The inflation rate in May reached its lowest level in over two years, according to a report from the Labor Department. This development is expected to relieve pressure on the Federal Reserve to continue increasing interest rates.

The consumer price index (CPI), which measures changes in goods and services, only rose by 0.1% for the month, resulting in an annual decrease from 4.9% in April to 4%. This marks the smallest increase in the past 12 months since March 2021, when inflation began its climb to the highest level in 41 years.

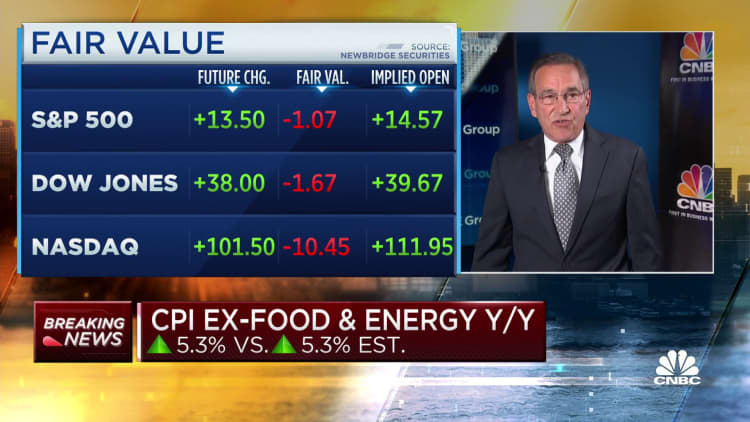

The overall picture is somewhat less optimistic when excluding volatile food and energy prices.

Core inflation, which excludes these volatile components, increased by 0.4% for the month and remains 5.3% higher compared to the same period last year, indicating that consumers are still facing significant price pressures.

All of these figures align precisely with the consensus estimates provided by Dow Jones.

A 3.6% decline in energy prices helped to moderate the CPI’s increase for the month, while food prices only rose by 0.2%.

However, the largest contributor to the overall CPI increase was a 0.6% rise in shelter prices, which account for approximately one-third of the index’s weighting.

In other sectors, used vehicle prices saw a 4.4% increase, consistent with April’s figures, and transportation services rose by 0.8%.

Despite the significance of this report for the Federal Reserve’s decision-making on interest rates, the market exhibited minimal response. Stock market futures showed a slight positive trend, while Treasury yields experienced a sharp decline.

Notably, fed funds market pricing indicates a 93% probability that the Fed will maintain its benchmark rates following the conclusion of their meeting on Wednesday.

Jeffrey Roach, chief economist at LPL Financial, stated, “The positive trend in consumer prices allows the Fed some flexibility to keep rates unchanged this month. If this trend continues, it is unlikely the Fed will raise rates for the remainder of the year.”

The subdued CPI reading brings good news for workers, as average hourly earnings adjusted for inflation increased by 0.3% for the month, according to the Bureau of Labor Statistics. Real earnings have experienced a 0.2% increase on an annual basis after remaining negative during the recent inflation surge that began two years ago.

This report highlights the growing disparity between the core and headline CPI figures. Typically, the all-items index tends to exceed the ex-food and energy measure, which is not currently the case.

The year-over-year discrepancy is primarily attributed to the steep increase in gas prices during the same period in 2022. Ultimately, gasoline prices exceeded $5 per gallon, a milestone previously unseen in the U.S. Gasoline prices have declined by 19.7% in the past year, as revealed in Tuesday’s BLS report.

However, food prices have risen by 6.7% compared to a year ago, although egg prices fell by 13.8% in May and are now slightly negative on a 12-month basis after surging in previous months. Shelter prices have increased by 8%, and transportation services have risen by 10.2%. Airline fares have also experienced a retreat, declining by 13.4% year over year.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.