-

The anti-obesity market could become a $100 billion industry by 2030, Goldman Sachs predicts.

-

The field is “still in its early stages” but may have reached an inflection point, the bank said.

-

The rise of GLP-1 weight loss drugs has meant big gains for Novo Nord Nordisk and Eli Lilly.

The anti-obesity market is primed for a massive surge over the next six years, according to Goldman Sachs.

Goldman Sachs, in a recent research note, expressed their optimism about the potential of weight loss drugs, or anti-obesity medications, to drive the industry’s value to $100 billion by 2030, marking a 16-fold increase from its current valuation of $6 billion. Although the market is still in its early stages, Chris Shibutani, a biopharmaceuticals analyst at Goldman Sachs, sees solid growth opportunities ahead. In fact, he believes that the industry may witness the development of some of the highest-grossing drugs of all time.

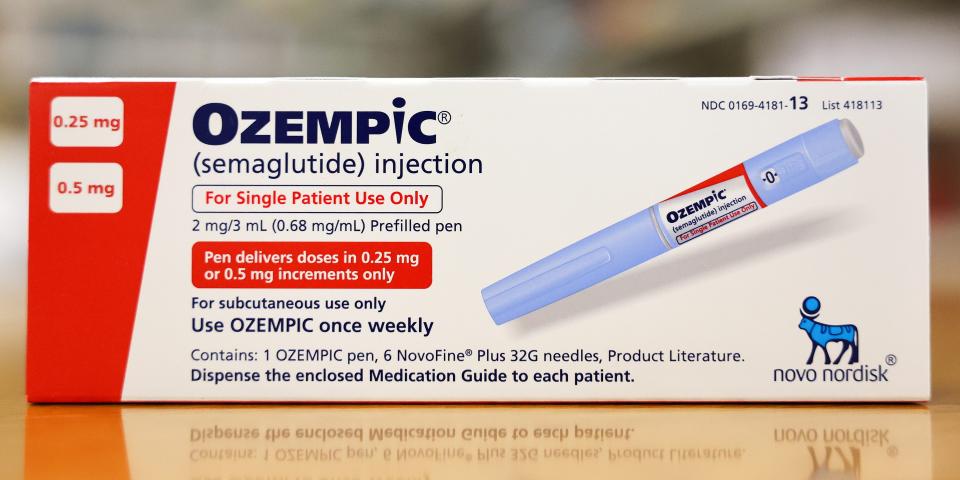

GLP-1 weight-loss drugs like Ozempic and Wegovy have gained significant popularity, creating a promising investment opportunity. As a result, pharmaceutical companies producing these medications, including Novo Nordisk and Eli Lilly, have experienced a surge in share prices. Recent drug trials have also shown positive outcomes, such as a reduction in the risk of kidney failure with semaglutide, a key ingredient in these drugs.

Goldman Sachs based its forecast on the assumption that by 2030, around 15 million American adults would be taking GLP-1 drugs, accounting for nearly 15% of the overweight or obese population.

Interestingly, Goldman Sachs is not the only financial institution recognizing the potential of the weight-loss market. Morgan Stanley expects the industry to be valued at $77 billion by 2030, attributing the faster-than-expected growth to the widespread popularity of these drugs on social media. Moreover, Barclays and Berenberg have estimated that the market could reach values of $100 billion and $85 billion, respectively.

Source: Business Insider