One year ago, President Joe Biden initiated a transformative era of US industrial policy with the signing of the Inflation Reduction Act and the Chips and Science Act. These two laws, passed in August of last year, provide over $400 billion in tax incentives, loans, and subsidies, all aimed at fostering the development of a domestic cleantech and semiconductor supply chain.

Since the enactment of the IRA and the Chips Act, the Financial Times has identified more than 110 significant manufacturing announcements in areas such as semiconductors, electric vehicles, batteries, and solar and wind components. These announcements have been driven by the groundbreaking legislation. Through careful examination and interviews with experts, we have gained valuable insights.

As a result of the IRA and the Chips Act, the US has witnessed the announcement of cleantech and semiconductor manufacturing projects worth at least $224 billion, with the potential to create 100,000 jobs. The Financial Times has compiled a list of company announcements, each totaling at least $100 million, from August 2022 until now. Although the pace of these announcements has slowed down, every month since the acts were passed has brought forth new projects. For instance, this month, Maxeon Solar Technologies, based in Singapore, revealed plans to establish a $1 billion solar panel facility in Albuquerque, New Mexico, while US manufacturer First Solar chose Louisiana for its $1.1 billion fifth factory, the largest investment in the region’s history.

Gregory Wetstone, CEO of the American Council on Renewable Energy, described the IRA as a catalyst for the nation’s energy transition and a pivotal force behind economic growth and the resurgence of American manufacturing. He remarked, “I don’t think, in my career, I’ve ever seen a law have a greater impact on economic development in this country.”

Significant commitments have predominantly come from semiconductor groups such as Intel, Taiwan Semiconductor Manufacturing Company, IBM, and Micron. These companies have announced plans to expand campuses, construct fabrication plants, and invest in regions like Arizona and New York. While projects are spread across the country, certain states and regions are leading the way and developing new manufacturing hubs. Georgia and South Carolina have secured the most projects, followed closely by Michigan, Ohio, and Arizona.

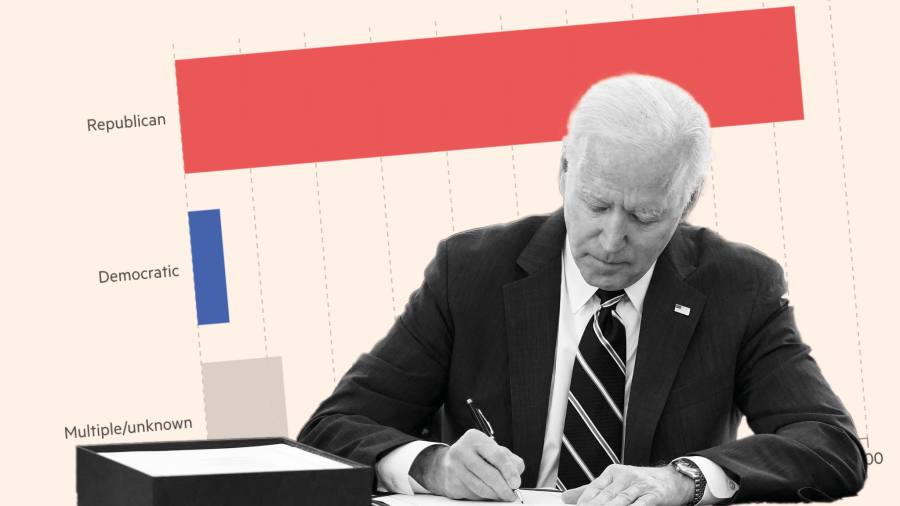

Notably, the majority of cleantech and semiconductor investments, comprising over 80%, have been allocated to Republican districts, despite the lack of Republican support for the IRA and lukewarm backing for the Chips Act in Congress. Qcells, a South Korean solar manufacturer, made a $2.5 billion investment in two Republican districts in Georgia. Republican-led efforts to weaken the IRA and calls from right-wing think tanks to roll back the legislation highlight the policy differences between Republican and Democratic candidates concerning energy and economic growth.

South Korean and European companies have been at the forefront of foreign capital investments, with 20 and 19 projects respectively announced since the enactment of the legislation. This influx of projects coincides with the introduction of competing policies by US allies who seek to address the perceived imbalance created by the IRA subsidies. To counter this, the EU has implemented its own industrial plan, including subsidies to retain developers within its bloc. Additionally, Swiss solar manufacturer Meyer Burger postponed its German expansion plans and instead established a $400 million factory in Colorado to benefit from IRA tax credits.

Notably, a few Chinese companies have made investments despite escalating tensions between China and the US. Gotion’s $2.4 billion battery factory in Michigan and Fuyao Glass’s $300 million expansion of its automotive glass factory in Ohio are among the largest Chinese investments. It is worth mentioning that the IRA’s EV tax credit does not cover imports from China, which was recently scrutinized by a Republican-led congressional committee.

The development of these manufacturing projects faces challenges such as a shortage of skilled workers, constraints in the availability of raw materials, and long construction lead times. The semiconductor industry and construction sector are particularly affected, with the need for qualified computer scientists, engineers, and construction workers surpassing the available supply. Additionally, the US solar cell factories are at risk of becoming functionally obsolete within the next five years due to lengthy construction timelines and technological advancements in Asia.

Experts argue that East Asia is likely to maintain its dominant position in the global cleantech and semiconductor supply chains throughout this decade. The International Energy Agency expects China to control over 60% of the global supply chain for wind, batteries, and solar by 2030. Moreover, Benchmark Mineral Intelligence projects that China will have more than double the battery manufacturing capacity of the US and Europe combined by the end of the decade.

Even if the US achieves self-sufficiency in battery cell and solar module production by 2025, challenges such as skilled labor shortages and the availability of critical minerals still need to be addressed to ensure long-term success in the cleantech and semiconductor sectors.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.