-low-risk US government debt.

The yield on the 10-year Treasury topped 5% for the first time since 2007 this week, and the plunge in bond prices represents one of the worst market crashes of all time, according to Bank of America.

But experts say that yields at 5% should look attractive to investors with cash on the sidelines, especially when considering the long-standing reputation of Treasurys as an extremely low-risk investment.

Here are three reasons why now could be a good time for investors to jump into the Treasury bond market, according to some of Wall Street’s top investing experts.

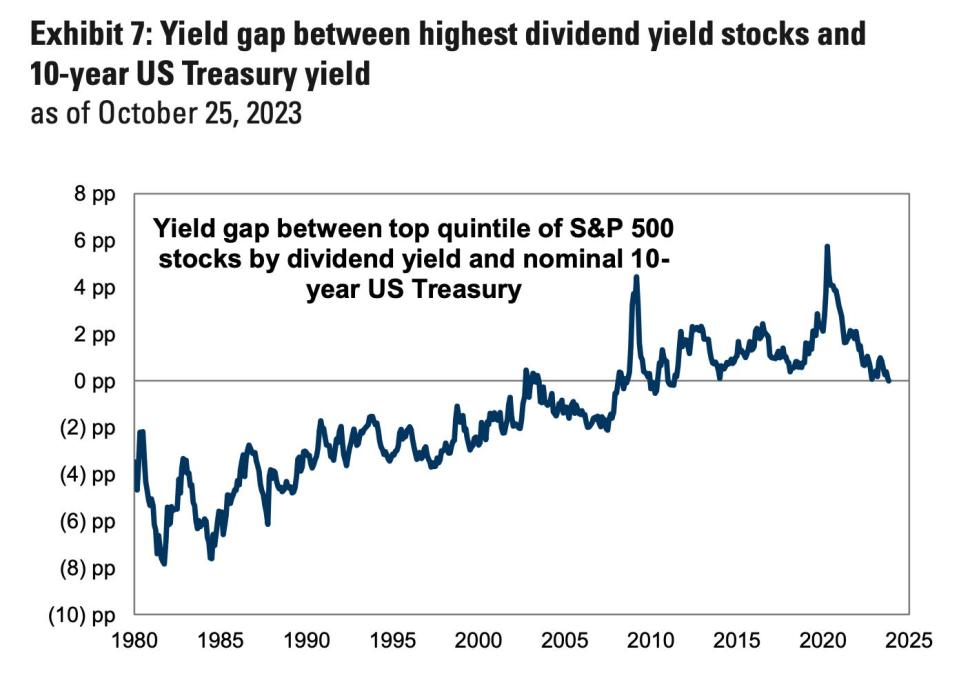

1. Treasury yields are now in line with the highest dividends paid by S&P 500 firms

The yield on the 10-year Treasury is about the same as the biggest dividends paid by S&P 500 firms, according to Goldman Sachs strategists.

The difference between the dividend yield of the top 20% of S&P 500 dividend payers and the yield on the 10-year US Treasury has narrowed from one percentage point in May to zero this week, strategists said in a note on Friday.

As that spread has narrowed, investors have been pulling money from dividend stock funds in 2023. Outflows from US equity dividend funds have more than doubled that of the broader market so far this year, according to Goldman Sachs data.

2. Bond yields probably aren’t falling soon

Treasury yields are likely staying elevated, thanks to the Fed’s commitment to keeping a lid on inflation. Central bankers have raised rates 525 basis-points over the past year to lower high prices, which has helped push Treasury yields higher.

BlackRock said in a note this week that it was overweight short-term Treasury bonds. Strategists at Vanguard, meanwhile, pointed to long-term US Treasuries as a competitive investment option, as they allow investors to lock in guaranteed yields, which will remain higher as interest rates stay elevated.

“Bond yields are likely to revert to the low levels of recent history, and we expect they will remain higher for longer. Remember that higher rates mean better long-term bond returns,” Vanguard said in a recent note