Stay updated with the latest news from Legal & General Group PLC by signing up for free.

Receive a myFT Daily Digest email every morning with the latest news from Legal & General Group PLC.

The significance of capitalism as a superior economic system has been challenged since the financial crisis.

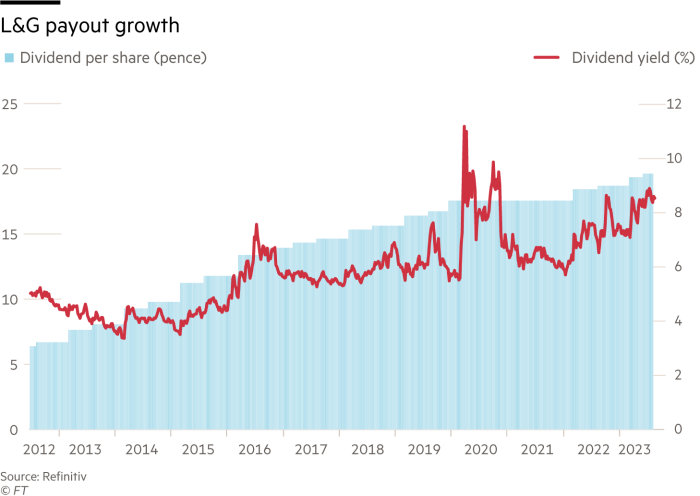

Sir Nigel Wilson, who is retiring from his position as chief executive of Legal & General, believes that the UK is particularly affected by this issue. He presented his final set of interim results for the company, offering an opportunity to evaluate his performance as an inclusive capitalist and CEO.

Wilson attributes the UK’s stagnant real wages and low productivity to a chronic lack of investment. With interest rates currently at a 15-year high, addressing this issue becomes even more challenging.

Rising interest rates are expected to benefit Wilson’s successor, António Simões, through bulk annuities. Legal & General sells these to defined benefit pension schemes to limit their risks. This year, a record £25 billion in bulk annuities have already been transacted, with £11 billion expected to be handled by Legal & General.

Insurers must allocate capital for bulk annuities, with the first half of this year requiring £106 million of capital for £4.9 billion of bulk deals. However, this 2.2% ratio is nearly half of the previously estimated 4%.

The efficiency ratio is projected to decrease further next year, thanks to solvency reforms that will reduce the capital ratio by an additional percentage point.

Denial of responsibility! VigourTimes is an automatic aggregator of Global media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, and all materials to their authors. For any complaint, please reach us at – [email protected]. We will take necessary action within 24 hours.