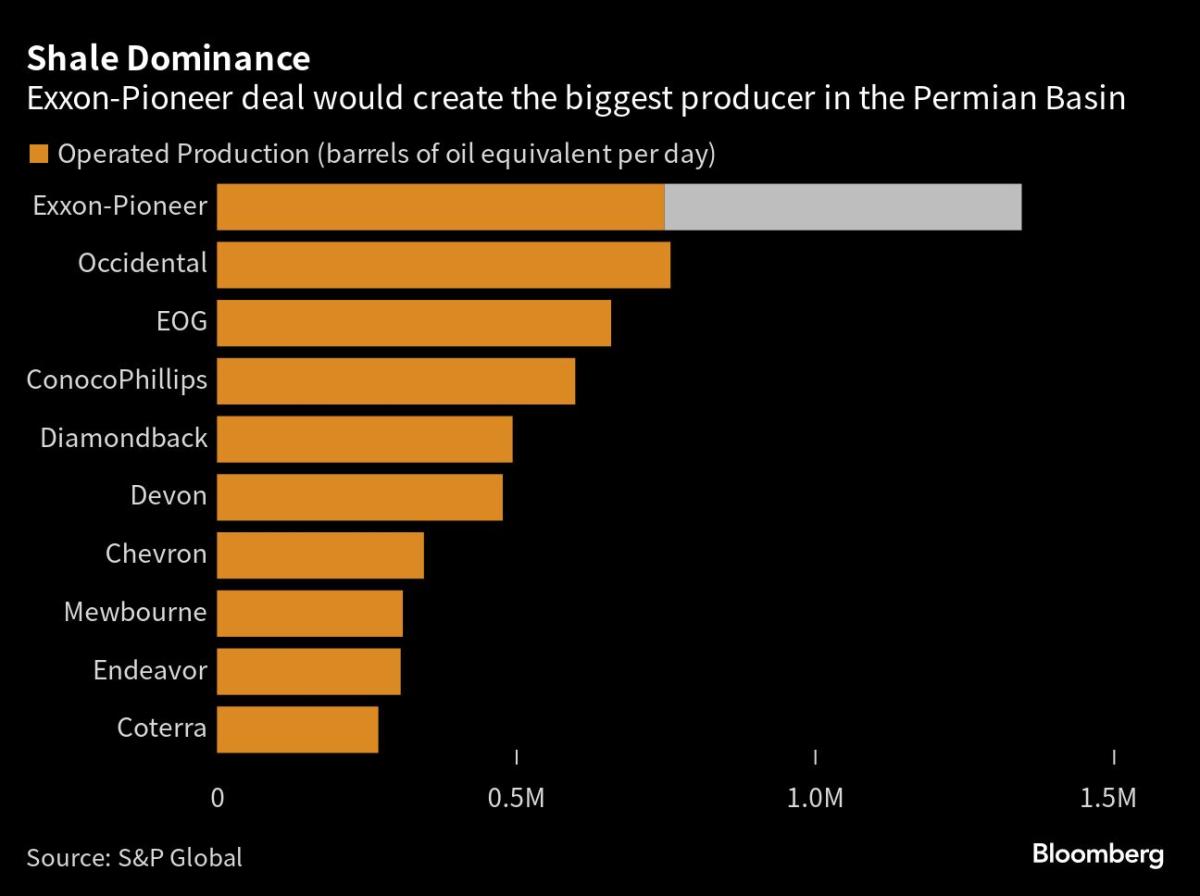

Three years ago, Scott Sheffield’s company, Pioneer Natural Resources Co., was facing trouble along with many other oil producers as oil prices dipped below zero. Sheffield, who had transformed Pioneer into one of the largest acreage holders in the Permian Basin, declined Exxon Mobil Corp.’s takeover offer, a decision that proved to be prescient. Exxon ultimately agreed to purchase Pioneer for $60 billion, four times its value in 2020. The deal marks the end of Exxon playing defense and solidifies its position as the dominant producer in the Permian Basin. Despite potential challenges in gaining approval from the Biden administration and concerns about reducing drilling program costs, Exxon CEO Darren Woods remains confident that the acquisition will result in improved recovery rates, lower emissions, and long-term success. Sheffield, known for his pioneering leadership in the Permian Basin, will join Woods on the Exxon board, creating an unlikely duo that will lead America’s largest oil basin.

The backstory reveals the challenges faced by Woods when he took over as CEO of Exxon in 2017. The company had fallen out of favor with Wall Street due to over-budget megaprojects, a failed exploration play in Russia, and a focus on shale gas when shale oil was where the money was. Woods pursued an aggressive expansion plan centered around shale oil in the Permian Basin, despite investor backlash. The COVID-19 pandemic further exposed Exxon’s vulnerabilities, leading to its first annual loss in 40 years and removal from the Dow Jones Industrial Average. Meanwhile, Chevron and ConocoPhillips made their own acquisitions. During this time, Sheffield and Woods discussed a possible deal, but Sheffield initially resisted selling Pioneer. Sheffield later made strategic moves to consolidate the Midland Basin and boost Pioneer’s value. However, when Engine No. 1, an activist investor group, launched a campaign against Exxon, hopes for a deal seemed unlikely. But by early 2022, the oil and gas sector rebounded, and Woods had the resources to pursue the acquisition he had long desired. Negotiations between Exxon and Pioneer focused on personnel rather than price, and the deal was finalized in September 2023.