(Bloomberg) — The VIX is currently at 20, making stocks on the brink of experiencing their worst October in the past five years. Moreover, the bond market seems to be constantly throwing tantrums.

Most Read from Bloomberg

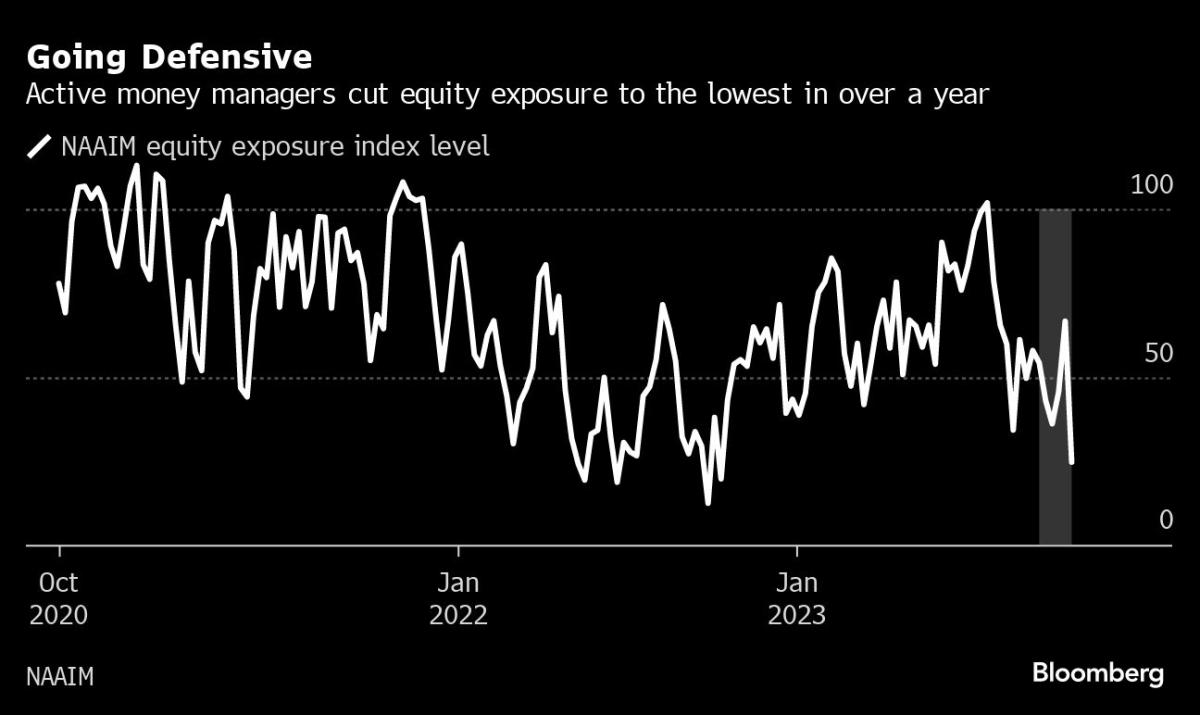

For those bullish on equities and always ready to dive in at the first sign of weakness, these turbulent times are proving to be too much. Investors across various categories are pulling their money out and adopting a defensive posture that hasn’t been seen in over a year, according to some metrics.

Professional managers, in surveys, reveal that they have cut down their equity positions to levels last seen during the 2022 bear market. Hedge funds have been increasing their single-stock short positions for the 11th consecutive week. Investor positioning models indicate that everyone, from mutual funds to systematic quants, has significantly reduced their exposure to equities, well below long-term averages.

Market timing is often criticized, but it tends to happen during times of stress. The big question leading into November is whether this recent exodus from the market is a precursor to a rebound or a prolonged period of pain.

“It’s troubling that a market setback as deep as the current one hasn’t resulted in more improvement” in sentiment, said Doug Ramsey, the chief investment officer at the Leuthold Group. “The ‘wall of worry’ that has accompanied much of the 2023 market action has now turned into a ‘slope of hope.”’

With the S&P 500 falling more than 1% on five separate occasions in October and entering into a correction on Friday, dip buyers are scarce. The Nasdaq 100 Index’s projected price volatility is at its highest level since March. Even after some positive earnings reports from Amazon.com Inc. and Intel Corp., the Nasdaq 100 closed out its worst two-week drop this year and is poised for its largest October loss since 2018.

A poll conducted by the National Association of Active Investment Managers reveals that money managers have reduced their exposures to levels seen in October 2022. Equity positioning has fallen below long-term averages for most investor categories, particularly hedge funds and mutual funds, according to Barclays Plc’s analysis of CFTC data. Goldman Sachs Group Inc.’s prime brokerage states that professional speculators have been ramping up short positions for nearly three months, marking the longest increase in the history of available data.

The Cboe Volatility Index, also known as the “fear gauge” on Wall Street, has remained above 20 for two consecutive weeks after being below this threshold for over 100 days. Bond volatility adds to investor concerns as significant fluctuations on Wednesday and Thursday further pressure an earnings season where companies that miss estimates are being severely impacted.

“With yields much higher than they were six months ago, the stock market is going to have to fall to valuation levels that are more in line with historical levels,” said Matt Maley, the chief market strategist at Miller Tabak & Co. “The most important issue is the very large divergence that has developed between the bond market and the stock market.”

From a contrarian perspective, the prevailing gloom can be seen as a positive sign, indicating potential latent buying power should sentiment shift. Several market strategists foresee this happening. Last year, major reversals in equities were closely tied to changes in institutional and retail positioning. Gains occurred after investors reduced their bullish bets, and declines followed buying sprees.

Barclays’ strategists state that lower exposure to stocks, bullish technical signals, and seasonality increase the likelihood of a year-end rally. Similar sentiments have been echoed by Bank of America Corp. and Deutsche Bank AG.

“Fear is uncomfortable, but it’s a healthy dynamic in markets,” said Callie Cox at eToro. “If investors are braced for the worst, they’re less likely to sell all at once if bad headlines do pop up.”

Of course, predicting market inflection points is impossible. With investors processing the Federal Reserve’s message of higher-for-longer interest rates and key inflation indicators still showing signs of life, the negative sentiment might actually be justified. The Fed’s rapid reduction of its government securities portfolio puts pressure on investors who are looking for clues about how high yields can go.

“The higher-for-longer message and recent inflation signs suggest that bonds will not be stabilizing any time soon,” said Peter van Dooijeweert, the head of defensive and tactical alpha at Man Group. “Related equity weakness off the rate rise may persist — especially if earnings don’t deliver.”

–With assistance from Lu Wang.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.