-

Goldman Sachs said the economy and investing landscape is returning to a pre-2008 environment.

-

Strategists said the global economy has outperformed expectations in 2023, and disinflation should carry on.

-

Conditions are normalizing as the era of ultra-low rates ends.

Goldman Sachs sees a 15% recession probability for the year ahead, and the bank expects a handful of tailwinds to support global growth and investments as the macro landscape reverts to pre-2008 conditions.

In a note to clients this week titled, “The Hard Part Is Over,” Goldman strategists led by Jan Hatzius highlighted that economies around the world have outperformed even optimistic expectations through 2023.

“2024 should cement the notion that the global economy has escaped the post-GFC environment of low inflation, zero policy rates and negative real yields,” Hatzius said. “The period since the GFC has often felt like an inexorable move towards lower global yields and low inflation — ‘liquidity trap’ and ‘secular stagnation’ were the decade’s buzzwords.”

Policymakers have put an end to the easy-money era, and the transition to higher rates has so far been rocky, as illustrated by high volatility in the stock market, the rapid tightening of financial conditions, and the rising number of “zombie” corporations going belly up.

“The big question is whether a return to the pre-GFC rate backdrop is an equilibrium,” according to the strategists. “The answer is more likely to be yes in the US than elsewhere, especially in Europe where sovereign stress might reemerge.”

The Fed pulled interest rates to near-zero in the aftermath of the Great Financial Crisis, but a return to a high-rate environment could spell trouble for heavily indebted firms and broader business conditions.

Other Wall Street forecasters, too, have cautioned that a wave of distressed debt and troubled balance sheets will come to the surface in the coming months as tighter financial conditions bite. Charles Schwab has estimated that defaults will peak sometime between now and the first quarter of 2024.

Upside for markets

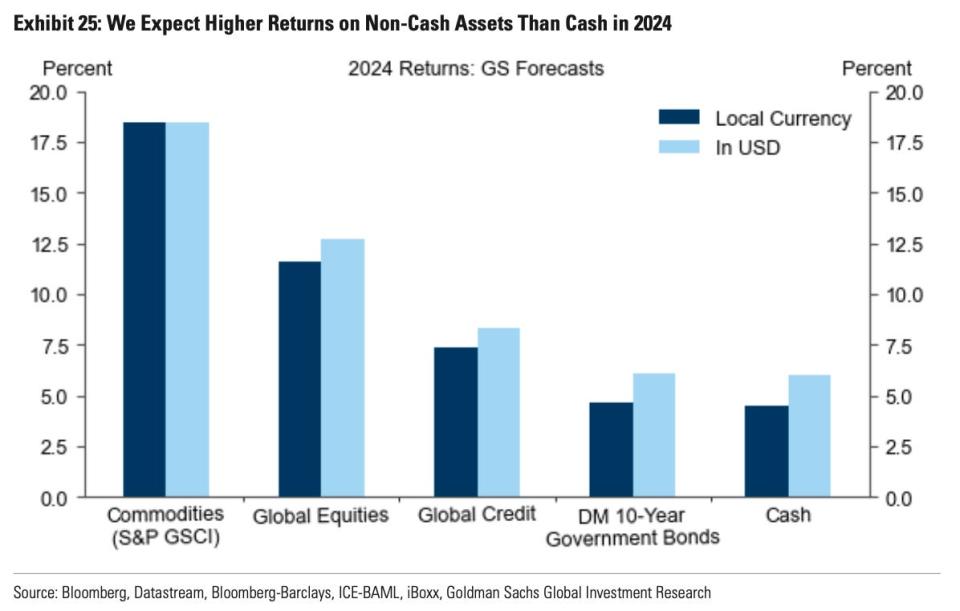

Goldman expects returns in rates, credit, equities and commodities to exceed cash in 2024.

“The transition [from the easy money era] has been bumpy, but the upside of this ‘Great Escape’ is that the investing environment now looks more normal than it has at any point since the pre-GFC era, and real expected returns now look firmly positive,” Hatzius said.

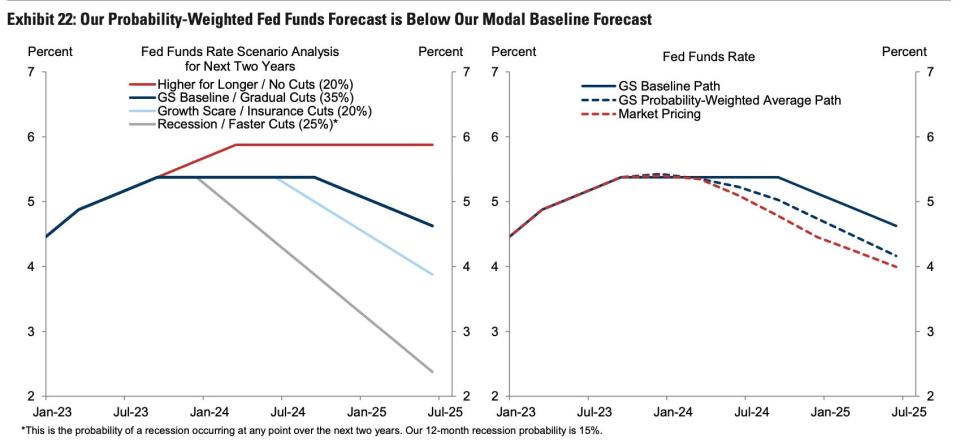

Inflation should continue to decline in 2024, real household income growth should grow, manufacturing activity will bounce back, and central banks led by the Federal Reserve should become increasingly willing to cut rates, in the firm’s view.

“We don’t think the last mile of disinflation will be particularly hard,” Hatzius said. “First, although the improvement in the supply-demand balance in the goods sector — measured for example by supplier delivery lags — is now largely complete, the impact on core goods disinflation is still unfolding and will likely continue through most of 2024.”

Despite their relative optimism, Goldman strategists said they see “higher-than-normal risks” for 2024.

Even if disinflation continues at a steady clip, it’s possible that the Fed and other central banks still keep interest rates high for longer than expected.

There are also downside risks around growth, the bank said. A recovery in global manufacturing could be delayed, particularly if high rates push companies to normalize inventory levels relative to sales below 2019 levels.

Read the original article on Business Insider