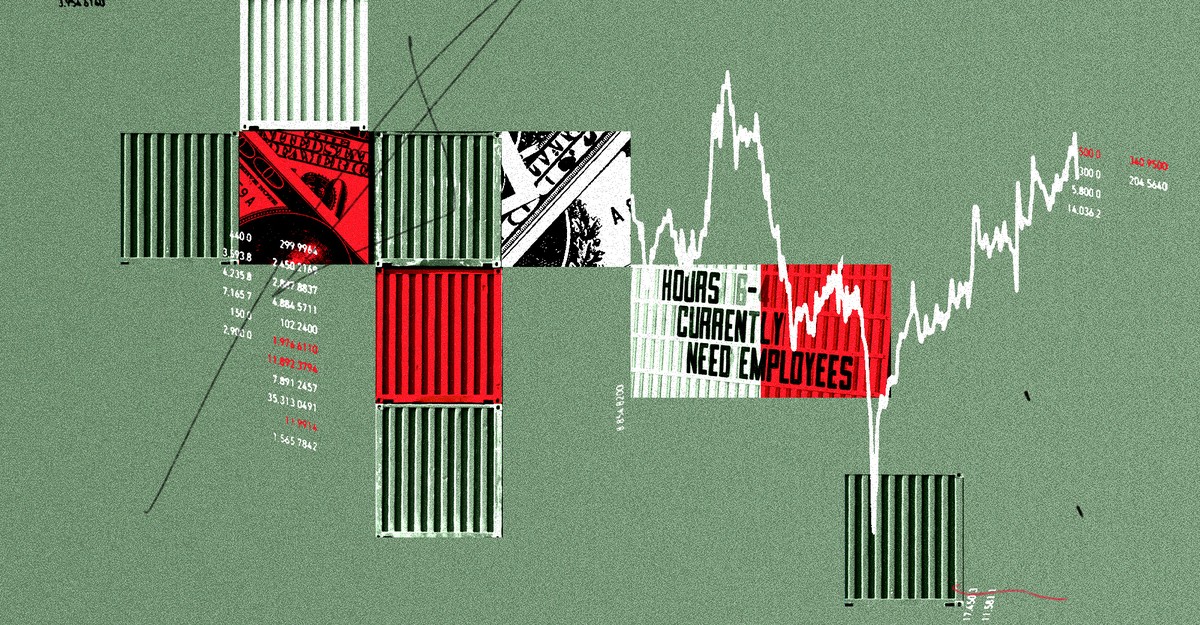

Fed Chair Indicates US Might Have Avoided Recession

The Federal Reserve believes that its policies have potentially played a role in preventing a recession and achieving a “soft landing” for the US economy, which was previously seen as unlikely by analysts. Following the announcement of the latest interest rate hike, Fed Chair Jerome Powell stated that the central bank no longer predicts a …